Creating a digital product suitable for investors in the finance sector requires an in-depth understanding of market dynamics, user needs, and regulatory compliance. The product must offer robust analytical tools, real-time data integration, and secure transaction capabilities to build trust and maximize investment efficiency. Tailoring features to address risk management and portfolio diversification is essential for appealing to sophisticated users. Explore the article to discover detailed strategies and innovative ideas for developing a standout financial digital product.

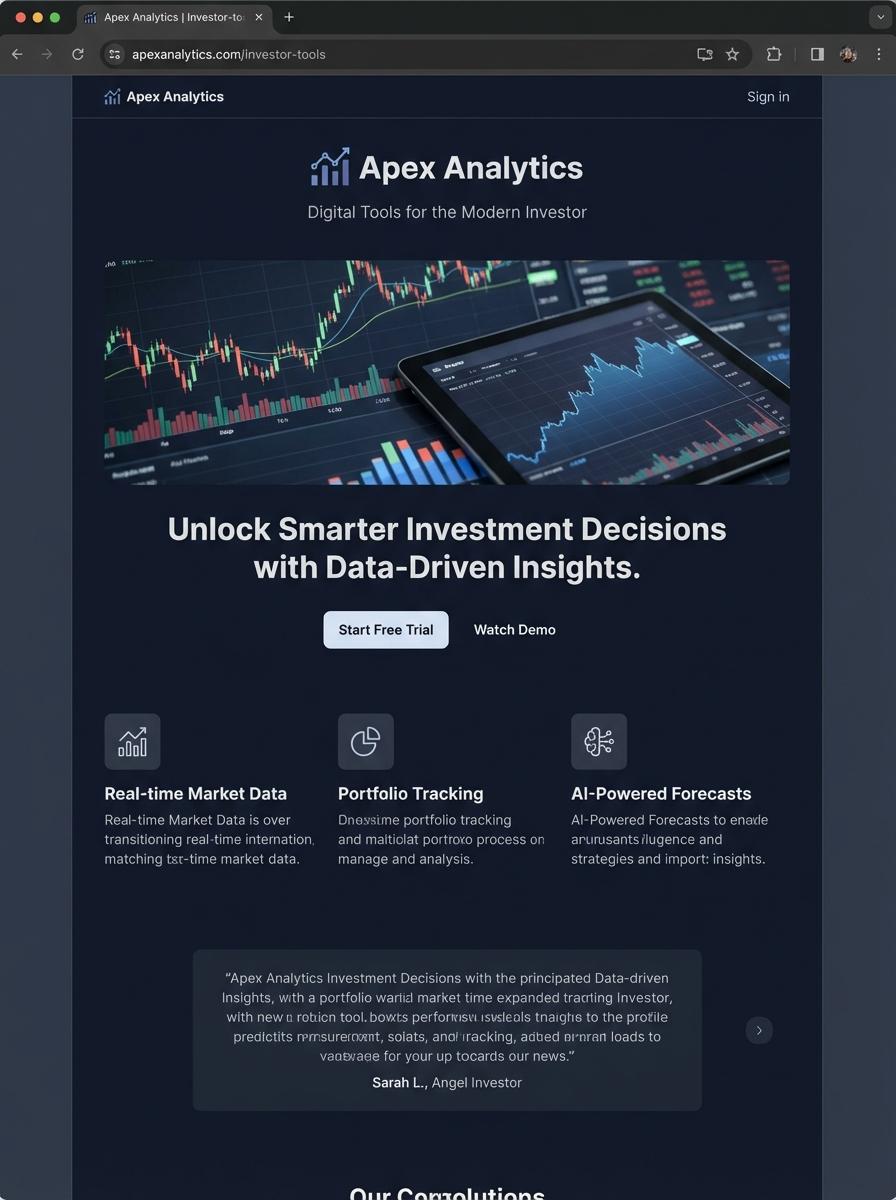

Illustration: Landing page for digital product for Investor

Financial Market Analysis Report (PDF)

The Financial Market Analysis Report provides investors with comprehensive data on market trends, stock performance, and economic indicators. It includes detailed charts and statistical summaries to facilitate informed decision-making. This PDF report is designed to deliver clear insights into market volatility and potential investment opportunities.

- Skills needed: proficiency in financial analysis, data visualization, and market research methodologies.

- Product requirements: high-resolution charts, data accuracy, and up-to-date financial metrics.

- Specifications: PDF format optimized for both desktop and mobile viewing with searchable text and interactive elements.

Investment Portfolio Tracker Template (Excel)

An Investment Portfolio Tracker Template in Excel allows investors to monitor asset allocations, track performance over time, and analyze risk metrics efficiently. This template supports multiple investment types including stocks, bonds, and mutual funds. Real-time data integration and customizable charts enhance decision-making accuracy.

- Skill needed: Proficiency in Excel functions such as pivot tables, formulas, and data visualization.

- Product requirement: Compatibility with latest Excel versions and ability to import CSV or API data.

- Specification: Include automated gain/loss calculations, asset diversification summaries, and performance benchmarking features.

Asset Allocation Guidebook (PDF)

The Asset Allocation Guidebook is a comprehensive PDF designed to help investors strategically distribute their investment portfolio across various asset classes. It provides data-driven insights and risk assessment techniques tailored to market trends and individual investment goals. This guidebook facilitates informed decision-making for optimizing returns while managing potential risks.

- Understanding of portfolio diversification and risk management principles.

- The guidebook must include clear charts, historical performance data, and case studies.

- Content should be compatible with desktop and mobile PDF readers for accessibility.

Stock Valuation Calculator (Excel)

Investors benefit from a Stock Valuation Calculator designed in Excel by enabling precise estimation of intrinsic stock value using models like discounted cash flow (DCF). Incorporating customizable inputs for financial metrics such as earnings per share (EPS), growth rate, and discount rate enhances analytical accuracy. This tool supports informed decision-making by quantifying investment risks and potential returns.

- Proficiency in Excel functions including NPV, IRR, and advanced formula construction.

- Must include user-friendly input fields for financial ratios and market data integration.

- Capability to generate dynamic charts and summary reports for clear visualization of valuation outcomes.

Investment Strategy Video Course (MP4)

The Investment Strategy Video Course offers a comprehensive learning experience designed to improve investors' decision-making skills through detailed market analysis and portfolio management techniques. This MP4 format allows convenient access on various devices, facilitating self-paced learning and practical application of advanced investment concepts. Tailored to both novice and experienced investors, the course emphasizes strategic asset allocation, risk management, and trend identification to enhance investment outcomes.

- Skill needed: Basic understanding of financial markets and investment principles.

- Product requirement: High-quality MP4 videos compatible with desktop and mobile devices.

- Specification: Include real-world case studies, clear visuals, and step-by-step strategy explanations.

Due Diligence Checklist (DOC)

Investors require a comprehensive Due Diligence Checklist (DOC) to evaluate potential investment opportunities effectively and minimize risks. This document consolidates critical financial, legal, and operational data points, providing a structured framework to assess the viability and sustainability of target companies. Ensuring accuracy and thoroughness of the checklist enhances decision-making and investor confidence.

- Skill needed: Expertise in financial analysis, legal compliance, and risk assessment.

- Product requirement: Clear categorization of financial statements, legal documents, and business metrics for ease of review.

- Specification: Integration capability with document management systems and secure access for multiple stakeholders.

Retirement Planning Workbook (Excel)

The Retirement Planning Workbook in Excel is a tailored digital tool designed to help investors forecast and optimize their retirement savings. It incorporates variables such as investment growth rates, inflation, and retirement age to deliver personalized financial scenarios. This workbook supports strategic decision-making by providing clear visualizations and detailed projections.

- Skill needed: Proficiency in Excel functions, financial modeling, and understanding of investment principles.

- Product requirement: Interactive formulas for dynamic calculations, customizable inputs for individual investor profiles, and built-in charts for data visualization.

- Specification: Compatibility with Excel 2016 and later, user-friendly interface, and automated updates to reflect changing market conditions.

Data-Driven Market Opportunity Analysis

Leverage data-driven insights to identify untapped market opportunities with high demand for your digital product. Utilize analytics tools to monitor trends, customer behavior, and competitor activities. Applying this approach ensures your product aligns with real market needs, reducing risks. A thorough analysis drives strategic decision-making for successful product positioning.

Scalable Revenue Growth Model

Develop a scalable revenue model that can grow seamlessly as the user base expands. Focus on subscription plans, tiered pricing, or usage-based charges to maximize revenue streams. Ensure your infrastructure supports increased demand without compromising performance. This approach sustains long-term profitability and market relevance.

Compelling Value Proposition for ROI

Create a compelling value proposition that clearly demonstrates the return on investment (ROI) for your target customers. Highlight unique features, benefits, and cost savings that differentiate your product. Transparently communicate how your solution solves problems and adds measurable value. This strengthens customer trust and drives conversions.

Robust User Acquisition Strategy

Implement a robust user acquisition strategy combining SEO, content marketing, and paid advertising to attract your target audience. Leverage social proof, referrals, and personalized campaigns to boost engagement. Continuously optimize acquisition channels based on performance data for efficiency. A strong acquisition plan accelerates growth and market penetration.

Clear Path to Monetization and Exit

Establish a clear path to monetization and exit from the outset, outlining revenue goals and potential buyer strategies. Consider partnerships, licensing, or product extensions as monetization options. Plan your exit with acquisitions or IPOs to maximize returns for stakeholders. Transparent planning builds investor confidence and business sustainability.