Creating a digital product suitable for investment bankers in the finance sector requires a deep understanding of their unique needs, including data security, real-time analytics, and compliance with financial regulations. The product must streamline complex financial processes, enhance decision-making with advanced analytics, and offer seamless integration with existing platforms. Prioritizing user experience and reliability is essential to meet the high standards expected in investment banking. Explore the article for detailed insights on developing a tailored digital solution that meets these criteria.

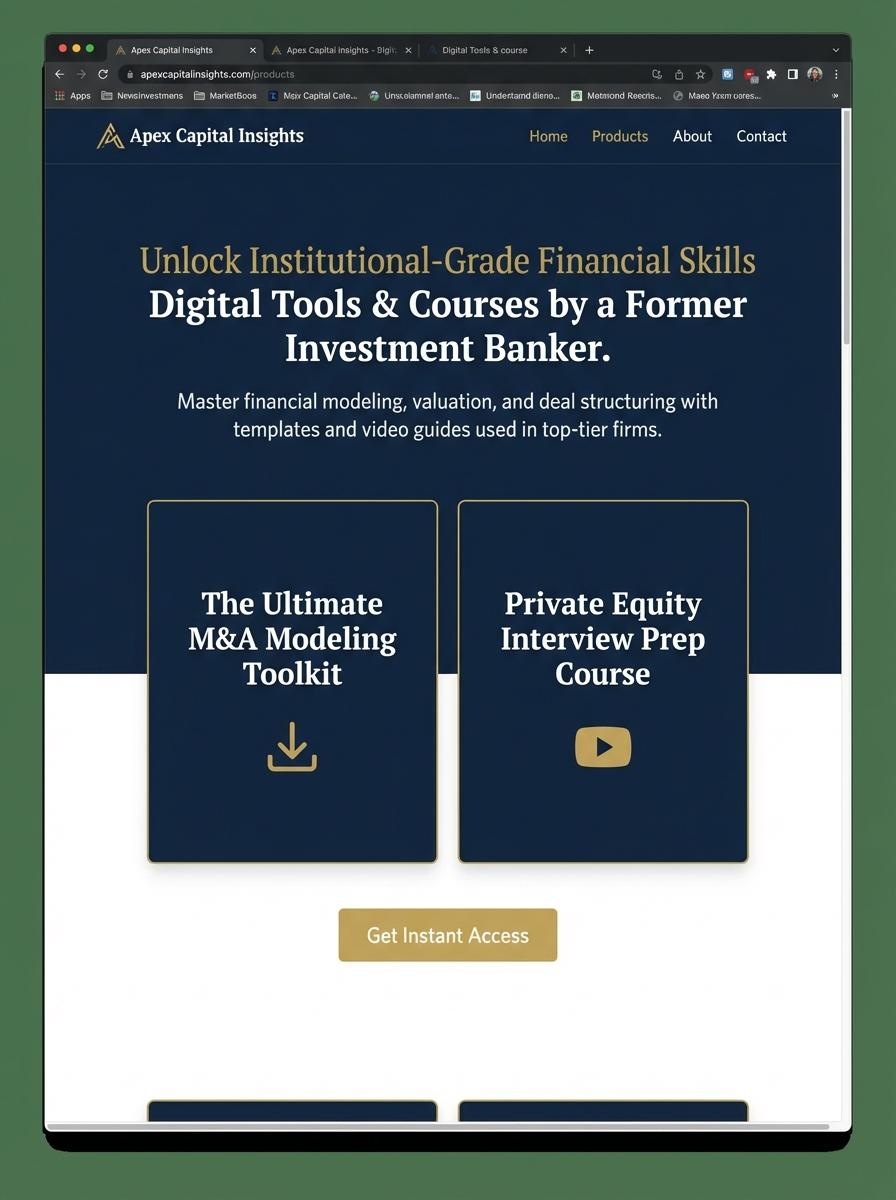

Illustration: Landing page for digital product for Investment banker

Financial Due Diligence Checklist (Excel or PDF)

Financial due diligence is a critical process performed by investment bankers to evaluate the financial health and risks of potential investment targets. The checklist should include detailed analysis of financial statements, cash flow, liabilities, and compliance with regulatory standards. A systematic approach ensures thorough assessment and informed decision-making during mergers and acquisitions.

- Skills needed: expertise in financial statement analysis, risk assessment, and knowledge of M&A processes.

- Product requirements: clear, organized checklist format compatible with Excel and PDF for easy customization and sharing.

- Specifications: sections covering income statements, balance sheets, cash flow reviews, debt obligations, and regulatory compliance verification.

Investment Pitch Deck Templates (PowerPoint or PDF)

Investment Pitch Deck Templates tailored for investment bankers streamline the presentation of financial data, market analysis, and growth strategies to potential investors. These templates often include customizable slides for portfolio highlights, valuation metrics, and deal structures. Designed with clarity and professionalism, they enhance persuasive communication in high-stakes investment scenarios.

- Skill Needed: Proficiency in financial modeling and data visualization specific to investment banking.

- Product Requirement: Compatibility with PowerPoint and export options in PDF format for versatile presentation.

- Specification: Inclusion of standard investment banking slide components such as market opportunity, competitive landscape, and exit strategy.

Merger & Acquisition Modeling Spreadsheet (Excel)

This Merger & Acquisition Modeling Spreadsheet for Excel streamlines complex financial analysis, integrating cash flow forecasting, synergy estimation, and accretion/dilution modeling tailored for investment bankers. It leverages dynamic formulas and structured data inputs to ensure accuracy and adaptability across various deal structures. The model facilitates informed decision-making by providing clear valuations and sensitivity analysis.

- Strong proficiency in Excel functions, financial modeling, and understanding of M&A transaction mechanics.

- Includes features such as scenario analysis, integration of balance sheets, and automated calculation of purchase price allocations.

- Requires compatibility with Excel 2016 or later and enables easy updating with real-time data links and audit-trail functionality.

Valuation Methods Guide (PDF)

Investment bankers rely heavily on accurate and reliable valuation methods to assess the true worth of companies and assets. Comprehensive guides covering Discounted Cash Flow (DCF), Comparable Company Analysis, and Precedent Transactions provide essential frameworks for decision-making. This PDF guide is tailored for precise application in mergers, acquisitions, and capital raising activities.

- Skill needed: Proficiency in financial modeling and interpreting valuation multiples.

- Product requirement: Clear examples of valuation scenarios relevant to investment banking deals.

- Specification: Easy-to-navigate format with detailed explanations and case studies for quick referencing.

Financial Statement Analysis Workbook (Excel)

Financial Statement Analysis Workbook in Excel is essential for investment bankers to evaluate company performance through detailed ratio calculations and trend analysis. The workbook integrates key financial statements, including the balance sheet, income statement, and cash flow statement, to provide comprehensive insights. Dynamic financial modeling enables scenario analysis and informed investment decisions.

- Skill needed: Proficiency in Excel functions, financial modeling, and accounting principles.

- Product requirement: Automated formulas for liquidity, profitability, and solvency ratios with customizable input fields.

- Specification: Interactive dashboards with visualizations, historical data comparison, and exportable reports.

Virtual Training Course on Deal Structuring (Video)

The Virtual Training Course on Deal Structuring provides investment bankers with in-depth modules covering key aspects of mergers and acquisitions, financial modeling, and negotiation strategies. The course includes high-quality video lectures, case studies, and interactive exercises to enhance practical understanding and decision-making skills. Designed specifically for professionals in investment banking, it emphasizes real-world applications and deal execution techniques.

- Skill Needed: Proficiency in financial analysis, valuation methods, and negotiation tactics.

- Product Requirement: High-resolution video content with segmented chapters for easy navigation.

- Specification: Compatibility with desktop and mobile devices, plus downloadable resources for offline study.

Private Equity Investment Memo Template (Word or PDF)

Crafting a Private Equity Investment Memo Template tailored for investment bankers involves structuring detailed financial analyses, market assessments, and risk evaluations. The template should facilitate clear presentation of investment theses and due diligence findings to stakeholders. Precision and clarity in content organization enhance decision-making in high-stakes private equity deals.

- Expertise in financial modeling, valuation techniques, and industry-specific metrics.

- The template must include customizable sections for executive summary, investment rationale, and risk factors.

- Availability in Word or PDF format with professional layout and branding flexibility.

Data-Driven Investment Insights for Informed Decision-Making

Utilizing data-driven insights empowers marketers to make informed decisions that optimize campaign effectiveness. Analyzing customer behavior and market trends helps tailor strategies that resonate with the target audience. This approach minimizes guesswork and maximizes ROI in digital product marketing. Emphasizing analytics fosters continuous improvement and smarter investment choices.

Seamless Portfolio Management with Real-Time Analytics

Integrating real-time analytics enables marketers to monitor campaign performance instantly and adjust tactics accordingly. This dynamic management ensures better resource allocation and timely responses to market changes. A seamless portfolio approach enhances overall efficiency in managing multiple digital marketing efforts. Real-time data visibility supports agile decision-making and improved outcomes.

Enhanced Client Engagement through Intuitive Digital Tools

Leveraging intuitive digital tools enhances client interaction by providing a user-friendly experience. Engaged customers are more likely to convert and remain loyal to the digital product. Interactive platforms and personalized communication build trust and foster lasting relationships. Prioritizing usability in digital marketing strategies drives higher engagement rates.

Robust Security Protocols Ensuring Data Confidentiality

Implementing robust security protocols is crucial for protecting sensitive client information and maintaining trust. Secure digital environments reassure customers, encouraging them to engage more deeply with the product. Compliance with industry standards enhances credibility and reduces risk. Marketing strategies must highlight security as a key value proposition.

Scalable Solutions Tailored for Investment Banking Needs

Offering scalable solutions ensures that marketing efforts can grow alongside business expansion without compromising performance. Tailoring digital products to meet the specific demands of investment banking enhances relevance and effectiveness. Scalability supports long-term success by adapting to evolving client requirements. Strategic flexibility in digital marketing drives sustainable growth.