Creating a digital product tailored for a Corporate Finance Associate in the finance sector involves developing tools that streamline financial analysis, enhance data management, and improve decision-making processes. Such solutions should integrate advanced analytics, real-time reporting, and compliance features to meet the complex demands of corporate finance roles. Emphasizing user-friendly interfaces and secure data handling ensures efficient workflow and trustworthiness. Explore the article for detailed strategies to design an effective digital product for finance professionals.

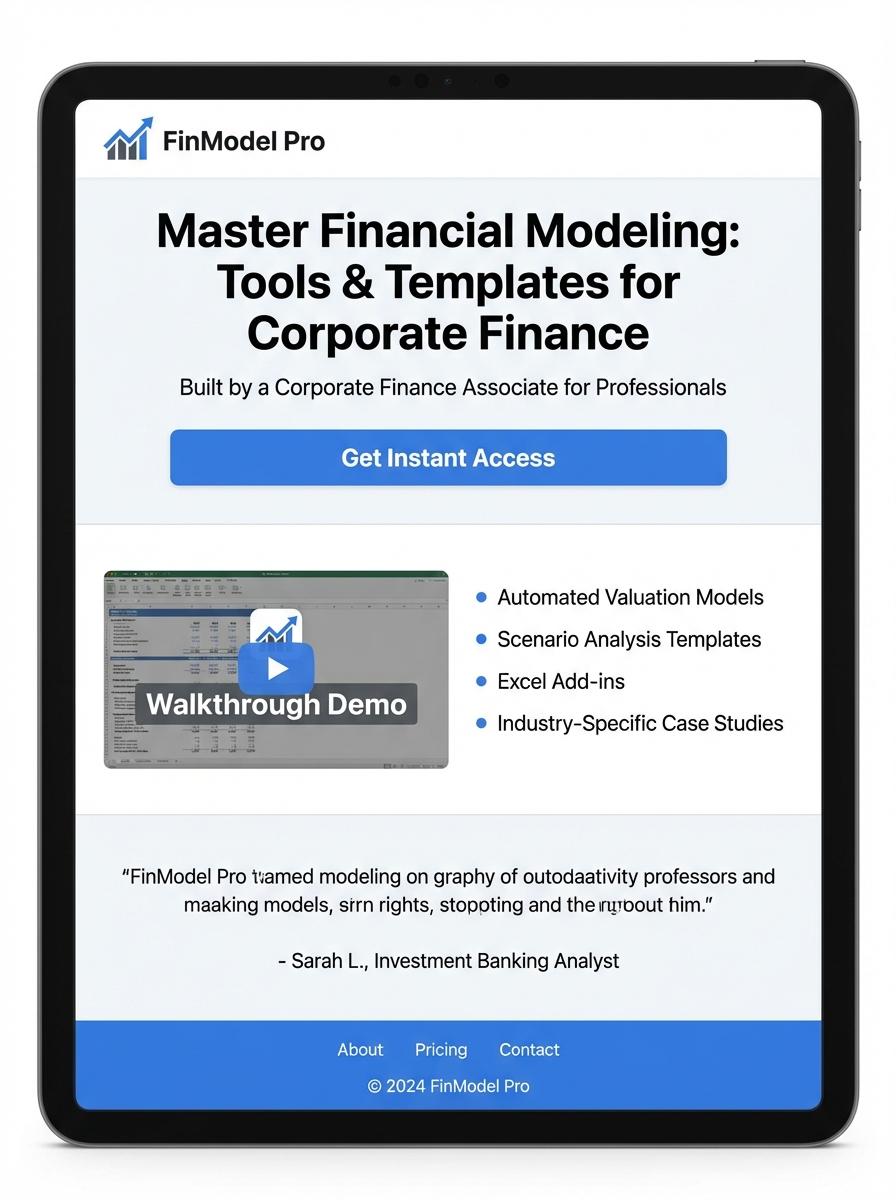

Illustration: Landing page for digital product for Corporate finance associate

Financial Ratio Analysis Report Template (Excel)

Corporate finance associates require accurate tools to evaluate company performance through key financial ratios such as liquidity, profitability, and solvency ratios. A Financial Ratio Analysis Report Template in Excel facilitates systematic data input, automated calculations, and clear visualization of financial metrics. This template enhances decision-making by delivering concise insights into financial health and operational efficiency.

- Skill needed: Proficiency in financial statement analysis and basic Excel functions such as formulas and pivot tables.

- Product requirement: Pre-built formulas for ratios like current ratio, return on equity, and debt-to-equity ratio with customizable input fields.

- Specification: User-friendly interface with clear labels, visual charts, and error-proof data validation features.

Corporate Budgeting Workbook (Excel)

The Corporate Budgeting Workbook is designed to streamline the financial planning process for corporate finance associates. It includes customizable sheets for revenue forecasting, expense tracking, and variance analysis to improve budgeting accuracy. Embedded formulas and charts provide dynamic insights to aid decision-making in financial management.

- Skill needed: Proficiency in Excel functions such as VLOOKUP, pivot tables, and financial formulas.

- Product requirement: User-friendly interface with clearly defined input fields and automatic error-checking tools.

- Specification: Compatibility with Excel 2016 and later versions, including macros for automated report generation.

M&A Valuation Model Toolkit (Excel)

The M&A Valuation Model Toolkit is tailored for Corporate Finance Associates to streamline the assessment of mergers and acquisitions through dynamic Excel models. It includes discounted cash flow (DCF) analysis, comparable company benchmarks, and accretion/dilution modeling to enhance deal evaluation accuracy. These tools optimize financial insights and support strategic transaction decision-making.

- Strong proficiency in Excel functions including VBA, pivot tables, and advanced financial formulas.

- The product requires integration of sensitivity analysis features and customizable input variables for flexible scenario planning.

- Specifications demand pre-built templates compatible with Excel 2016 and later, ensuring ease of use and adaptability across deal types.

Debt Financing Guide (PDF)

Debt financing involves borrowing funds that must be repaid with interest, typically used by corporations to raise capital for expansion or operational needs. A well-crafted guide comprehensively covers types of debt instruments, risk assessment, and negotiation techniques vital for corporate finance associates. Understanding covenant structures and repayment schedules is crucial for effective debt management and maintaining corporate creditworthiness.

- Analytical skills to evaluate debt options and assess credit risk.

- Clear, concise explanation of debt types, terms, and financial implications.

- Inclusion of case studies and customizable repayment templates for practical application.

Cash Flow Forecasting Template (Excel)

A Cash Flow Forecasting Template in Excel is essential for Corporate Finance Associates to analyze and predict company liquidity over future periods. This tool helps track operating, investing, and financing cash inflows and outflows, enabling informed decision-making and risk management. Accurate forecasts support budgeting, financial planning, and optimal resource allocation within the organization.

- Skill needed: Proficiency in Excel functions, financial modeling, and data analysis techniques.

- Product requirement: Dynamic input fields for revenues, expenses, and capital expenditures allowing customizable forecasting periods.

- Specification: Visual dashboards with charts and conditional formatting to highlight cash surplus or deficit scenarios.

Corporate Finance Fundamentals Presentation (PowerPoint)

Corporate Finance Fundamentals Presentation provides a comprehensive overview of key financial principles tailored for Corporate Finance Associates. It covers essential topics such as capital budgeting, financial analysis, and risk management to enhance decision-making skills. The presentation is designed to support practical application in real-world corporate financial environments.

- Strong understanding of accounting principles and financial statements.

- Clear, professional PowerPoint slides with concise text and relevant visuals.

- Includes case studies, real-world examples, and interactive elements for engagement.

Capital Structure Decision Checklist (PDF)

The Capital Structure Decision Checklist is designed to assist Corporate Finance Associates in systematically evaluating financing options. This PDF resource outlines critical financial metrics such as debt-equity ratio, cost of capital, and risk assessment. Users gain a structured approach to optimize capital allocation aligned with firm objectives.

- Skill needed: Proficiency in financial statement analysis and familiarity with debt and equity instruments.

- Product requirement: Clear, concise sections with actionable items and relevant financial formulas included in the PDF.

- Specification: Compatible with common PDF readers and printable format for ease of use in board meetings and presentations.

Data-Driven Decision-Making in Financial Solutions

Leveraging data-driven decision-making is essential for marketing digital products in the financial sector. By analyzing customer behavior and market trends, marketers can tailor strategies that resonate with their target audience. This approach minimizes risks and maximizes ROI, creating a competitive advantage. Incorporating data insights ensures smarter, evidence-based marketing efforts.

Seamless Integration with Corporate Finance Systems

Ensuring your digital product offers seamless integration with existing corporate finance systems is crucial for market acceptance. Integration reduces operational friction and enhances user experience, which increases client trust and satisfaction. Highlighting compatibility with popular finance platforms strengthens your product's value proposition. This connectivity often differentiates successful products in a crowded market.

Enhanced Compliance and Regulatory Support

Marketing a financial digital product requires prominent focus on enhanced compliance and regulatory support. Clients seek solutions that guarantee adherence to evolving financial laws and standards. Emphasizing your product's robust compliance features minimizes potential legal risks. Clear communication of regulatory benefits builds credibility and attracts compliance-conscious customers.

Real-Time Analytics for Financial Performance

Offering real-time analytics empowers users to make timely and informed financial decisions. Marketing should emphasize how instant data visibility improves operational efficiency and financial outcomes. Real-time insights foster greater engagement and user satisfaction, critical factors in digital product success. Highlighting this feature can significantly boost buyer confidence in your solution.

Scalable Solutions for Growing Corporate Needs

Promote your digital product's ability to provide scalable solutions that adapt to evolving corporate finance demands. Scalability ensures long-term usability and justifies investment for growing enterprises. Successful marketing stresses flexibility and growth potential as key selling points. Corporate clients prioritize adaptable tools that evolve with their business landscape.