Creating a digital product suitable for wealth managers in the finance sector involves understanding their unique needs for portfolio management, client communication, and regulatory compliance. The product must offer advanced analytics, secure data handling, and seamless integration with existing financial tools. Emphasizing user-friendly interfaces and real-time reporting enhances decision-making efficiency for wealth managers. Explore the article to discover detailed ideas for developing an effective digital solution tailored to wealth management professionals.

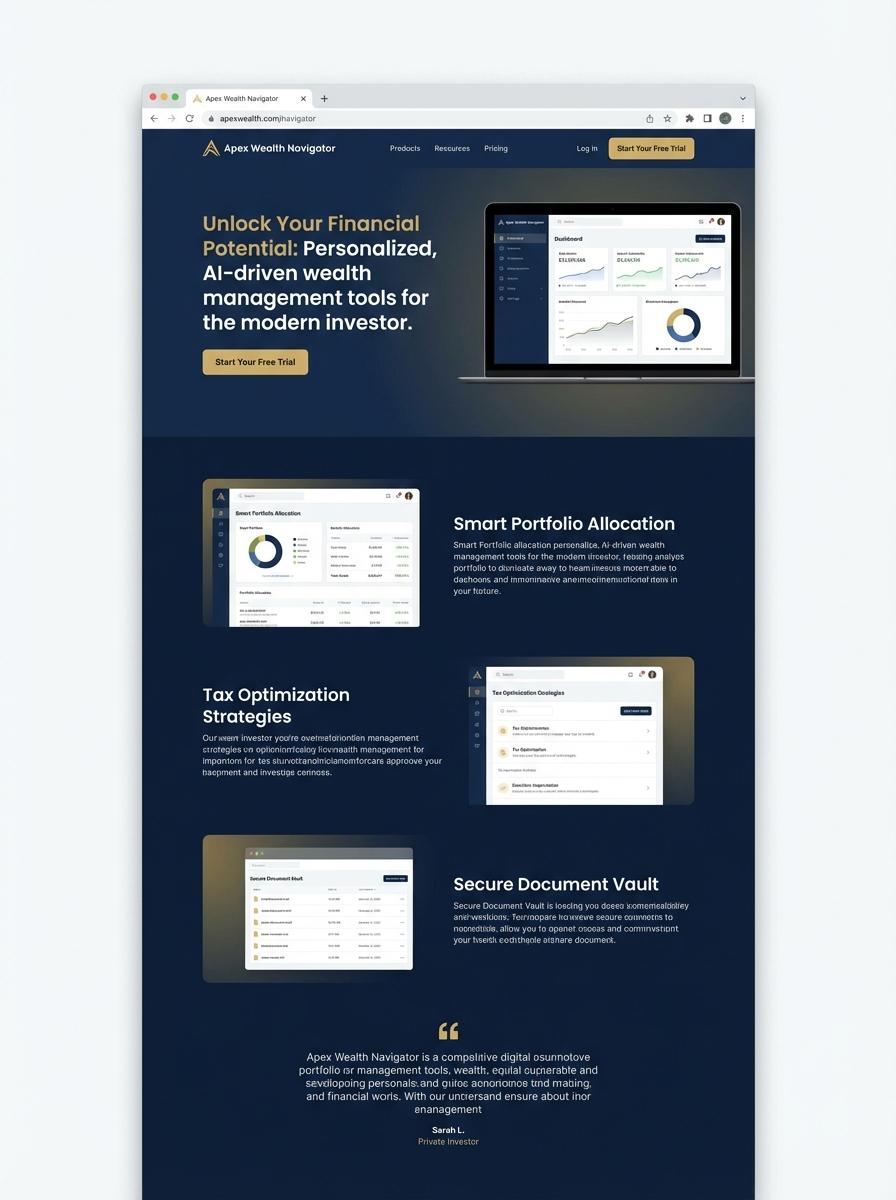

Illustration: Landing page for digital product for Wealth manager

Investment Portfolio Templates (Excel)

Investment Portfolio Templates in Excel are designed to help wealth managers efficiently track, analyze, and optimize client investments. These templates incorporate asset allocation, risk assessment, and performance metrics to provide clear visual insights. Customizable formulas and charts enhance the ability to deliver tailored financial strategies.

- Proficiency in Excel formulas, pivot tables, and data visualization.

- Template must support multiple asset classes and include risk-adjusted return calculations.

- Integration capability with client data import/export features for seamless updates.

Personal Financial Planning Guide (PDF)

The Personal Financial Planning Guide PDF is tailored for wealth managers aiming to enhance client advisory through comprehensive strategies in asset allocation, retirement planning, and tax optimization. It consolidates critical financial principles and actionable insights to streamline personalized portfolio construction and risk management. This guide serves as an essential tool to elevate client engagement and financial outcomes.

- Skill needed: Expertise in portfolio diversification, tax laws, and retirement planning strategies.

- Product requirement: Interactive PDF format with embedded calculators and client scenario templates.

- Specification: Clear, concise language with data visualizations and compliance with financial advisory regulations.

Retirement Planning Calculator (Excel)

Retirement Planning Calculator in Excel enables wealth managers to analyze clients' financial data and project retirement savings accurately. By integrating key variables such as annual contributions, expected returns, inflation, and retirement age, the tool supports tailored financial advice. This calculator optimizes decision-making, ensuring personalized and effective retirement strategies.

- Skill needed: Advanced Excel proficiency including formulas, pivot tables, and conditional formatting.

- Product requirement: Must allow input customization for variables like income, expenses, inflation, and investment returns.

- Specification: Output should include a detailed savings forecast, visual charts, and scenario analysis functionality.

Tax Optimization Checklist (PDF)

Tax Optimization Checklist designed for wealth managers enhances client portfolio efficiency by identifying key tax-saving strategies. It includes comprehensive guidelines on federal and state tax regulations, investment tax implications, and deductible opportunities. Utilizing this checklist supports customized financial planning and improves overall client wealth preservation.

- Skills needed: expertise in tax law, financial analysis, and client consultation.

- Product requirements: clear, well-organized PDF format compatible with common devices and software.

- Specifications: inclusion of up-to-date tax codes, actionable steps, and client-friendly terminology.

Wealth Management E-book (PDF)

The Wealth Management E-book in PDF format serves as a comprehensive guide designed exclusively for wealth managers aiming to enhance client portfolio strategies. It incorporates advanced financial planning techniques, risk assessment models, and market analysis tailored to high-net-worth individuals. The document's structure facilitates easy navigation through crucial wealth management concepts and regulatory considerations.

- Skill needed: Expertise in financial planning, asset allocation, and client communication tailored for wealth management.

- Product requirement: Interactive PDF format with clickable table of contents and embedded charts for clear data visualization.

- Specification: Content must include up-to-date compliance guidelines, investment strategies, and case studies relevant to wealth managers.

Financial Literacy Video Series (Video)

Financial Literacy Video Series offers wealth managers a strategic tool to enhance client understanding of investment principles, asset allocation, and risk management. Tailored content ensures relevance and authority in wealth management practices, fostering trust and informed decision-making. The series employs clear visuals and expert narration to simplify complex financial concepts and promote engagement.

- Skill needed: Expertise in wealth management and effective video communication techniques.

- Product requirement: High-quality video production with professional graphics and clear audio.

- Specification: Content should cover key topics such as portfolio diversification, retirement planning, and tax efficient strategies.

Estate Planning Document Organizer (Word)

Estate Planning Document Organizer is a vital digital product designed to streamline the management of key legal and financial documents for wealth managers. It centralizes client estate plans, wills, trusts, powers of attorney, and asset inventories in an organized Word format. This tool enhances efficiency in client consultations and reduces risk of document misplacement or oversight.

- Skill needed: Proficiency in estate planning concepts and document structuring in Microsoft Word.

- Product requirement: User-friendly templates with editable fields for legal terminology and client-specific data.

- Specification: Compatibility with standard office software and secure file encryption for sensitive information.

Targeted Lead Generation with Personalized Financial Solutions

Effective marketing starts with targeted lead generation tailored to the financial needs of your audience. Personalized financial solutions attract high-value prospects by addressing their specific challenges and goals. Utilize data segmentation to deliver relevant offers that resonate deeply with potential clients. This strategic approach increases conversion rates and optimizes marketing ROI.

Trust-Building Content Showcasing Regulatory Compliance

Establishing trust is crucial in marketing digital products, especially in the financial sector. Create trust-building content that highlights your adherence to regulatory compliance and industry standards. Transparency through informative articles, case studies, and certifications assures clients of your credibility. This foundation of trust encourages long-term engagement and client retention.

Seamless Digital Onboarding and User Experience

A smooth, seamless digital onboarding process enhances client satisfaction and reduces dropout rates. Ensure your platform is intuitive, secure, and quick to navigate, providing a hassle-free experience. Simplify steps with clear guidance and support to facilitate effortless product adoption. Positive user experience fosters loyalty and accelerates client acquisition.

Data-Driven Insights for Scalable Client Acquisition

Leverage data-driven insights to refine marketing strategies and scale client acquisition efficiently. Analyze customer behavior, preferences, and engagement metrics to identify growth opportunities. Continuously optimize campaigns based on performance data to maximize reach and conversion. Informed decision-making drives sustainable and scalable success.

Multi-Channel Engagement to Nurture High-Net-Worth Clients

Engage high-net-worth clients across multiple channels for comprehensive relationship-building. Integrate personalized email, social media, webinars, and direct messaging to maintain consistent communication. Tailoring content and interaction to each channel enhances client experience and loyalty. This multi-channel approach nurtures trust and drives long-term business growth.