Creating a digital product suitable for risk managers in the finance sector requires deep understanding of financial regulations, risk assessment methodologies, and real-time data analysis capabilities. The product must integrate advanced analytics, predictive modeling, and user-friendly dashboards to enable proactive risk mitigation and compliance management. Security features and scalability are essential to safeguard sensitive financial information and support growing organizational needs. Explore the article for detailed strategies and innovative ideas on developing effective digital solutions tailored for finance risk management.

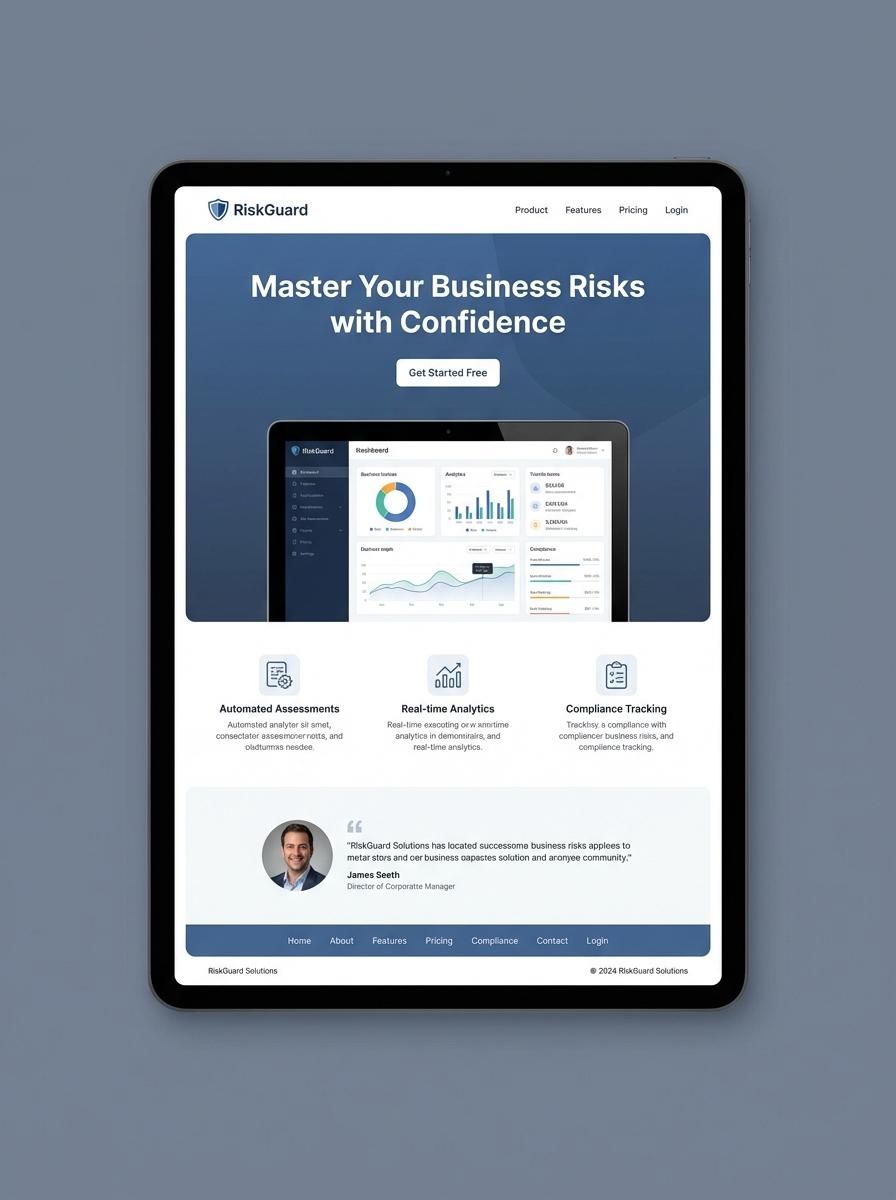

Illustration: Landing page for digital product for Risk manager

Comprehensive Risk Assessment Templates (Excel)

Creating Comprehensive Risk Assessment Templates in Excel enables risk managers to systematically identify, evaluate, and mitigate potential threats. These templates should incorporate customizable risk categories, impact ratings, and probability scores for accurate analysis. Automating data visualization and reporting enhances decision-making efficiency and compliance tracking.

- Skill needed: proficiency in Excel functions, formula creation, and data visualization tools like PivotTables and charts.

- Product requirement: customizable fields for risk types, impact levels, and mitigation actions with automated risk scoring.

- Specification: compatibility with Excel 2016 or later versions, including macros for workflow automation and export options to PDF.

Financial Risk Management Policy Guide (PDF)

Financial Risk Management Policy Guide (PDF) serves as an essential resource for risk managers, detailing comprehensive strategies to identify, assess, and mitigate financial risks. This guide includes frameworks compliant with industry standards and regulatory requirements, facilitating effective risk control and decision-making. Utilizing data-driven models enhances prediction accuracy and ensures the policy remains responsive to market changes.

- Expertise in risk assessment methodologies and regulatory compliance.

- Clear documentation and user-friendly interface in PDF format.

- Integration of real-time data analytics and scenario analysis tools.

Credit Risk Evaluation Checklist (Word)

The Credit Risk Evaluation Checklist is designed to assist risk managers in systematically assessing potential credit risks in lending or investment decisions. This Word document incorporates key metrics, risk indicators, and regulatory compliance checkpoints to enhance the accuracy of creditworthiness analysis. It streamlines comprehensive evaluations while maintaining consistency across assessments.

- Skills Needed: Expertise in credit risk assessment, regulatory knowledge, and analytical skills.

- Product Requirement: Editable Word format with predefined sections for inputting client financial information, risk indicators, and approval status.

- Specification: Include automated formulas or guidelines for risk scoring, a clear layout with headings, and sections for comments or recommendations.

Video Tutorial: Introduction to Market Risk Analysis (MP4)

Market risk analysis is essential for Risk Managers to identify, assess, and mitigate potential financial losses stemming from market fluctuations. This video tutorial in MP4 format offers a comprehensive introduction to risk measurement techniques such as Value at Risk (VaR) and stress testing. Understanding these methodologies enables more informed decision-making and improved risk management strategies.

- Skill needed: Knowledge of financial markets, statistical analysis, and risk management principles.

- Product requirement: High-quality MP4 video with clear audio and visual explanations of complex concepts.

- Specification: Includes real-world case studies, interactive quizzes, and downloadable resources for practical application.

Regulatory Compliance Tracker Spreadsheet (Excel)

Risk managers require a Regulatory Compliance Tracker Spreadsheet in Excel to monitor adherence to relevant laws and standards effectively. This tool enables systematic documentation and tracking of compliance status, deadlines, and risk assessments. It helps mitigate legal risks through proactive management and regular updates.

- Skill Needed: Proficiency in Excel functions, data validation, conditional formatting, and familiarity with regulatory frameworks.

- Product Requirement: Include customizable columns for regulation name, compliance status, assigned personnel, deadlines, and risk level.

- Specification: Must support automated alerts for upcoming deadlines and integration capabilities with other risk management software.

Stress Testing Scenario Workbook (Excel)

Stress Testing Scenario Workbook designed in Excel provides a robust framework for risk managers to model financial risks under various hypothetical conditions. It includes dynamic input fields and automatic calculations to simulate market, credit, and operational risk scenarios. The tool aids in identifying vulnerabilities and preparing mitigation strategies based on quantitative stress test results.

- Skill needed: Proficiency in Excel functions, risk modeling, and scenario analysis methodologies.

- Product requirement: Must support customizable stress scenarios with adjustable parameters and real-time data updates.

- Specification: The workbook should integrate validation rules, clear documentation, and visually intuitive dashboards for risk reporting.

Fraud Detection and Prevention Guidebook (PDF)

A comprehensive Fraud Detection and Prevention Guidebook in PDF format offers essential methodologies and risk assessment strategies for Risk Managers. It consolidates best practices, real-world fraud scenarios, and actionable prevention techniques tailored to financial and operational risks. This guidebook serves as a critical resource for enhancing vigilance and safeguarding organizational assets.

- Strong analytical skills for identifying suspicious patterns and signals.

- PDF format optimized for easy navigation with clickable table of contents and embedded case studies.

- Clear, jargon-free language with visual aids such as flowcharts and checklists for practical application.

Utilize Data-Driven Risk Assessment Tools

Implementing data-driven risk assessment tools helps decision-makers identify potential challenges before they escalate. These tools analyze market trends and consumer behaviors to minimize risks associated with digital product launches. By leveraging accurate data, marketers can make informed decisions that enhance success rates. Prioritizing data adds a strategic advantage in today's competitive digital landscape.

Employ Real-Time Compliance Monitoring

Real-time compliance monitoring ensures your digital product adheres to industry regulations at every stage. This proactive approach helps avoid costly fines and reputational damage. Automated reporting systems allow marketers to swiftly address compliance issues, maintaining trust with customers and stakeholders. Staying compliant in real-time increases operational efficiency and market confidence.

Integrate Seamlessly with Risk Management Platforms

The ability to seamlessly integrate risk assessment tools with existing risk management platforms promotes streamlined processes. Integration reduces manual errors and saves valuable time in monitoring product performance. It fosters collaboration between departments, enhancing overall risk mitigation strategies. Smooth integration aligns marketing efforts with organizational risk management goals.

Leverage Advanced Analytics for Predictive Modeling

Advanced analytics empower marketers with predictive risk modeling, forecasting potential market fluctuations and customer responses. Predictive insights guide resource allocation and campaign adjustments to maximize product impact. Understanding future risks allows marketers to prepare strategic responses in advance. This foresight strengthens product positioning and long-term growth.

Adopt Scalable Solutions for Regulatory Changes

Scalable solutions are essential for adapting to evolving regulatory environments affecting digital products. Flexible risk management tools ensure compliance even as laws change, reducing operational disruptions. Scalable platforms support business growth while maintaining rigorous adherence to regulations. Embracing adaptability secures sustained success in dynamic markets.