Creating a digital product tailored for mortgage brokers in the finance sector enhances client management and streamlines loan processing. Such a product integrates advanced algorithms to provide accurate mortgage calculations and personalized loan options. It also ensures compliance with financial regulations while improving communication channels between brokers and clients. Explore the detailed ideas in the article to learn how to develop an effective digital solution for mortgage professionals.

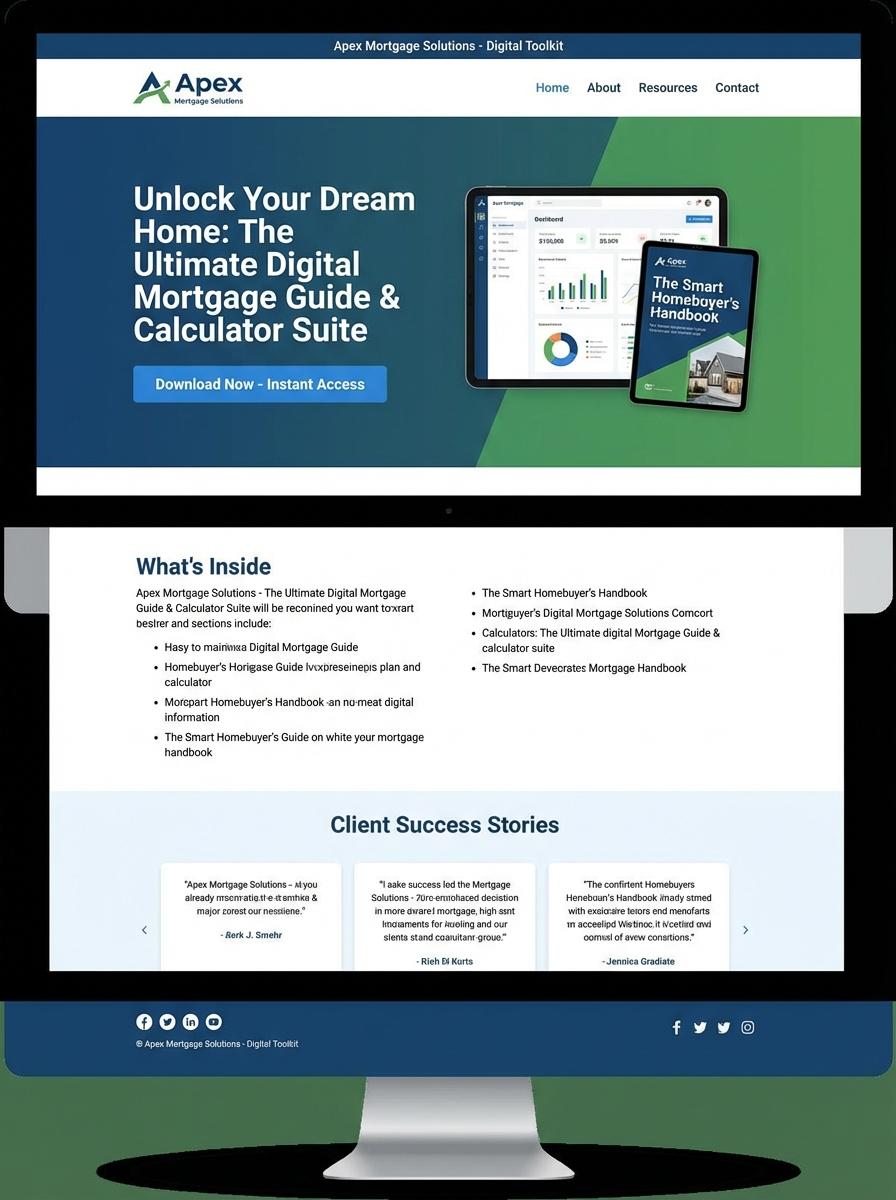

Illustration: Landing page for digital product for mortgage broker

Mortgage Application Checklist (PDF)

A Mortgage Application Checklist PDF serves as a critical tool for mortgage brokers to streamline client onboarding and ensure all necessary documentation is collected promptly. It includes essential items such as proof of income, credit reports, and property details. Organizing this information reduces processing errors and accelerates loan approval times.

- Skill needed: Understanding of mortgage lending criteria and client document verification.

- Product requirement: Clear categorization of document types with space for client notes and status tracking.

- Specification: Printable and fillable PDF format optimized for both digital use and hardcopy handling.

Homebuyer Budget Planner (Excel)

Mortgage brokers benefit from a Homebuyer Budget Planner in Excel that streamlines financial assessments for clients. This planner simplifies mortgage qualification by accurately calculating budgets, expenses, and potential loan amounts. It enhances client consultations with clear, data-driven insights into home financing options.

- Skills needed: Proficiency in Excel formulas, financial modeling, and understanding of mortgage lending criteria.

- Product requirement: Easy-to-use interface with input fields for income, debts, down payment, and interest rates.

- Specification: Include automated calculations for affordability, monthly payments, and amortization schedules.

Mortgage Comparison Template (Excel)

A Mortgage Comparison Template designed in Excel enables mortgage brokers to efficiently evaluate multiple loan options by comparing interest rates, loan terms, and monthly payments. This streamlined tool supports data-driven decisions and client consultations, enhancing transparency and trust in the mortgage selection process. Brokers can customize variables to reflect current market conditions, ensuring relevant and accurate mortgage comparisons.

- Skill Needed: Proficiency in Excel functions, formulas, and data visualization techniques to create dynamic and user-friendly templates.

- Product Requirement: The template must support input fields for loan amount, interest rates, loan terms, fees, and calculate total cost and monthly payment automatically.

- Specification: Include comparative charts and summary tables to clearly present differences between mortgage options, optimized for easy customization by brokers.

First-Time Homebuyer Guide (PDF)

The First-Time Homebuyer Guide is designed to provide comprehensive mortgage-related insights tailored for individuals purchasing their first home. It covers essential topics such as mortgage options, application processes, and financial planning. This PDF guide aims to empower clients with knowledge to make informed borrowing decisions.

- Skill needed: Expertise in mortgage lending, client communication, and financial advising.

- Product requirement: Clear, concise content with step-by-step mortgage application instructions and common terminologies explained.

- Specification: Printable PDF format, mobile-friendly design, and inclusion of interactive checklists and contact information.

Mortgage Terminology Glossary (PDF)

The Mortgage Terminology Glossary is an essential digital reference designed to clarify complex mortgage terms for brokers. It consolidates definitions of industry-specific vocabulary to improve client communication and transaction transparency. Brokers use this glossary to ensure accurate and consistent understanding throughout the lending process.

- Skill Needed: Strong understanding of mortgage industry concepts and language proficiency for clear definitions.

- Product Requirement: A well-organized, searchable PDF format optimized for quick reference on mobile and desktop devices.

- Specification: Include up-to-date terminology, borrower-focused explanations, and visually distinct key terms for quick scanning.

Step-by-Step Home Loan Process Video

Creating a Step-by-Step Home Loan Process Video enables mortgage brokers to clearly explain complex financing stages to clients. This digital product enhances client understanding through visual and auditory learning methods, increasing trust and conversion rates. It should cover key phases such as pre-approval, document submission, underwriting, and loan closing with precise details.

- Skills needed: video scripting, mortgage industry knowledge, visual storytelling, and video editing software proficiency.

- Product requirements: clear narration, infographic visuals, accurate mortgage terminology, and client-friendly language.

- Specifications: video length between 5-7 minutes, HD resolution (1080p), subtitles for accessibility, and mobile-friendly format.

Debt-to-Income Ratio Calculator (Excel)

The Debt-to-Income Ratio Calculator in Excel helps mortgage brokers accurately assess clients' financial standing by calculating the ratio of monthly debt payments to gross monthly income. This metric is crucial in determining mortgage eligibility and ensures compliance with lending standards. Utilizing an Excel-based tool provides flexibility and ease of customization for various client scenarios.

- Skill Needed: Proficiency in Excel formulas and financial analysis.

- Product Requirement: Ability to input multiple debt categories and gross monthly income.

- Product Specification: Automated calculation of debt-to-income ratio with clear output display and error handling.

Targeted Lead Generation for Home Loan Prospects

Effective lead generation in the digital mortgage space starts with identifying and targeting the right audience. Use precise demographic and behavioral data to reach potential borrowers actively seeking home loan options. Leverage social media, SEO, and paid ads to capture high-quality leads. This focused approach improves conversion rates and marketing ROI.

Personalized Mortgage Solutions for Diverse Needs

Offering customized mortgage solutions is crucial for appealing to varying borrower profiles. Tailor loan products to different income levels, credit scores, and homeownership goals. Personalization enhances the customer experience and builds trust. Use digital tools to simplify the loan selection process and highlight relevant benefits.

Seamless Digital Customer Onboarding Experience

A smooth digital onboarding process ensures prospects become customers with ease. Streamline application forms, automate document uploads, and provide real-time assistance. Reducing friction improves satisfaction and reduces drop-off rates. Emphasize convenience and speed in your onboarding workflow.

Data-Driven Marketing Automation for Higher Conversions

Marketing automation powered by data insights enables personalized and timely communication. Use predictive analytics to nurture leads through drip campaigns and retargeting ads. Automate follow-ups and content delivery based on user behavior for maximum engagement. This data-driven strategy boosts conversion efficiency and scales marketing efforts.

Trust-Building Content Highlighting Expertise and Compliance

Creating trustworthy content that showcases industry expertise and compliance reassures potential borrowers. Publish blogs, FAQs, and case studies addressing common concerns and regulatory standards. Transparent communication strengthens credibility and fosters long-term customer relationships. Trust is a key factor in choosing a mortgage provider.