Creating a digital product suitable for equity analysts involves understanding their specific needs in the Finance sector, such as real-time data analysis, financial modeling, and market trend forecasting. The product must offer intuitive interfaces, robust analytics tools, and seamless integration with various financial databases to enhance decision-making. Prioritizing accuracy, speed, and user customization ensures the tool effectively supports equity analysts in evaluating stocks and investment opportunities. Explore the detailed ideas in the article to learn how to design a digital product that meets these critical demands.

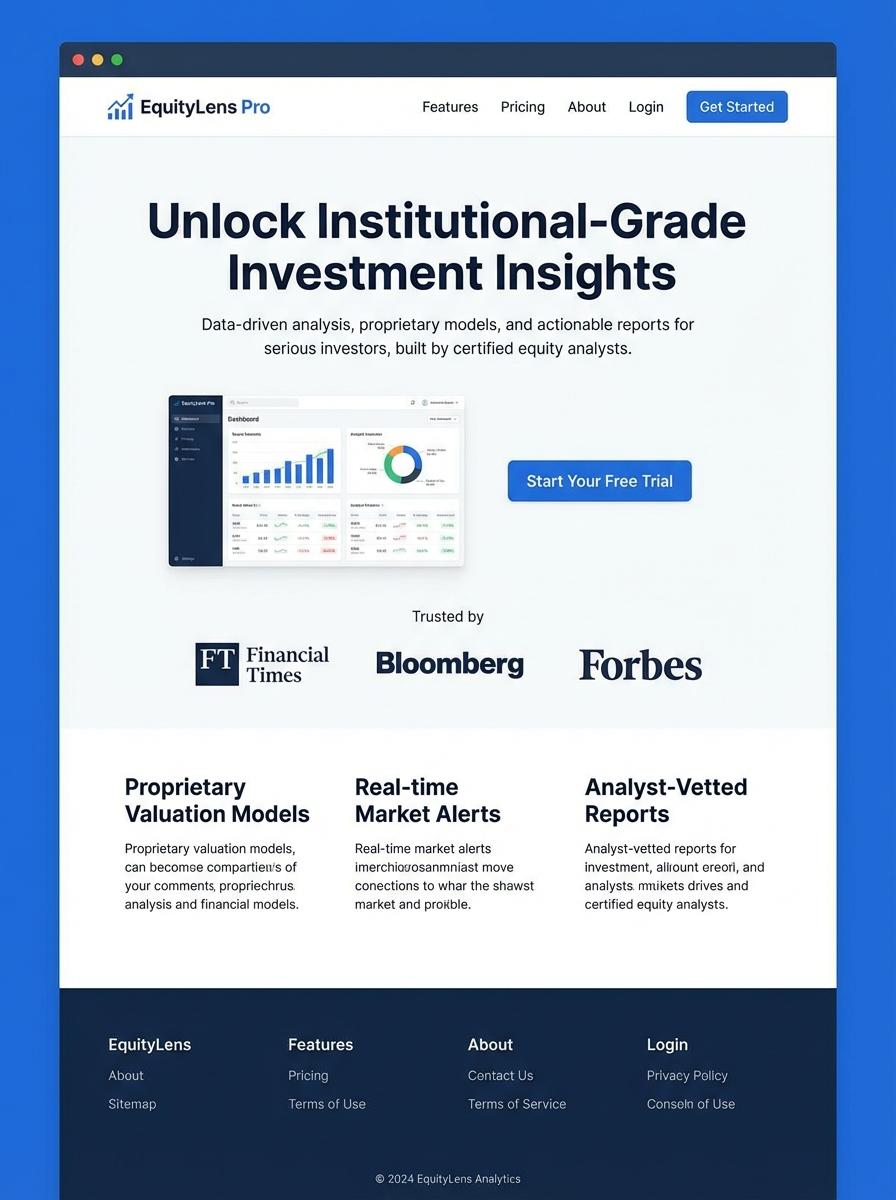

Illustration: Landing page for digital product for equity analyst

Equity Research Report (PDF)

An Equity Research Report in PDF format delivers comprehensive analysis on stock performance, market trends, and company fundamentals tailored for equity analysts. It includes detailed financial metrics, valuation models, and risk assessments to support investment decisions. Visual charts and clear data presentation enhance the readability and impact of the report.

- Skill needed: Proficiency in financial analysis, stock valuation techniques, and knowledge of market dynamics.

- Product requirement: Integration of up-to-date financial data, customizable templates, and interactive charting tools.

- Specification: Exportable PDF format with searchable text, embedded hyperlinks, and secure access for authorized users.

Financial Model Template (Excel)

Financial Model Template in Excel is essential for equity analysts to perform detailed company valuation, forecast financial performance, and analyze investment opportunities. It integrates historical financial data, market assumptions, and key performance indicators to provide dynamic scenario analysis and sensitivity testing. Advanced Excel functions and features, such as pivot tables, macros, and data validation, enhance accuracy and efficiency in financial reporting and decision-making.

- Proficiency in Excel, including advanced formulas, pivot tables, and VBA scripting.

- Compatibility with Excel 2016 or later versions and support for both Windows and Mac operating systems.

- Pre-built customizable templates that include integrated financial statements, discount cash flow (DCF) models, and automated sensitivity analyses.

Sector Comparative Analysis Dashboard (Excel)

The Sector Comparative Analysis Dashboard in Excel empowers equity analysts to evaluate multiple industry sectors simultaneously through dynamic data visualization and comprehensive financial metrics. It integrates real-time stock performance, key financial ratios, and sector-specific benchmarks for effective comparative assessment. Customizable filters allow analysts to focus on targeted market segments and adjust analysis parameters based on evolving market conditions.

- Proficiency in Excel functions, pivot tables, and data visualization techniques.

- Compatibility with live financial data feeds and automated data refresh capability.

- User-friendly interface with customizable filters and drill-down features for detailed sector insights.

Valuation Multiples Cheat Sheet (PDF)

Valuation multiples are essential tools for equity analysts to assess company worth through comparative analysis. The Valuation Multiples Cheat Sheet in PDF format consolidates key ratios like P/E, EV/EBITDA, and Price/Sales for quick reference. It streamlines the evaluation process by offering standardized metrics across industries and sectors.

- Skill needed: Proficiency in financial statement analysis and understanding of industry-specific valuation metrics.

- Product requirement: Comprehensive inclusion of widely used valuation multiples with clear definitions and formulas.

- Specification: PDF format optimized for quick navigation, printable layout, and mobile-friendly readability.

Investment Thesis Presentation (PowerPoint or PDF)

An Investment Thesis Presentation is essential for equity analysts to effectively communicate the rationale behind stock recommendations. It typically includes detailed financial analysis, competitive positioning, and risk assessment. Clear visuals and concise data points enhance the decision-making process for portfolio managers and investors.

- Skills needed: Financial modeling, data visualization, and persuasive communication.

- Product requirement: Compatibility with PowerPoint and PDF formats for versatile sharing.

- Specification: Use of standardized templates with sections for market overview, valuation, and key investment drivers.

Industry Trends & Insights Whitepaper (PDF)

The Industry Trends & Insights Whitepaper (PDF) provides equity analysts with in-depth analysis of market movements, sector performance, and emerging economic indicators. It leverages proprietary data modeling and historical trends to highlight key investment opportunities and risks. This whitepaper serves as a strategic tool for making data-driven equity investment decisions.

- Skill needed: Advanced financial modeling and sector-specific research capabilities

- Product requirement: Clear, data-rich format optimized for quick insights and PDF compatibility

- Specification: Inclusion of up-to-date charts, expert commentary, and actionable investment recommendations

Video Tutorial: Fundamental Equity Analysis (MP4)

Equity analysts require a solid understanding of financial statements, market trends, and valuation methods to evaluate stocks effectively. This video tutorial offers step-by-step guidance on fundamental equity analysis, focusing on metrics like P/E ratio, EPS, and dividend yield. The MP4 format ensures easy access and review across multiple devices for practical learning.

- Skill needed: proficiency in financial statement analysis and interpretation of market data.

- Product requirement: high-quality MP4 video with clear visual aids and examples.

- Specification: content tailored specifically for equity analysts, including real-world case studies.

Real-time Financial Data Integration for Actionable Insights

Integrating real-time financial data is crucial for gaining immediate and relevant insights in digital product marketing. This allows marketers to respond swiftly to market changes and customer behavior. Leveraging accurate data ensures that strategies remain effective and aligned with current trends. Keeping information up-to-date enables better decision-making and competitive advantage.

AI-driven Equity Analysis to Enhance Investment Decisions

Utilizing AI-driven equity analysis enhances the ability to make informed investment decisions. AI algorithms process vast datasets quickly, identifying patterns and opportunities that may be missed by human analysis. This leads to smarter marketing allocations and maximized returns. Integrating AI tools supports predictive analytics and market forecasting for your digital product.

Customizable Dashboards for Efficient Portfolio Monitoring

Customizable dashboards streamline the monitoring of marketing investments and portfolio performance. Tailoring dashboards to specific metrics highlights key performance indicators (KPIs) that matter most to your campaign's success. This improves efficiency by providing clear visualization and quick access to critical data. A personalized dashboard ensures continuous optimization of marketing efforts.

Seamless Collaboration Tools for Analyst Teams

Effective marketing demands seamless collaboration between analyst teams to share insights and strategies efficiently. Collaboration tools enable smooth communication, version control, and task management. These solutions foster teamwork and alignment, reducing delays and errors in campaign execution. Enhanced teamwork drives faster innovation and campaign adaptability.

Regulatory-Compliant Reporting and Data Security Compliance

Maintaining regulatory-compliant reporting and ensuring data security are essential in digital product marketing. Compliance builds trust with customers and stakeholders by protecting sensitive information. Adhering to regulations avoids legal penalties and reputational damage, enhancing brand credibility. Prioritizing security safeguards both your product and your audience's data.