Creating a digital product suitable for fund managers in the finance sector requires an in-depth understanding of their unique needs, including portfolio management, risk assessment, and real-time data analysis. The product must offer robust security features, intuitive interfaces, and seamless integration with existing financial systems to enhance decision-making efficiency. Leveraging advanced analytics and automation can significantly streamline fund management tasks and improve overall performance. Explore detailed strategies and innovative ideas in the article to develop effective digital solutions for fund managers.

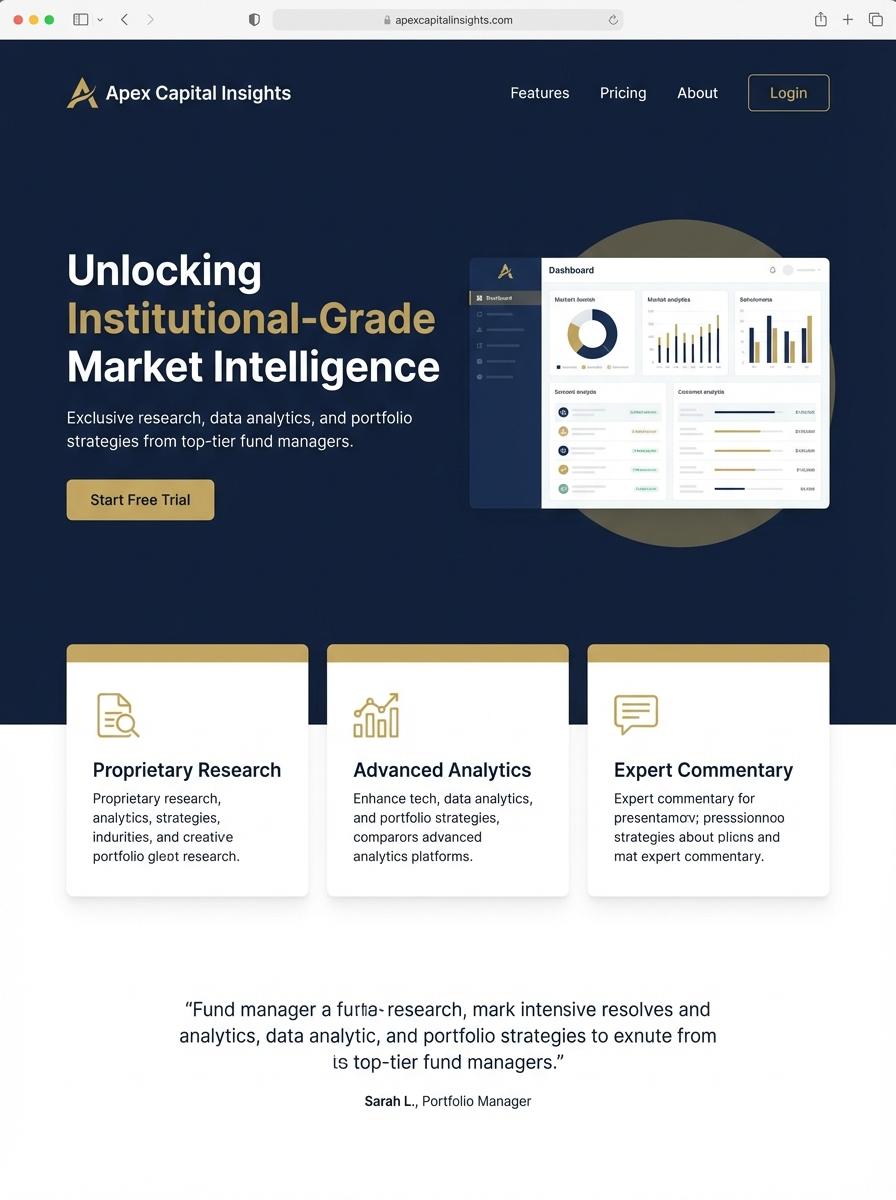

Illustration: Landing page for digital product for Fund manager

Investment Portfolio Performance Report (PDF)

An Investment Portfolio Performance Report in PDF format provides fund managers with accurate and comprehensive insights into asset allocations, returns, and risk metrics over specific periods. It enables data-driven decisions by clearly displaying performance trends, benchmarking against market indices, and highlighting portfolio diversification. The report supports regulatory compliance with transparent documentation of investment activities and results.

- Strong analytical skills to interpret financial data and performance metrics.

- Requirement for dynamic data visualization tools to present charts, graphs, and tables clearly.

- Specifications include secure PDF generation with customizable templates accommodating multi-period breakdowns and benchmark comparisons.

Financial Market Analysis Whitepaper (PDF)

Fund managers benefit greatly from a Financial Market Analysis Whitepaper that synthesizes complex market data and trends into actionable insights. This whitepaper should focus on asset allocation, risk assessment, and emerging market opportunities relevant to portfolio management. Accurate, up-to-date financial models and statistical forecasts enhance decision-making efficacy.

- Advanced knowledge of financial modeling, quantitative analysis, and market trend evaluation.

- High-resolution PDF format with interactive charts, embedded hyperlinks to data sources, and mobile-friendly design.

- Inclusion of detailed sector-by-sector breakdown, risk-factor analysis, and proprietary market insights tailored for fund management.

Excel-based Mutual Fund Comparison Tool (Excel)

Creating an Excel-based Mutual Fund Comparison Tool allows fund managers to analyze multiple mutual funds efficiently by leveraging data organization and advanced Excel functions. The tool facilitates side-by-side comparisons of key performance indicators such as NAV, expense ratio, and historical returns. Incorporating dynamic charts and pivot tables enhances decision-making processes and strategy evaluations.

- Skill needed: Proficiency in Excel formulas, pivot tables, and VBA scripting for automation.

- Product requirement: Integration of real-time data feeds or manual data import features for mutual fund data updates.

- Specification: Customizable comparison metrics, including risk measures, sector allocation, and growth trends displayed in both tabular and graphical formats.

Quarterly Economic Outlook Presentation (PowerPoint/PDF)

Quarterly Economic Outlook Presentation for fund managers provides detailed analysis of global economic trends, market forecasts, and sector performance to support informed investment decisions. It highlights key macroeconomic indicators such as GDP growth, inflation rates, and interest rate changes. Visual data representation enhances understanding of market dynamics and potential risks.

- Skills needed: Proficiency in economic analysis, data visualization, and financial market knowledge.

- Product requirement: High-quality slides with clear charts, graphs, and concise expert commentary.

- Specification: Compatible formats including PowerPoint and PDF for easy sharing and presentation.

Tokenization Investment Strategy Video Tutorial (Video)

Tokenization is revolutionizing asset management by enabling digital representation of investment assets on the blockchain. Fund managers benefit from enhanced liquidity, fractional ownership, and transparent transaction records. A Tokenization Investment Strategy Video Tutorial can guide fund managers in leveraging these innovations to optimize portfolio performance and compliance.

- Skills needed: Understanding of blockchain technology, knowledge of financial regulations, and effective digital content creation.

- Product requirements: High-quality video production, clear instructional content on tokenization processes, and real-world case studies for fund management.

- Specifications: Video length of 20-30 minutes, inclusion of visual aids and examples, and downloadable supplementary materials for implementation.

ESG Fund Impact Assessment Checklist (Excel/PDF)

ESG Fund Impact Assessment provides fund managers with a systematic approach to evaluate environmental, social, and governance factors within investment portfolios. The checklist facilitates transparent reporting and compliance with sustainability standards. Key metrics include carbon footprint, social impact scores, and governance risk assessments.

- Skill needed: Knowledge of ESG criteria, data analysis, and financial reporting.

- Product requirement: Compatible with Excel and PDF formats for ease of use and distribution.

- Specification: Must include customizable metrics, automated calculations, and clear visual summaries.

Private Equity Due Diligence Template (Word/PDF)

Private Equity Due Diligence Template tailored for Fund Managers ensures comprehensive evaluation of investment opportunities. This template includes sections for financial analysis, risk assessment, and compliance checks to streamline decision-making processes. The due diligence framework is designed for clarity and thoroughness, supporting efficient fund management.

- Skill needed: Proficiency in financial analysis and understanding of private equity investment criteria.

- Product requirement: Editable Word and PDF formats compatible with standard office software.

- Specification: Include customizable sections for fund strategy, portfolio company evaluation, and legal review checkpoints.

Data-Driven Investment Insights for Portfolio Optimization

Leveraging data-driven insights is crucial for optimizing your portfolio effectively. Utilize advanced analytics to identify trends and make informed decisions that maximize returns. Continuous analysis ensures your marketing strategy adapts to changing market conditions. This approach leads to smarter investments and a higher chance of success.

Real-Time Performance Analytics and Reporting

Implementing real-time performance analytics allows immediate insight into how your digital product marketing efforts are performing. Access to up-to-date reports helps you quickly adjust campaigns for better outcomes. This transparency builds trust with stakeholders and supports agile decision-making. Consistent monitoring ensures you stay ahead in a competitive environment.

Seamless Integration with Existing Financial Platforms

A key factor in success is seamless integration with current financial tools and platforms. This allows for smooth data exchange and process automation, saving time and reducing errors. Integration enhances user experience by providing a unified interface for managing investments. It also supports scalability as your product grows in complexity.

Regulatory Compliance and Robust Security Features

Ensuring regulatory compliance safeguards your digital product from legal risks and builds customer confidence. Implementing robust security measures protects sensitive data and prevents breaches. Staying updated with industry regulations shows professionalism and reliability. This foundation is essential for long-term sustainability and trustworthiness.

Personalized Client Engagement and Communication Tools

Using personalized engagement strategies strengthens your connection with clients and enhances satisfaction. Tailor communication tools to meet individual needs and preferences for more effective interactions. Personalized experiences increase retention and encourage word-of-mouth referrals. This approach transforms clients into loyal advocates for your product.