Creating a digital product for Tax specialists in the Finance sector requires a precise understanding of tax regulations and financial compliance. The product must streamline complex tax calculations, reporting, and filing processes to enhance efficiency and reduce errors. Integration with existing financial software and real-time data updates are essential features that cater to the dynamic needs of tax professionals. Explore the article to discover detailed strategies and innovative ideas for developing a tailored digital solution in this niche.

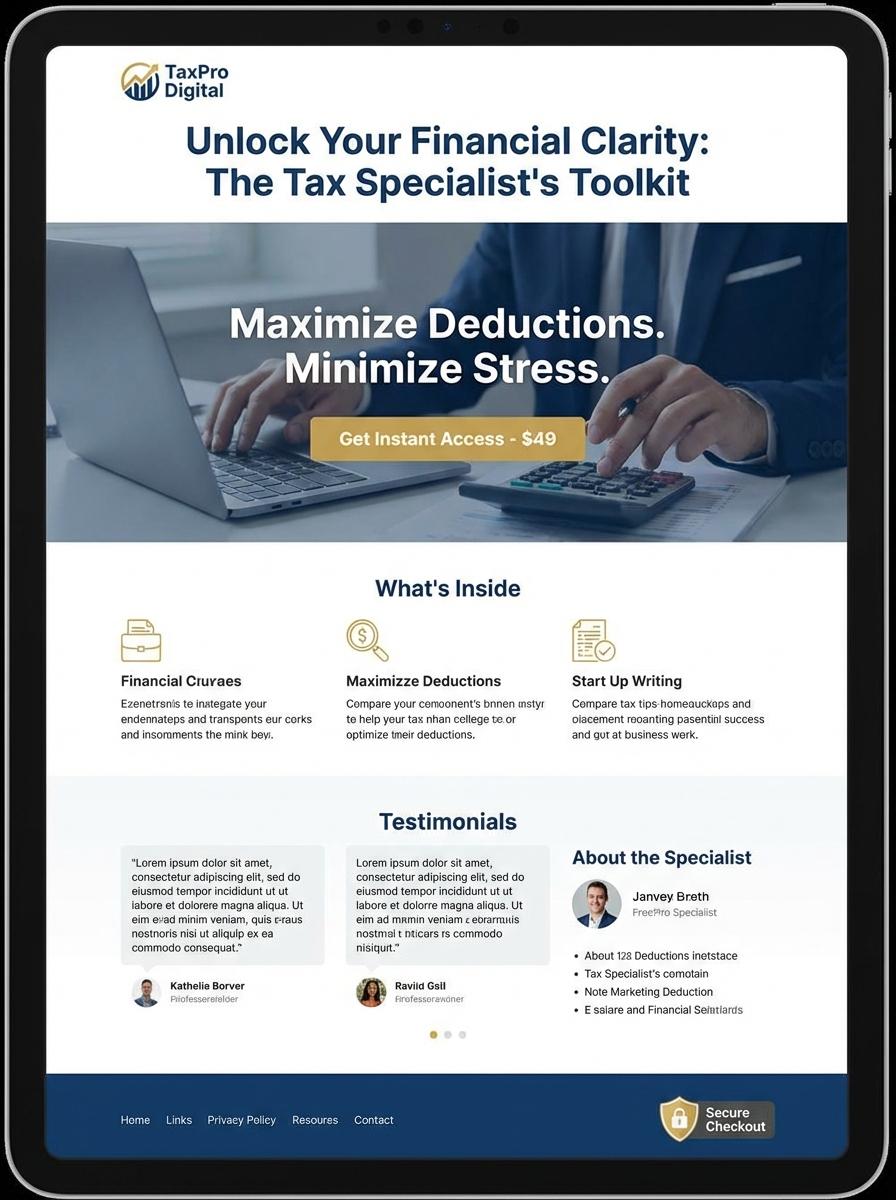

Illustration: Landing page for digital product for Tax specialist

Tax Planning Guide for Small Businesses (PDF)

A Tax Planning Guide for Small Businesses PDF is designed to assist tax specialists in delivering precise, actionable advice to entrepreneurial clients. It encompasses detailed strategies for minimizing tax liability, adhering to regulatory requirements, and optimizing financial decisions. The guide leverages up-to-date tax codes and industry-standard best practices to support informed decision-making.

- Skill needed: Expertise in current tax laws, strong analytical capabilities, and proficiency in tax regulation interpretation.

- Product requirement: Comprehensive coverage of tax deductions, credits, and compliance checklists tailored for small business scenarios.

- Specification: User-friendly layout with clear examples, updated annually to reflect latest tax code changes, and available in searchable PDF format.

Annual Tax Calendar & Checklist Template (Excel)

The Annual Tax Calendar & Checklist Template for Tax Specialists provides an organized schedule of key tax deadlines tailored to diverse client categories. It incorporates essential tax filing dates, reminder alerts, and compliance checkpoints to ensure timely submissions. This template streamlines workflow management and reduces the risk of missed deadlines during the fiscal year.

- Proficiency in Excel functions such as formulas, conditional formatting, and data validation is essential.

- The template must include customizable date fields, auto-updating reminders, and categories for various tax forms.

- Compatibility with multiple Excel versions and the ability to export or print checklists for offline use are required.

Tax Deductions Cheat Sheet for Freelancers (PDF)

Freelancers often struggle to identify applicable tax deductions that can minimize their taxable income and increase savings. A well-crafted Tax Deductions Cheat Sheet provides clear, concise categories such as business expenses, home office deductions, and mileage calculations. This resource supports accurate tax filing, helping to avoid errors and maximize eligible claims.

- Strong knowledge of current tax codes and regulations affecting freelancers.

- The PDF must be easily navigable with clear headings and concise explanations.

- Inclusion of up-to-date deduction categories, dollar limits, and relevant tax form references.

Step-by-Step Corporate Tax Filing Video Tutorial (Video)

The Step-by-Step Corporate Tax Filing Video Tutorial offers an in-depth guide tailored for tax specialists aiming to enhance their expertise in corporate tax compliance. This digital product addresses complex filing procedures, tax regulations, and compliance standards. It ensures users master each stage of the corporate tax submission process with precision and accuracy.

- Skill needed: Proficiency in corporate tax laws, familiarity with tax software, and strong analytical skills for interpreting tax codes.

- Product requirement: High-quality video format with clear screen recordings, comprehensive captions, and downloadable reference materials.

- Specification: Stepwise modules covering tax form preparation, submission deadlines, common errors to avoid, and recent tax law updates.

VAT/GST Compliance Workbook (Excel)

The VAT/GST Compliance Workbook in Excel is designed to streamline tax reporting for professionals dealing with value-added and goods and services taxes. It includes automated calculations and data validation features tailored for accuracy and efficiency. Comprehensive sheets facilitate input, adjustment, and reconciliation of tax liabilities following official guidelines.

- Skill needed: proficiency in advanced Excel functions such as pivot tables, VLOOKUP, and conditional formatting.

- Product requirement: built-in formulas for calculating VAT/GST based on varying jurisdiction rates and transaction types.

- Specification: compatibility with multiple data import formats and ability to generate detailed audit-ready summary reports.

Tax Audit Readiness Toolkit (PDF & Doc)

The Tax Audit Readiness Toolkit provides comprehensive resources tailored for tax specialists to efficiently prepare for audits. This digital product includes detailed checklists, document templates, and audit procedures in both PDF and DOC formats. It streamlines the process of organizing and reviewing tax-related documentation to ensure compliance and accuracy.

- Skill needed: Expertise in tax laws, audit processes, and documentation standards.

- Product requirement: Include editable templates and up-to-date audit checklists compatible with common software.

- Specification: Provide downloadable files in PDF for easy viewing and DOC for customization and editing.

Income Tax Calculator for Individuals (Excel)

An Income Tax Calculator for Individuals in Excel empowers tax specialists to efficiently analyze and compute accurate tax liabilities based on the latest tax codes and individual financial data. It integrates dynamic formulas to accommodate various income sources, deductions, and tax brackets applicable to individuals. Enhanced with user-friendly interfaces, it ensures precise calculation and easy scenario simulation for personalized tax planning.

- Advanced knowledge of current tax laws, bracket structures, and deduction categories.

- Excel functionalities including complex formulas, logical functions, and data validation mechanisms.

- Accurate integration of tax rate tables and automated update capability for regulatory changes.

Streamline Tax Workflows with Automation

Utilize cutting-edge automation tools to simplify complex tax processes, reducing manual effort and errors. Automated workflows enhance efficiency, allowing you to focus on strategic marketing rather than administrative tasks. Leveraging these tools positions your digital product as a modern, practical solution for tax professionals. Emphasizing automation creates a significant competitive edge in your marketing approach.

Boost Client Satisfaction with Cloud-Based Solutions

Offer your clients secure, cloud-based tax solutions that ensure data safety and easy accessibility. Cloud platforms improve collaboration, enabling clients to access their tax data anytime, anywhere. Highlighting security features builds trust, which is crucial for customer retention and referrals. Incorporating cloud-based benefits into your marketing message enhances product desirability.

Accelerate Tax Returns Processing

Promote the ability of your digital product to accelerate tax returns processing, increasing overall productivity for tax professionals. Faster processing times help clients meet deadlines and reduce backlog, key selling points in marketing campaigns. Use data and case studies to demonstrate time-saving advantages. Position your product as a solution that transforms workflow speed and efficiency.

Enhance Compliance with Advanced Analytics

Integrate advanced analytics into your digital product to help users maintain compliance and reduce costly errors. Analytics provide real-time insights and predictive capabilities, improving accuracy in tax filings. Market this feature to appeal to risk-averse professionals seeking peace of mind. Strong compliance tools differentiate your product in a competitive market.

Scale Your Tax Practice Effortlessly

Highlight seamless client collaboration features that enable tax practices to grow without operational bottlenecks. Effective collaboration tools improve communication and workflow between tax professionals and clients. Marketing your product as a scalable solution attracts growing firms looking to expand efficiently. Emphasizing scalability ensures long-term customer retention and satisfaction.