Creating a digital product suitable for venture capitalists in the finance sector requires a focus on innovation, scalability, and regulatory compliance. Prioritizing secure technology and data analytics can attract investment by demonstrating growth potential and market disruption. Understanding venture capitalists' expectations helps tailor solutions that address financial challenges efficiently. Explore detailed insights and strategies for developing such impactful digital products in the full article.

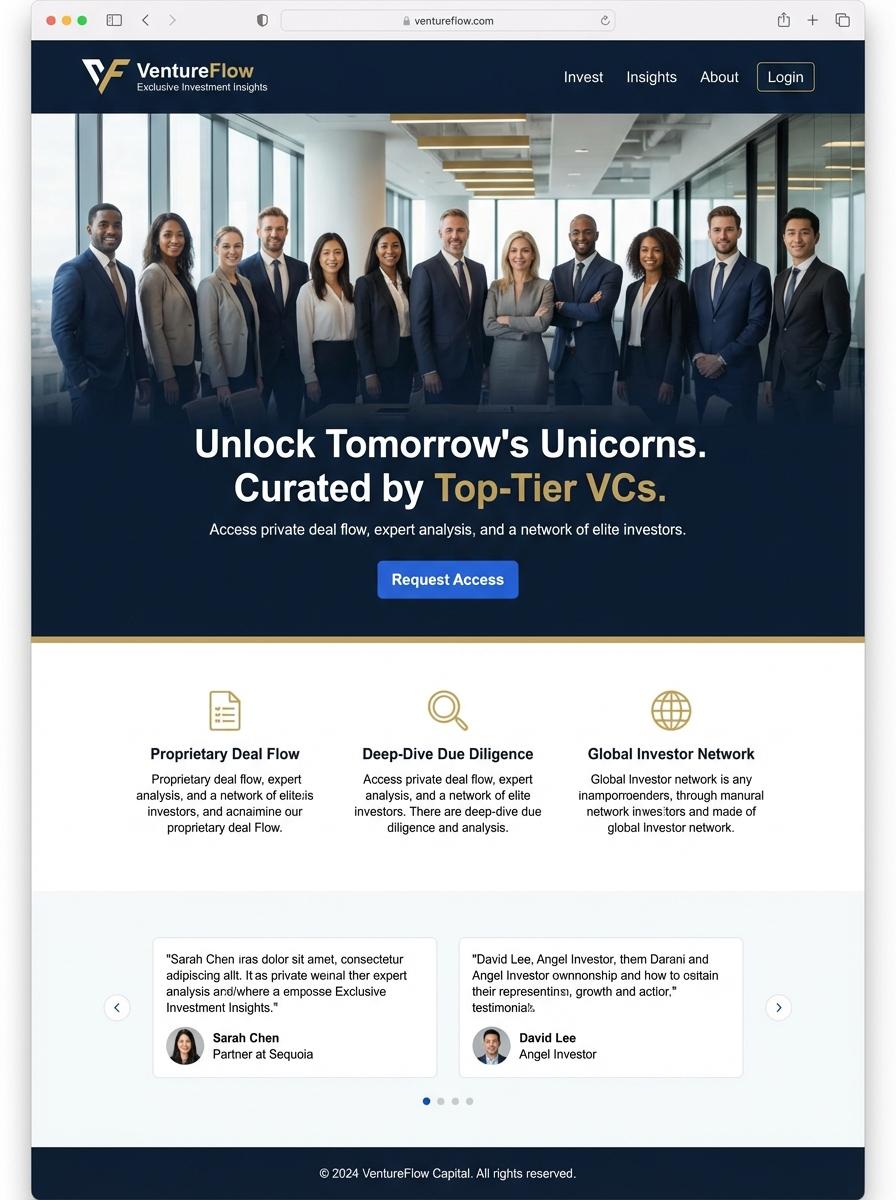

Illustration: Landing page for digital product for Venture capitalist

Investment Due Diligence Checklist (Excel/PDF)

Venture capitalists rely on a comprehensive Investment Due Diligence Checklist to evaluate potential startup investments efficiently. This checklist includes financial metrics, market analysis, and risk assessments tailored to high-growth ventures. Providing the checklist in Excel and PDF formats ensures flexibility and accessibility during evaluation processes.

- Skill needed: Proficiency in financial analysis and venture capital investment principles.

- Product requirement: Inclusion of customizable financial models and market validation sections.

- Specification: Compatibility with Excel for data manipulation and PDF for secure sharing and printing.

Financial Modeling Template for Startups (Excel)

Financial modeling templates for startups are essential tools that enable clear projections and valuation analysis tailored for venture capitalists. These templates focus on key metrics such as cash flow, burn rate, and equity distribution, providing a transparent view of a startup's financial health. Utilizing a structured Excel model helps streamline investment decision-making by offering reliable, customizable scenarios.

- Skill Needed: Proficiency in Excel functions, financial forecasting, and understanding of startup financing structures.

- Product Requirement: The template must include dynamic input fields for revenue, expenses, funding rounds, and equity allocation.

- Specification: Incorporate built-in assumptions for market size, growth rates, and exit valuations with clear visualization charts.

Venture Capital Term Sheet Sample (PDF/Doc)

A Venture Capital Term Sheet outlines the key terms and conditions under which an investor, typically a venture capitalist, agrees to invest in a startup or emerging growth company. It acts as a non-binding agreement that precedes the detailed legal contracts. Important components include valuation, investment amount, equity stake, liquidation preferences, and control rights.

- Skill Needed: Deep understanding of corporate finance, startup valuation, and legal negotiation.

- Product Requirement: Clear, customizable templates available in both PDF and editable Doc formats for ease of use.

- Specification: Inclusion of clauses such as anti-dilution, board composition, and voting rights tailored for venture capital deals.

Market Research Report on FinTech Trends (PDF)

Comprehensive Market Research Report on FinTech Trends offers venture capitalists deep insights into emerging technologies, investment flows, and competitive landscape within the financial technology sector. The PDF format ensures easy accessibility and detailed data visualization, supporting informed decision-making. Focus on trend analysis, funding rounds, and regulatory impacts drives strategic investment opportunities.

- Skill needed: Expertise in financial technologies, data analysis, and market trend forecasting.

- Product requirement: High-quality data sources, clear charts, and sector-specific case studies.

- Specification: Portable Document Format (PDF) optimized for readability and interactive navigation features.

Portfolio Performance Dashboard Template (Excel)

A Portfolio Performance Dashboard Template in Excel provides venture capitalists with a centralized view of investment metrics, including IRR, MoIC, and cash flow analysis. It enables tracking of portfolio company valuations, funding rounds, and exit scenarios to inform strategic investment decisions. The template leverages Excel's data visualization and formula capabilities to present real-time performance insights efficiently.

- Skill needed: Advanced Excel proficiency including pivot tables, advanced formulas, and data visualization tools.

- Product requirement: Integration of dynamic financial models tailored to venture capital metrics such as valuation multiples and exit timing.

- Specification: User-friendly interface with customizable dashboards and automated data updates from multiple investment sources.

VC Pitch Deck Guide and Example Slides (PDF)

Creating a VC pitch deck tailored for venture capitalists involves highlighting key investment metrics, market opportunity, and competitive advantage succinctly. Including clear, data-driven slides enhances credibility and captures investor interest effectively. A well-structured PDF format ensures easy sharing and professional presentation.

- Skill needed: Expertise in financial modeling, market analysis, and persuasive storytelling for investors.

- Product requirement: High-quality PDF with editable slides covering problem, solution, market size, traction, and team.

- Specification: Concise, visually appealing layouts optimized for clarity, with data visualizations and investor-focused language.

Educational Video Series: VC Fundraising Strategies (Video)

VC Fundraising Strategies video series offers venture capitalists targeted insights into capital acquisition, portfolio management, and deal structuring. The content emphasizes data-driven techniques and real-world case studies to enhance investment outcomes. It equips VCs with practical frameworks to navigate fundraising complexities efficiently.

- Skill Needed: Deep understanding of venture capital market dynamics and financial modeling expertise.

- Product Requirement: High-definition, professionally produced videos with expert interviews and animated infographics.

- Specification: Modular video format allowing flexible learning paths and downloadable supplementary materials.

Scalable User Acquisition Strategy

Implementing a scalable user acquisition strategy ensures sustained growth for your digital product. Focus on channels that deliver consistent and cost-effective leads. Leverage automation tools to manage campaigns efficiently and scale up without sacrificing quality. Continuously test and refine to maximize reach and impact.

Data-Driven ROI Optimization

Using data-driven ROI optimization helps in allocating budgets where they generate the highest returns. Track key metrics such as customer acquisition cost, conversion rates, and engagement levels. Analyze this data to identify and eliminate underperforming campaigns. Optimize marketing spend to boost profitability and growth.

Customer Lifetime Value Maximization

Maximizing customer lifetime value is essential for long-term success in marketing digital products. Focus on retention strategies like personalized communication, loyalty programs, and excellent support. Higher CLV means increased revenue from each customer without extra acquisition costs. Consistently nurture relationships to enhance brand loyalty.

Rapid Product-Market Fit Validation

Achieving rapid product-market fit validation allows you to focus marketing efforts on the right audience. Conduct swift market testing to gauge user interest and usability. Use feedback loops to refine your product before large-scale launches. Early validation reduces risk and accelerates growth.

Viral Growth and Network Effects

Capitalizing on viral growth and network effects can exponentially increase your user base. Encourage sharing through referral incentives and social proof. A strong network effect makes your product more valuable as more users join. This creates sustainable momentum and competitive advantage.