Creating a digital product suitable for brokers in the finance sector involves understanding their specific needs for speed, accuracy, and regulatory compliance. Such a product must offer seamless integration with existing trading platforms, real-time data analysis, and secure transaction handling to support efficient decision-making. Ensuring scalability and user-friendly interfaces enhances broker performance and client satisfaction. Explore the detailed strategies and features essential for developing successful broker-focused digital products in the full article.

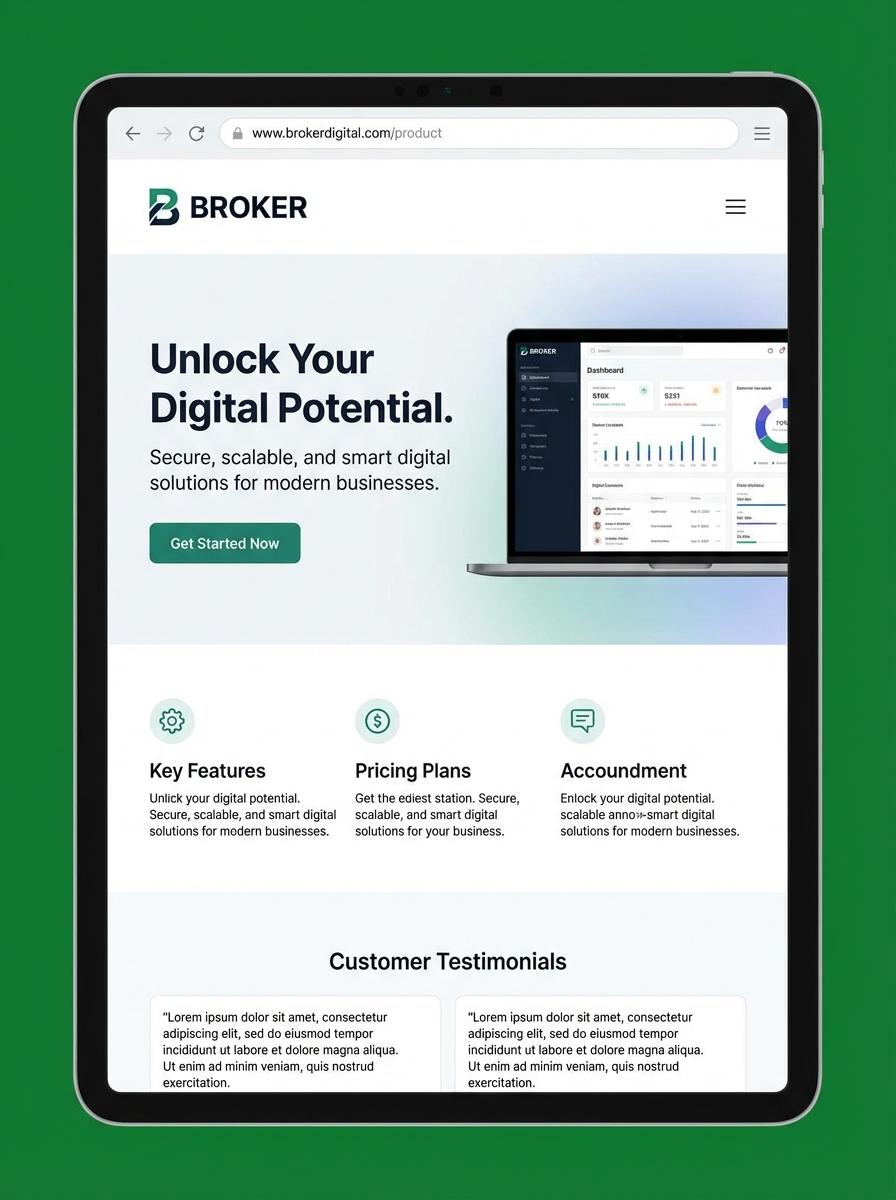

Illustration: Landing page for digital product for Broker

Investment Strategy E-books (PDF)

Investment Strategy E-books (PDF) tailored for brokers provide comprehensive, data-driven insights to enhance portfolio management and client advisory services. These e-books predominantly focus on market trends, asset allocation, and risk mitigation techniques, helping brokers make informed decisions. Clear visualization of financial models and up-to-date regulatory guidelines are essential components.

- Skill needed: Expertise in financial analysis, strong understanding of investment products, and ability to communicate complex data clearly.

- Product requirement: Include interactive charts, case studies, and updated market data to increase engagement and relevance.

- Specification: PDF format must be optimized for accessibility, mobile viewing, and include hyperlinks to additional broker resources.

Market Analysis Reports (PDF/Excel)

Market Analysis Reports tailored for brokers provide comprehensive insights into market trends, price movements, and sector performance, essential for informed decision-making. These reports combine quantitative data and qualitative analysis to forecast potential investment opportunities and risks. High accuracy and up-to-date information enhance brokers' ability to advise clients effectively and stay competitive.

- Skill needed: Proficiency in financial data analysis and market research techniques.

- Product requirement: Ability to export reports in both PDF and Excel formats for diverse client needs.

- Specification: Integration of real-time data feeds and customizable report templates for targeted analysis.

Financial Planning Templates (Excel)

Financial planning templates in Excel provide brokers with tailored tools to analyze client portfolios and forecast investment growth. These templates often include customizable fields for asset allocation, risk assessment, and cash flow projection. Using Excel-based financial planning templates enhances decision-making efficiency and accuracy for brokers managing diverse client portfolios.

- Skill needed: Proficiency in Excel formulas, pivot tables, and basic VBA scripting for customization.

- Product requirement: Templates must allow for easy input of client-specific financial data and generate visual reports.

- Specification: Include built-in sensitivity analysis features and pre-configured graphs for portfolio performance tracking.

Trading Tutorial Videos (MP4)

Creating Trading Tutorial Videos in MP4 format helps brokers educate clients on market strategies and platform usage. These videos improve client engagement by providing visual demonstrations of trading techniques and real-time examples. High-quality tutorial content ensures brokers enhance user confidence and trading success rates.

- Skill needed: Expertise in financial markets, video editing, and instructional design.

- Product requirement: Clear, concise, and engaging video content with step-by-step trading instructions.

- Specification: MP4 format with HD resolution, subtitles, and compatibility with multiple devices and platforms.

Risk Assessment Checklists (PDF/DOC)

Creating Risk Assessment Checklists tailored for brokers enhances their ability to identify and evaluate potential market, credit, and operational risks systematically. These checklists serve as a crucial tool for regulatory compliance and risk mitigation strategies. Utilizing both PDF and DOC formats ensures accessibility and ease of customization for diverse brokerage environments.

- Skill needed: Understanding of financial regulations and risk management principles applicable to brokerage operations.

- Product requirement: Compatibility with PDF and DOC formats for easy sharing and editing across different platforms.

- Specification: Clear categorization of risk types including market, credit, operational, and compliance risks specific to brokerage activities.

Portfolio Tracker Spreadsheets (Excel)

Portfolio Tracker Spreadsheets designed for brokers offer a comprehensive solution for managing diverse financial assets efficiently. These spreadsheets integrate real-time data import, customizable performance metrics, and detailed transaction logs to enhance decision-making. Excel-based portfolio tracking ensures accuracy and ease of use for daily brokerage operations.

- Skill needed: Proficiency in Excel formulas, VBA scripting, and financial analysis concepts.

- Product requirement: Real-time data connectivity and customizable dashboard views.

- Specification: Secure data handling, support for multiple asset classes, and automatic performance reporting.

Regulatory Compliance Guides (PDF)

Regulatory Compliance Guides are essential digital documents designed specifically for brokers to ensure adherence to legal standards across jurisdictions. These PDFs consolidate complex regulations into accessible formats, aiding brokers in risk management and operational transparency. Precise updates reflecting current laws enable brokers to maintain situational awareness and compliance integrity.

- Skill Needed: Expertise in financial regulation, document design, and legal writing to accurately compile and present compliance information.

- Product Requirement: Interactive PDF features such as hyperlinks, bookmarks, and embedded search functions for user-friendly navigation.

- Specification: Up-to-date, jurisdiction-specific regulatory content with clear citation of authoritative sources and compliance deadlines.

Targeted Audience Segmentation for Lead Generation

Effective audience segmentation is crucial for maximizing lead generation. By dividing your market into distinct groups based on demographics, behavior, or interests, you can deliver highly relevant content. This approach increases engagement and improves the quality of leads. Tailoring your messaging to specific segments fosters stronger connections and better conversion rates.

Multi-Channel Digital Advertising Strategy

Utilizing a multi-channel advertising strategy ensures broad visibility across various platforms like social media, search engines, and email. Each channel offers unique targeting options, enhancing reach and engagement with your ideal audience. Consistent messaging across channels reinforces brand recognition. Combining channels optimizes budget allocation and drives more qualified traffic.

Conversion-Optimized Landing Pages

Landing page optimization plays a vital role in converting visitors into customers. Clean design, clear calls-to-action, and fast loading times increase the likelihood of conversion. Highlighting benefits and social proof builds trust and encourages action. Testing different elements ensures your page meets the needs of your audience effectively.

Data-Driven Performance Analytics

Leveraging data-driven analytics enables marketers to measure campaign success accurately. By tracking key performance indicators (KPIs), you can identify what works and where improvements are needed. Insights from analytics help in refining strategies and increasing ROI. Continuous monitoring fosters informed decision-making and sustained growth.

Automated Client Engagement Workflows

Automation of client engagement streamlines communication and nurtures leads consistently. Automated workflows deliver personalized messages at optimal times, enhancing customer experience. This approach saves time and reduces manual effort, allowing focus on strategy. Effective automation strengthens relationships and accelerates conversion.