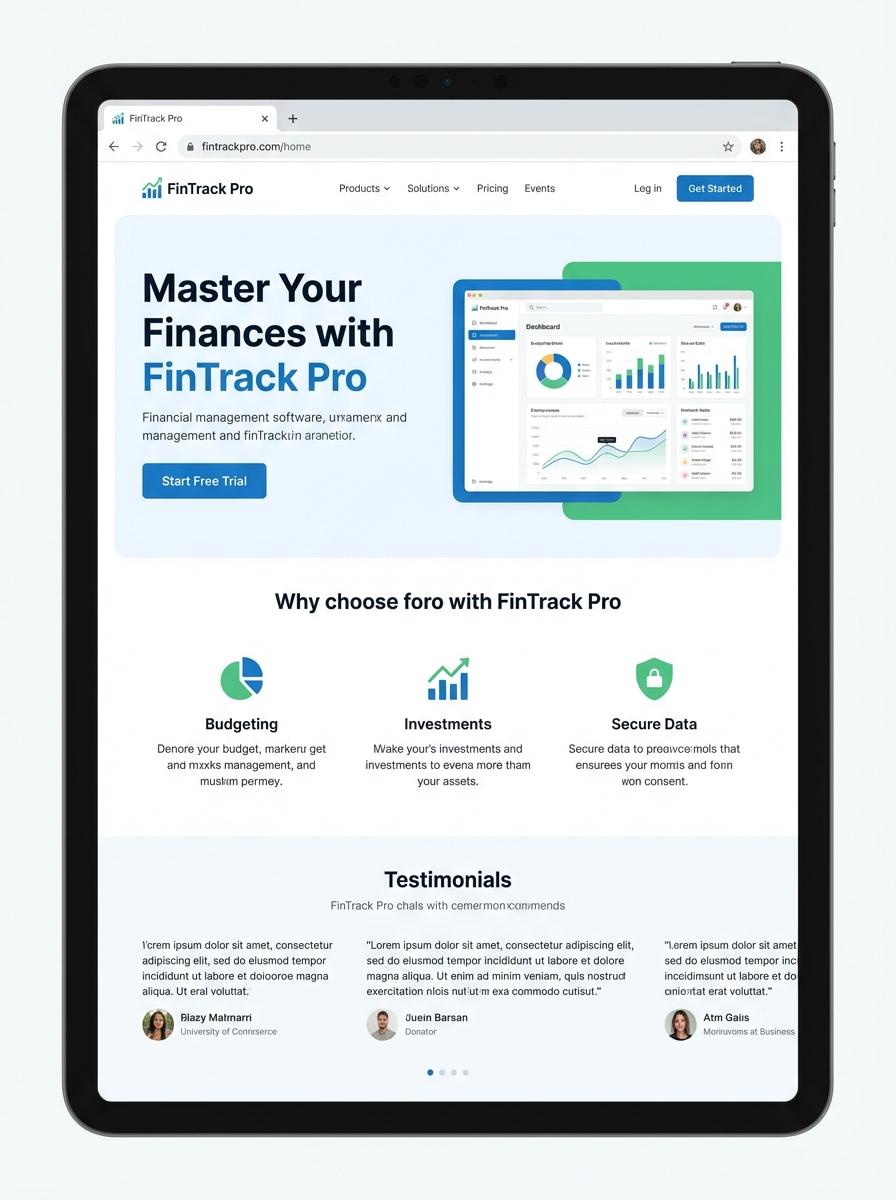

Illustration: Landing page for digital product in Making Digital Products in Finance Industry

Regulatory Compliance and Data Security

Building digital products in the finance industry requires strict adherence to regulatory compliance to protect sensitive consumer data. Ensuring robust data security protocols helps prevent breaches and maintain customer trust. Compliance with laws like GDPR and PCI DSS is critical for operational success.

User Authentication and Identity Verification

Strong user authentication mechanisms are essential to safeguard financial platforms from fraud. Multi-factor authentication and biometric verification enhance identity verification processes. This reduces the risk of unauthorized access and ensures user accounts remain secure.

Real-time Transaction Processing

Financial products must support real-time transaction processing to provide users with immediate updates on their account activities. This capability enhances customer experience by enabling instant transfers and payments. It also improves transparency and operational efficiency.

Intuitive Interface for Financial Data

An intuitive interface simplifies complex financial information, making it accessible to all users. Clear visualizations and easy navigation increase user engagement and satisfaction. A user-friendly design is pivotal in promoting trust and seamless interaction with financial data.

Scalable Infrastructure for Growth

Developing digital finance products requires a scalable infrastructure that can handle increasing user demands and data volumes. Cloud technologies and modular architecture facilitate growth without compromising performance. Scalability ensures longevity and adaptability of financial platforms.

Automated Risk Assessment Algorithms

Automated risk assessment algorithms enable early detection of fraudulent activities and credit risks. These intelligent tools analyze large datasets quickly to provide actionable insights. Automation enhances accuracy and reduces manual intervention in risk management.

Integration with Third-Party Financial Services

Seamless integration with third-party financial services broadens the functionality and reach of digital products. APIs allow for real-time data exchange and expanded service offerings such as payments, lending, and investment options. This interoperability supports innovation and customer convenience.