Creating a digital product suitable for Corporate Treasurer involves understanding the unique challenges faced in the finance sector, such as cash management, risk assessment, and regulatory compliance. The product must offer seamless integration with existing financial systems, provide real-time data analytics, and ensure robust security features to protect sensitive information. Tailoring the solution to enhance decision-making efficiency and streamline treasury operations is essential. Explore the detailed ideas in the article to learn how to develop an effective digital tool for corporate treasurers.

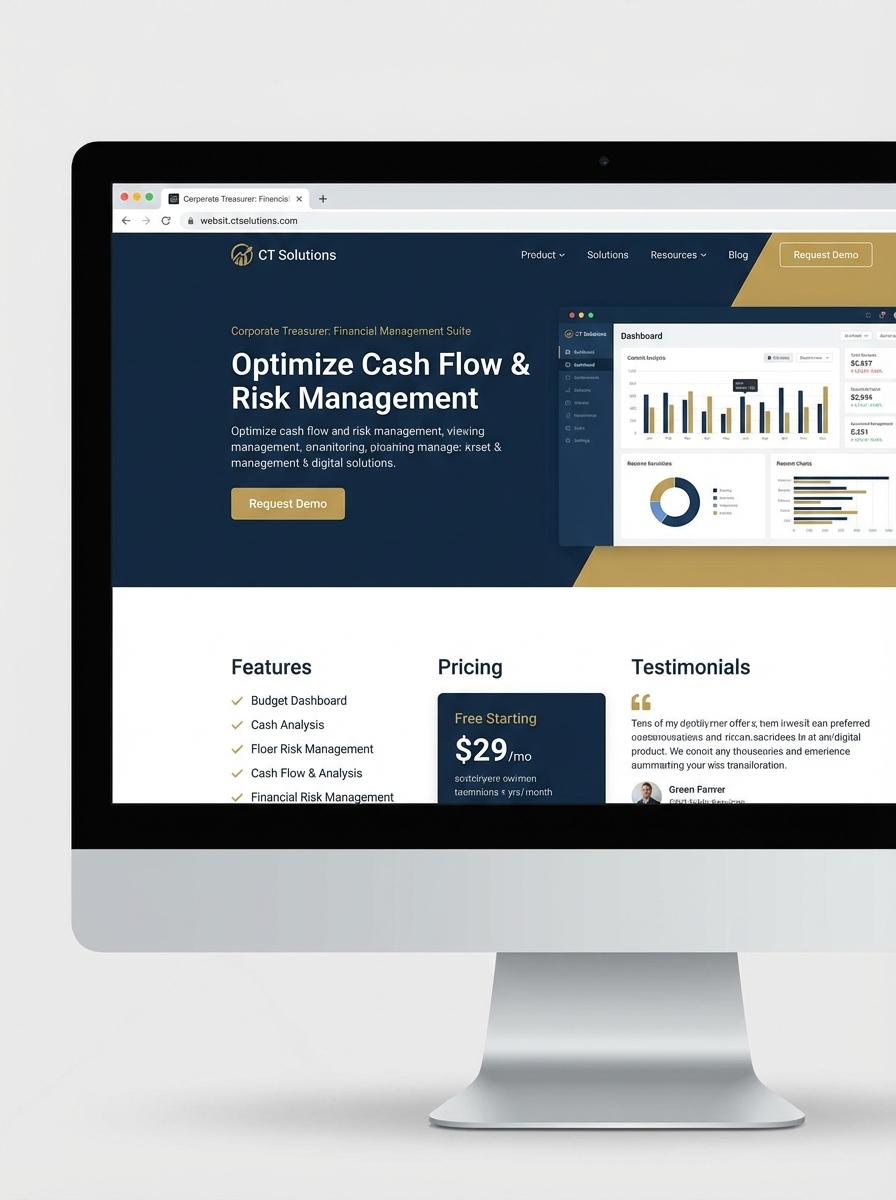

Illustration: Landing page for digital product for Corporate treasurer

Cash Flow Forecasting Template (Excel)

A Cash Flow Forecasting Template in Excel enables corporate treasurers to systematically project cash inflows and outflows, ensuring precise liquidity management. It integrates historical data and key financial metrics to provide accurate short-term and long-term forecasts. This tool supports strategic decision-making by highlighting potential cash shortages and surpluses.

- Proficiency in Excel functions such as PivotTables, VLOOKUP, and data visualization tools.

- Template must provide customizable time periods, automated calculations, and scenario analysis capabilities.

- Secure and user-friendly interface with options for data import from ERP systems or bank statements.

Treasury Policy Manual (PDF)

The Treasury Policy Manual is an essential guide for Corporate Treasurers to establish standardized procedures for cash management, risk mitigation, and compliance. It outlines critical roles, responsibilities, and internal controls necessary to safeguard organizational assets. This digital product, in PDF format, aims to streamline treasury operations and ensure regulatory adherence.

- Skill needed: Expertise in corporate treasury management and regulatory compliance.

- Product requirement: Clear, concise documentation with customizable policy templates and examples.

- Specification: PDF format ensuring accessibility, security, and easy distribution within the organization.

Foreign Exchange Risk Management Guide (PDF)

Corporate treasurers face constant challenges in managing foreign exchange risk to protect company assets and profits. Effective risk management requires accurate market analysis, hedging strategies, and compliance with international financial regulations. A comprehensive guide provides detailed methodologies and practical tools tailored for the corporate treasury function.

- Skills needed: Expertise in currency markets, financial risk assessment, and hedging instruments.

- Product requirements: Clear explanations, case studies, and real-world examples of foreign exchange risk management.

- Specifications: Accessible PDF format, well-structured chapters, and inclusion of compliance checklists for treasurers.

Liquidity Management Dashboard (Excel)

Liquidity Management Dashboard in Excel offers corporate treasurers real-time visibility into cash flow, enabling accurate forecasting and cash position analysis. It integrates multiple data sources, streamlining the monitoring of inflows and outflows for optimized treasury operations. Customizable features enhance decision-making through scenario analysis and risk assessment.

- Skill needed: Advanced Excel proficiency including pivot tables, formulas, and VBA scripting.

- Product requirement: Integration capability with ERP and banking systems for automatic data updates.

- Specification: Dashboard must support real-time cash flow visualization and customizable forecast models.

Bank Relationship Scorecard (Excel)

The Bank Relationship Scorecard in Excel enables Corporate Treasurers to systematically evaluate banking partners by analyzing metrics such as service quality, fee structures, and transaction turnaround times. This scorecard consolidates key performance indicators to enhance decision-making on banking relationships and optimize financial operations. Through data-driven insights, treasurers can identify opportunities for cost savings and improved banking services.

- Skill needed: Proficiency in Excel functions, data analysis, and financial metrics interpretation.

- Product requirement: Customizable templates to capture varied banking KPIs and quantitative scoring methods.

- Specification: Integration of dynamic charts and pivot tables for visualizing bank performance trends.

Short Video Training on Hedging Strategies (Video)

Corporate treasurers require a comprehensive understanding of hedging strategies to effectively manage financial risks associated with currency fluctuations, interest rates, and commodity prices. This short video training highlights practical applications and advanced techniques tailored for dynamic corporate environments. Emphasizing real-world scenarios improves decision-making and risk mitigation.

- Skill needed: Proficiency in financial risk management and familiarity with derivatives such as forwards, options, and swaps.

- Product requirement: High-quality video content with clear visual aids illustrating complex hedging concepts and case studies.

- Specification: Interactive elements such as quizzes or scenario-based exercises to reinforce learning outcomes for corporate treasury professionals.

Treasury Compliance Checklist (Doc)

A Treasury Compliance Checklist is essential for Corporate Treasurers to ensure adherence to regulatory requirements and internal policies. It includes verifying accuracy of financial records, monitoring cash flow, and maintaining updated documentation of compliance activities. This checklist minimizes risk and enhances transparency in treasury operations.

- Skills needed: Knowledge of regulatory frameworks, financial analysis, and risk management.

- Product requirement: Interactive and easy-to-navigate document with clear categories and compliance checkpoints.

- Specification: Printable format with customizable fields for company-specific policies and real-time update capabilities.

Streamlined Treasury Operations for Enhanced Efficiency

Implementing automated treasury operations ensures smoother workflows and reduces manual errors. Efficient processes help in managing digital product revenues and expenses effectively. Streamlining these operations allows marketing teams to focus more on growth strategies rather than administrative tasks. This ultimately supports faster decision-making and improved financial health.

Real-Time Cash Visibility and Liquidity Management

Maintaining real-time cash visibility is crucial for timely marketing investments and campaign optimizations. Liquidity management gives marketers the ability to allocate resources dynamically based on cash flow patterns. Ensuring immediate access to funds enhances agility in responding to market changes. This transparency boosts confidence in budgeting for digital product launches.

Robust Security and Regulatory Compliance Solutions

Marketing digital products demands adherence to strong security standards to protect sensitive customer data. Compliance with regulations fosters trust and avoids legal pitfalls that can damage brand reputation. Using secure platforms and encryption safeguards transactions and personal information. Integrating compliance checks into marketing strategies strengthens overall credibility.

Seamless Integration with ERP and Banking Systems

Integrating marketing tools with ERP and banking systems streamlines financial tracking and reporting. This connection simplifies budgeting, payment processing, and revenue reconciliation. Seamless integration provides a holistic view of business performance, supporting effective marketing spend analysis. It also enables smoother coordination between marketing and finance teams.

Data-Driven Insights for Strategic Financial Decision-Making

Leveraging data-driven insights empowers marketers to optimize campaigns based on financial performance. Analytics reveal trends, customer behaviors, and ROI, guiding budget allocation. Strategic decisions backed by accurate data improve marketing effectiveness and profitability. This insight-driven approach leads to smarter investments in digital product growth.