Creating a digital product tailored for tax consultants in the finance sector involves understanding their unique workflows and compliance requirements. Such a product should streamline tax calculations, ensure up-to-date regulatory adherence, and provide secure data management. Integrating advanced analytics and automation can significantly enhance efficiency and accuracy. Discover detailed strategies and practical insights for developing this specialized digital tool in the article.

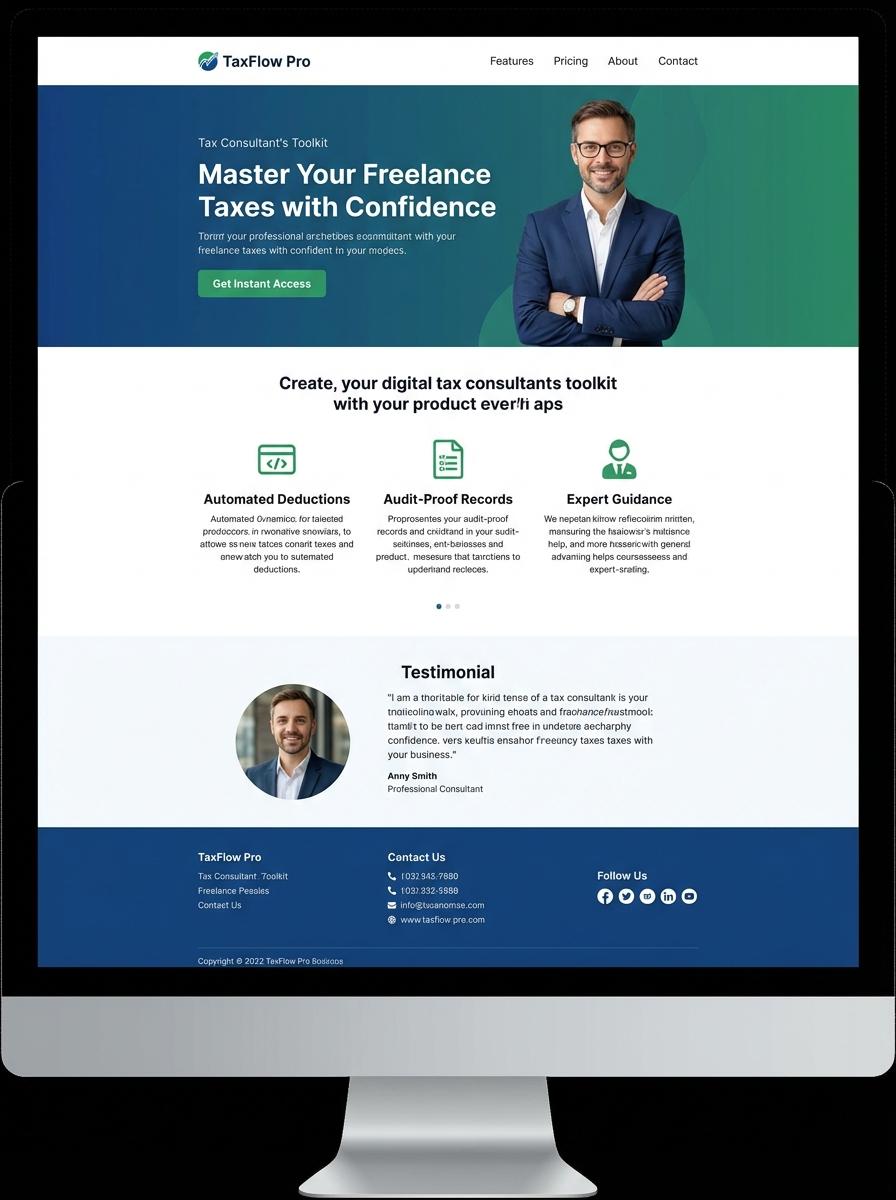

Illustration: Landing page for digital product for Tax consultant

Tax Planning Checklist (PDF)

Tax consultants require a comprehensive Tax Planning Checklist (PDF) to systematically identify client deductions, credits, and tax-saving opportunities. This digital product must include up-to-date tax codes, deadlines, and personalized strategies to optimize clients' financial situations. The checklist should serve as an efficient tool for ensuring compliance and maximizing tax benefits.

- Skills needed: In-depth knowledge of tax laws, attention to detail, and expertise in financial planning.

- Product requirement: Interactive PDF format allowing easy updates and client-specific customization.

- Specification: Incorporate clear sections for income, deductions, credits, deadlines, and filing tips with user-friendly navigation.

Year-End Tax Filing Guide (PDF)

Creating a Year-End Tax Filing Guide (PDF) tailored specifically for tax consultants streamlines the complex tax preparation process and enhances client advisory accuracy. This guide consolidates essential updates on tax laws, deduction strategies, and filing deadlines relevant to the fiscal year. Incorporating clear visuals and practical checklists improves usability and professional value.

- Skill needed: Expertise in current tax regulations and proficiency in document design software such as Adobe InDesign or Canva.

- Product requirement: The guide must include updated tax codes, step-by-step filing instructions, and client communication templates.

- Specification: PDF format should ensure easy navigation with clickable table of contents and optimized print quality for professional distribution.

Tax Deduction Tracker Template (Excel)

The Tax Deduction Tracker Template in Excel is designed to help tax consultants efficiently organize and monitor client deductions. It integrates customizable categories and automated calculations to ensure accuracy during tax filing. This tool streamlines the deduction tracking process, saving time and reducing errors.

- Skill needed: Proficiency in Excel formulas and functions for dynamic tracking.

- Product requirement: Predefined deduction categories tailored to tax regulations.

- Specification: Clear data input sections with automatic summary reports.

Small Business Tax Calendar (PDF)

Tax consultants require an organized and reliable Small Business Tax Calendar that highlights essential deadlines for filings, estimated payments, and compliance tasks, tailored for various tax jurisdictions. Incorporating periodic reminders and crucial tax codes enhances the calendar's utility for proactive advisory services. Precise date tracking supports improved client management and optimized workload distribution throughout the fiscal year.

- Skill needed: Expertise in tax law, especially small business regulations, and proficiency in calendar design.

- Product requirement: Include key tax deadlines, multi-jurisdictional compliance dates, and customizable alert options.

- Specification: PDF format must support easy printing, interactive elements like clickable links, and professional layout.

Tax Compliance Video Tutorial (Video)

The Tax Compliance Video Tutorial targets tax consultants aiming to enhance their expertise in regulatory standards and reporting obligations. This digital product covers crucial tax laws, filing processes, and audit preparation techniques. It ensures consultants stay updated with current compliance requirements and practical applications.

- Skill needed: In-depth knowledge of local and international tax regulations.

- Product requirement: High-definition video format with clear audio narration and on-screen annotations.

- Specification: Modular content structure for topic-specific lessons allowing flexible learning schedules.

Income vs. Expense Spreadsheet (Excel)

Income vs. Expense Spreadsheet is an essential digital tool designed specifically for tax consultants to systematically track clients' financial transactions. This Excel-based product enables detailed categorization and efficient analysis of income and expenses, improving accuracy in tax preparation. It supports precise data entry, formula automation, and customizable reporting to meet diverse client needs.

- Proficiency in Excel functions such as SUMIF, PivotTables, and data validation is necessary.

- The spreadsheet must include clearly defined input fields for various income sources and deductible expenses.

- Automated calculation of net income and tax obligations with error-checking capabilities should be incorporated.

Tax Audit Preparation Handbook (PDF)

The Tax Audit Preparation Handbook is a comprehensive PDF guide tailored for tax consultants. It covers key audit procedures, compliance checklists, and documentation best practices to streamline the audit process. This handbook ensures consultants are well-prepared to manage and mitigate risks during tax audits effectively.

- Skill needed: Proficiency in tax laws, audit principles, and risk assessment methodologies.

- Product requirement: Clear, concise explanations with real-world examples and templates for audit documentation.

- Specification: Well-structured PDF format with searchable content, indexed sections, and printable checklists.

Targeted SEO for Tax Consulting Services

Effective SEO targeting is essential for marketing digital products, especially in specialized fields like tax consulting. By optimizing your website with relevant keywords and localized content, you can attract highly qualified leads actively searching for tax services. Utilize keyword research tools to identify high-intent search terms and consistently update your content to stay ahead of competitors. This targeted approach boosts your online visibility and drives organic traffic that converts.

Trust-Building Client Testimonials

Client testimonials play a critical role in establishing trust and credibility for your digital product. Showcase authentic reviews and case studies on your landing pages to highlight successful outcomes. Video testimonials or detailed written reviews help future clients feel confident in your offerings. Trust signals like these reduce buyer hesitation and increase conversion rates.

Clear Value Proposition for Digital Efficiency

A strong value proposition clearly communicates how your digital product improves efficiency and solves specific problems for your audience. Make it explicit why your tax consulting service offers superior digital solutions compared to traditional methods. Use concise, benefit-driven language to instantly convey your product's unique advantages. This clarity helps potential clients quickly understand the value you provide.

Compelling Lead Magnets (eBooks, Checklists)

Create lead magnets such as eBooks or checklists that deliver actionable insights and practical tips related to tax consulting. These valuable resources attract prospects by offering immediate benefits in exchange for their contact information. Well-designed lead magnets nurture trust and position your brand as an industry authority. This strategy effectively builds your email list for future marketing efforts.

Automated Personalized Follow-up Campaigns

Implement automated personalized follow-up campaigns to engage leads consistently without manual effort. Use marketing automation tools to send tailored emails based on user behavior, preferences, and past interactions. Personalization fosters stronger relationships and increases the likelihood of conversion. Automated sequences ensure timely, relevant communication that keeps your brand top of mind.