Creating a digital product tailored for a Quantitative analyst in the Finance sector involves integrating advanced data analytics and algorithmic tools that enhance decision-making efficiency. Such a product must support complex mathematical modeling, real-time data processing, and predictive analysis to meet the demanding needs of financial markets. User-friendly interfaces combined with robust backend systems help analysts generate actionable insights quickly. Explore the article to discover detailed strategies for developing an effective digital solution in this niche.

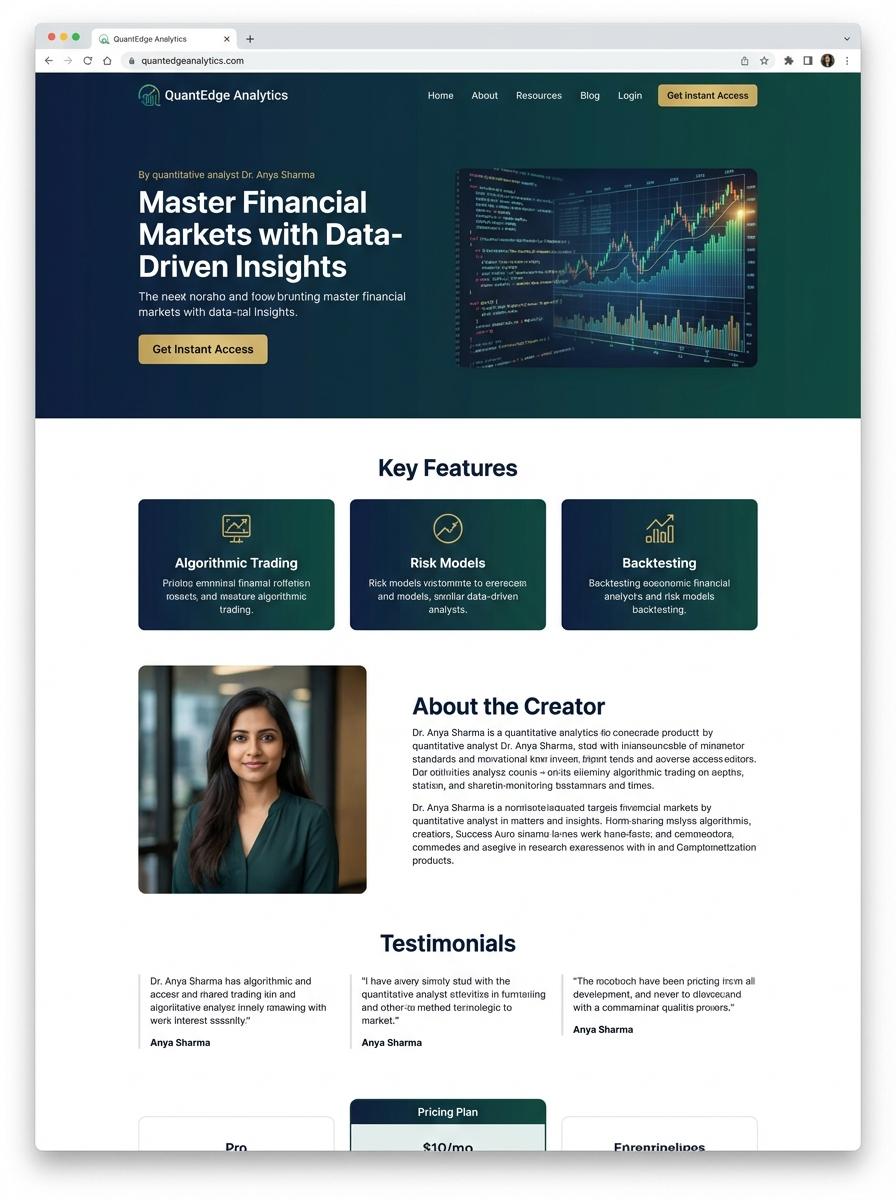

Illustration: Landing page for digital product for Quantitative analyst

Financial Risk Modeling Templates (Excel)

Financial Risk Modeling Templates in Excel offer quantitative analysts a practical framework to evaluate market, credit, and operational risks using advanced formulas and scenario analysis tools. These templates integrate VBA macros for automation and customizable dashboards to visualize risk metrics. Modeling accuracy depends on the integration of historical data, statistical distributions, and stress-testing capabilities.

- Skills needed: Expertise in Excel functions, VBA programming, statistical analysis, and financial risk concepts.

- Product requirements: Dynamic model calculators, user-friendly input forms, and comprehensive documentation.

- Specifications: Compatibility with Excel 2016 or later, error-checking mechanisms, and customizable risk factor parameters.

Quantitative Trading Strategy Reports (PDF)

Quantitative Trading Strategy Reports provide data-driven insights into trading algorithms and market conditions, tailored specifically for quantitative analysts. These reports include detailed statistical analysis, performance metrics, and risk assessments to facilitate informed decision-making. Accurate and up-to-date data extraction ensures the reliability and relevance of the strategies presented.

- Skill needed: Proficiency in statistical analysis, financial modeling, and programming languages such as Python or R.

- Product requirement: Automated data integration from reliable financial databases and customizable report templates.

- Specification: Output as high-quality PDFs with clear visualization of backtesting results, performance indicators, and risk metrics.

Portfolio Optimization Tools (Excel)

Quantitative analysts require Portfolio Optimization Tools designed in Excel to efficiently allocate assets and maximize returns through advanced mathematical modeling. These tools leverage Excel's robust functions and VBA scripting to handle large datasets, optimize risk and return trade-offs, and provide actionable insights. Integration with financial data sources and real-time updating enhances decision-making accuracy and speed.

- Strong proficiency in Excel functions, VBA programming, and quantitative finance concepts.

- Capability to support multi-asset portfolio input, constraints handling, and scenario analysis.

- Requirement for seamless integration with external financial databases and automated data refresh.

Algorithmic Backtesting Scripts (Python files)

Quantitative analysts utilize algorithmic backtesting scripts written in Python to evaluate trading strategies against historical financial data. These scripts enable the simulation of strategy performance, helping to identify potential risks and returns before live deployment. Precision in data handling and computational efficiency are critical for reliable backtest outcomes.

- Skill needed: Proficiency in Python programming, including libraries such as Pandas, NumPy, and backtesting frameworks.

- Product requirement: The script must support integration with historical market data sources and allow parameter optimization.

- Specification: Include clear documentation for algorithm logic, input/output formats, and testing protocols to ensure reproducibility.

Market Data Analysis Dashboards (Excel)

Market Data Analysis Dashboards in Excel provide quantitative analysts with dynamic visualizations and real-time data tracking necessary for predictive modeling and risk assessment. These dashboards integrate multiple data streams, applying advanced Excel formulas and pivot tables for comprehensive market trend analysis. Users benefit from automated updates and customizable views tailored to specific asset classes and trading strategies.

- Skill needed: Proficiency in advanced Excel functions such as Power Query, PivotTables, and VBA scripting.

- Product requirement: Real-time data connectivity to financial markets and robust data validation features.

- Specification: Customizable visualization components including charts, heat maps, and conditional formatting for immediate insight.

Financial Forecasting Models (Excel)

Financial forecasting models in Excel provide quantitative analysts with robust tools to project future financial performance using historical data, statistical methods, and algorithms. These models enable scenario analysis, risk assessment, and decision-making through precise data manipulation and visualization. Advanced Excel functions, such as regression analysis and pivot tables, are integral in capturing complex financial dynamics.

- Strong proficiency in Excel, including VBA, advanced formulas, and data analysis tools.

- Accurate historical financial data and relevant economic indicators are essential inputs for model reliability.

- Model specifications must support scenario planning, sensitivity analysis, and easy update mechanisms.

Quantitative Finance Tutorial Videos (MP4)

Quantitative Finance Tutorial Videos (MP4) provide targeted educational content designed to enhance the expertise of quantitative analysts in statistical modeling, algorithmic trading, and risk management. These videos deliver complex financial concepts and practical applications through clear visual and auditory learning formats. Incorporation of real-world case studies and data-driven strategies ensures effective knowledge transfer and skill development.

- Skill needed: Strong foundation in mathematics, programming (Python or R), and financial theory.

- Product requirement: High-definition MP4 format compatible with various devices and streaming platforms for seamless access.

- Specification: Content structured with modular chapters including coding demonstrations, model evaluations, and quantitative finance tools.

Leverage Data-Driven Insights for Success

Utilizing data-driven insights is crucial for marketing a digital product effectively. These insights help you understand customer behaviors and optimize your trading strategies. By analyzing market trends, you can tailor your messaging to meet the needs of your target audience, increasing engagement and conversion rates.

Utilize Advanced Analytics Tools

Incorporating advanced analytics tools designed for quantitative finance enables marketers to make informed decisions. These tools assist in identifying high-value customer segments and forecasting product demand. They enhance campaign precision, leading to better resource allocation and higher ROI.

Ensure Seamless Platform Integration

Marketing efforts are amplified when your digital product offers seamless integration with leading financial platforms. This compatibility boosts user experience and builds trust with potential clients. Highlighting this feature can be a key selling point in marketing materials.

Monitor Performance in Real-Time

Real-time performance monitoring empowers marketers to track campaign effectiveness instantly. This allows for swift adjustments to strategies, ensuring optimal outcomes. Regular reporting keeps teams aligned and focused on meeting marketing goals efficiently.

Implement Scalable Solutions for Growth

Adopting scalable solutions is essential for sustaining marketing success as demand grows. Scalable algorithmic trading optimization tools support expanding customer bases without compromising performance. Promoting the scalability of your product attracts larger clients and fosters long-term trust.