Creating a digital product suitable for actuaries in the finance sector requires a deep understanding of risk assessment and financial modeling. Such products must integrate advanced analytics, predictive algorithms, and regulatory compliance features to support accurate decision-making. Prioritizing user-friendly interfaces and real-time data processing ensures actuaries can efficiently evaluate financial risks. Explore the detailed ideas in the article to discover how to develop a cutting-edge digital solution tailored for actuaries.

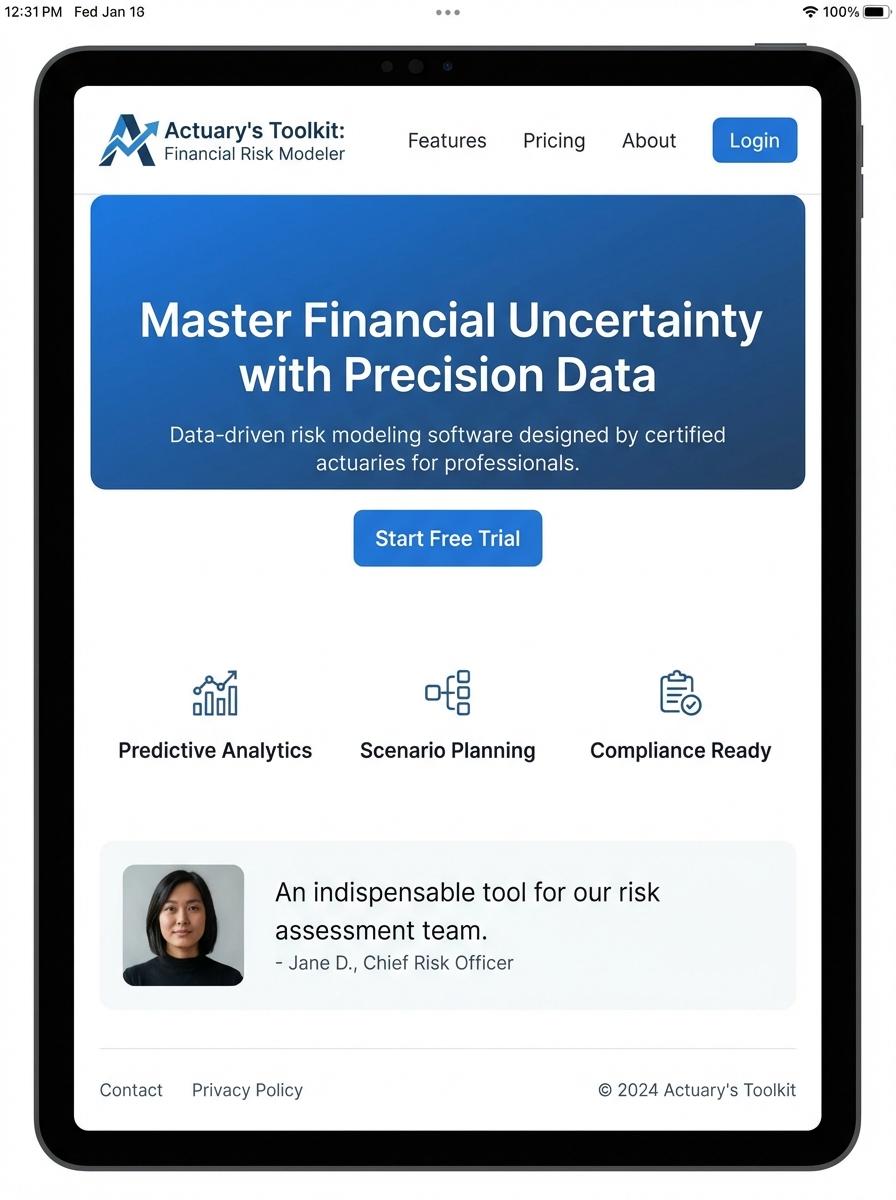

Illustration: Landing page for digital product for Actuary

Insurance Pricing Model Templates (Excel)

Creating Insurance Pricing Model Templates in Excel requires advanced actuarial techniques and precise data manipulation to accurately forecast risk and premium rates. These templates must integrate statistical methods, loss development factors, and underwriting data to support reliable pricing decisions. Excel's functionality enables actuaries to customize assumptions and automate iterative calculations for dynamic model adjustments.

- Skill needed: Proficiency in actuarial science, statistical analysis, and advanced Excel functions including VBA scripting.

- Product requirement: Template must allow input of underwriting variables, claims history, and exposure data for flexible risk modeling.

- Specification: Include automated calculation of loss ratios, trend analysis, discounting, and scenario testing features for pricing validation.

Financial Risk Assessment Reports (PDF)

Financial Risk Assessment Reports are essential tools for actuaries to evaluate and quantify potential financial risks using statistical models and historical data. These reports utilize advanced algorithms to predict future liabilities and assess the financial stability of insurance portfolios or pension funds. A comprehensive risk analysis is crucial for informed decision-making and regulatory compliance.

- Skills needed: proficiency in actuarial science, statistical analysis, data modeling, and expertise in relevant software such as R, Python, or SAS.

- Product requirements: clear, concise presentation of risk metrics, integration of up-to-date financial and demographic data, and customizable report templates.

- Specifications: PDF format output, compatibility with data import/export standards, and secure encryption to protect sensitive financial information.

Pension Valuation Calculators (Excel)

Pension Valuation Calculators in Excel provide actuaries with precise tools to model and assess pension liabilities and future payments. These calculators integrate actuarial formulas to estimate present values, discount rates, and mortality assumptions effectively. Such tools improve accuracy and efficiency in pension fund valuation and reporting processes.

- Skills needed: Proficiency in actuarial science, advanced Excel functions, and knowledge of pension fund regulations.

- Product requirement: Must include customizable parameters for discount rates, mortality tables, and benefit formulas.

- Specification: User-friendly interface enabling scenario analysis and automated report generation for valuation results.

Actuarial Data Visualization Dashboards (Excel)

Actuarial Data Visualization Dashboards in Excel enable actuaries to transform complex datasets into clear, interactive visuals that enhance risk assessment and decision-making processes. These dashboards integrate essential actuarial metrics such as loss ratios, claim frequencies, and reserve estimates, offering real-time insights through dynamic charts and tables. Leveraging Excel's pivot tables and Power Query enhances data manipulation capabilities for precise trend analysis.

- Proficiency in Excel functions, pivot tables, and VBA for automation.

- Support for importing and cleaning large actuarial datasets efficiently.

- Interactive elements like slicers and dynamic charts tailored to actuarial KPIs.

Claims Reserving Methodology Guides (PDF)

Claims Reserving Methodology Guides provide actuaries with essential frameworks and techniques for estimating future claim liabilities accurately. These guides incorporate detailed actuarial models, loss development factors, and risk margin calculations essential for reserve adequacy. They enable informed decision-making to maintain financial stability and regulatory compliance within insurance companies.

- Strong knowledge of actuarial science and claims reserving principles

- Clear and professional PDF format with indexed chapters and cross-references

- Inclusion of real-world case studies, formula derivations, and statutory requirements

Investment Strategy Simulation Tools (Excel)

Actuaries require precise Investment Strategy Simulation Tools built in Excel to model various financial scenarios and assess risk effectively. These tools enable detailed sensitivity analyses, allowing actuaries to project future cash flows and evaluate portfolio performance under varying economic conditions. Accurate data integration and dynamic scenario adjustments are crucial for reliable simulation outcomes.

- Skill needed: Proficiency in Excel formulas, VBA scripting, and financial modeling tailored to actuarial principles.

- Product requirement: Ability to input variable economic parameters and automate scenario generation for risk assessment.

- Specification: Integration of stochastic models and sensitivity analysis features with clear, interpretable output dashboards.

Actuarial Training Video Tutorials (Video)

Actuarial Training Video Tutorials provide comprehensive educational content tailored to aspiring and professional actuaries. These tutorials cover key topics such as risk assessment, probability, and financial mathematics essential for actuarial exams. Interactive and structured modules enhance the learning experience by simulating real-world actuarial problem-solving scenarios.

- Skills needed: Deep understanding of actuarial science, proficiency in statistical software, and effective communication abilities.

- Product requirements: High-definition video quality, clear audio narration, and segmented lessons for progressive learning.

- Specifications: Include practice quizzes, downloadable resources, and compatibility with multiple devices and platforms.

Leverage Data-Driven Insights

Utilize data-driven insights to make smarter decisions in marketing your digital product. Analyzing customer behavior and market trends allows you to target your audience effectively. This approach helps in refining your strategies and improving overall campaign performance. Emphasizing data ensures decisions are evidence-based and results-oriented.

Ensure Seamless Workflow Integration

Integrate your marketing tools smoothly into existing workflows to avoid disruptions. Compatibility with current systems enhances productivity and reduces resistance from your team. A seamless setup supports continuous operations and better collaboration. Prioritize tools that complement your existing processes for optimal results.

Enhance Risk Modeling with Analytics

Apply advanced analytics to improve your risk modeling capabilities. This helps anticipate market fluctuations and potential challenges in promoting your digital product. Enhanced analysis enables proactive adjustments and mitigates risks more effectively. Leveraging analytics provides a competitive edge in decision-making.

Automate Actuarial Reporting

Implement time-saving automation for generating actuarial reports to boost efficiency. Automation reduces manual errors and frees up valuable time for strategic tasks. Streamlined reporting accelerates insights delivery and supports faster decision-making. Investing in automation tools enhances overall productivity.

Adopt Scalable Solutions

Choose scalable solutions tailored to the needs of actuarial teams for sustainable growth. Scalability ensures your marketing efforts grow in alignment with your product and audience demands. Tailored solutions provide flexibility and adaptability in varying market conditions. A scalable approach future-proofs your marketing strategy.