Creating a digital product suitable for asset managers in the real estate sector requires a deep understanding of property portfolio management and market dynamics. Such a product must streamline asset tracking, financial analysis, and reporting to enhance decision-making efficiency. Integrating advanced analytics and user-friendly interfaces ensures asset managers can optimize returns and mitigate risks effectively. Explore the article for detailed strategies and innovative features to develop an impactful digital solution.

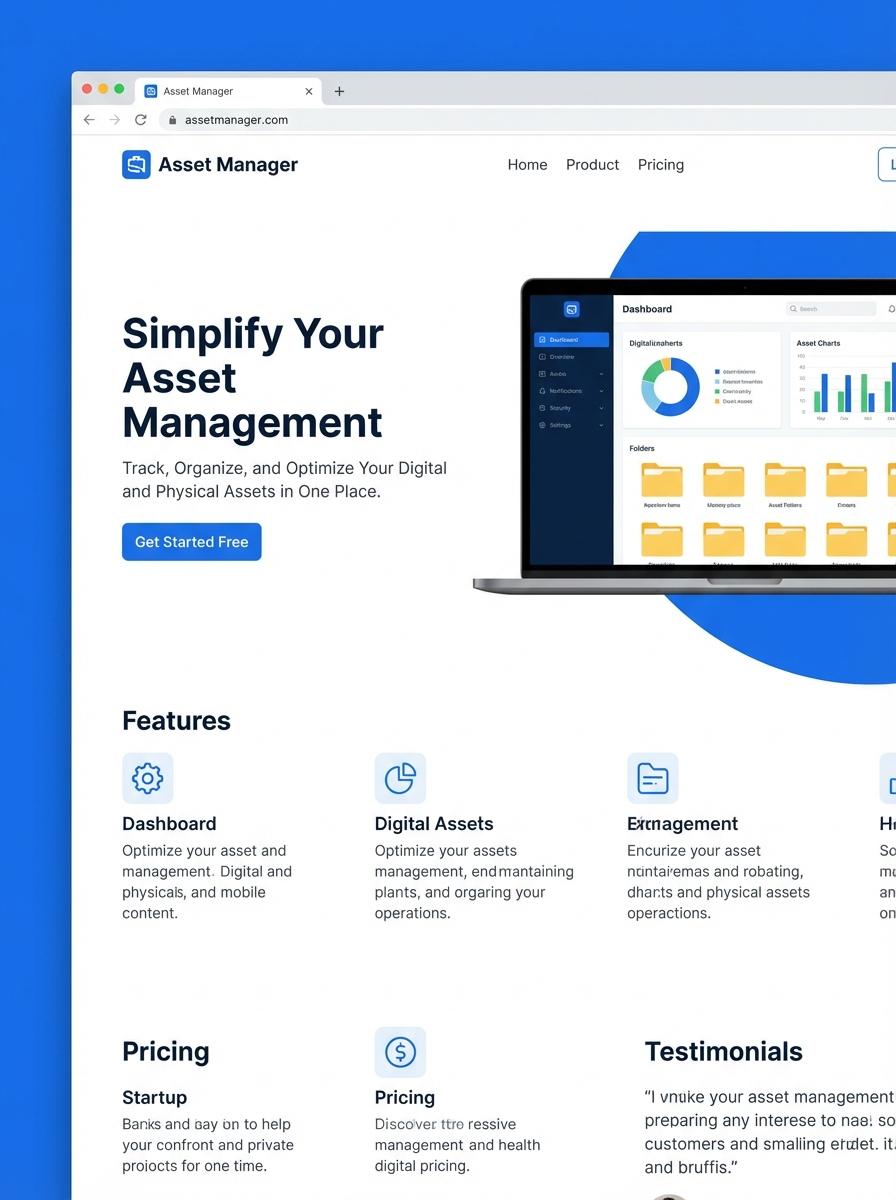

Illustration: Landing page for digital product for Asset Manager

Property Portfolio Performance Dashboard (Excel)

Property Portfolio Performance Dashboard in Excel enables Asset Managers to analyze real-time data across multiple properties, tracking key metrics like rental income, occupancy rates, and maintenance costs. This tool supports data-driven decision-making by consolidating financial and operational data into interactive charts and tables. It enhances portfolio optimization and risk management through customizable performance indicators and scenario analysis.

- Skills needed: Proficiency in Excel functions, data visualization, financial analysis, and portfolio management.

- Product requirements: Integration with property management databases, user-friendly interface, and customizable KPI tracking.

- Specifications: Dynamic dashboards with drill-down capability, automated data updates, and exportable reports for stakeholder presentations.

Real Estate Market Analysis Report (PDF)

Real Estate Market Analysis Report in PDF format provides comprehensive insights into property values, market trends, and investment potential specific to asset management. It equips Asset Managers with data-driven evaluations of geographic locations, economic indicators, and comparable sales metrics essential for portfolio optimization. The report supports strategic decision-making by highlighting risk factors and growth opportunities.

- Skill Needed: Proficiency in financial modeling, real estate market research, and data analytics.

- Product Requirement: High-resolution PDF output with interactive charts and tables summarizing key market metrics.

- Specification: Include historical price trends, demographic analysis, and detailed property breakdowns.

Lease Agreement Templates (Word/Doc)

Lease Agreement Templates in Word format provide asset managers with customizable documents tailored to property leasing. These templates ensure compliance with legal standards while simplifying contract creation. A professional lease agreement reduces risks and streamlines asset management workflows.

- Skill Needed: Understanding of property management and lease law basics.

- Product Requirement: Editable .doc/.docx format compatible with Microsoft Word.

- Specification: Clear sections covering terms, rent, maintenance, and termination clauses.

Asset Maintenance Schedule Planner (Excel)

The Asset Maintenance Schedule Planner in Excel is designed specifically for Asset Managers to streamline the tracking and scheduling of maintenance tasks. It enables efficient management of asset lifecycle data, ensuring timely upkeep and reducing downtime. The planner supports customized alerts and detailed record-keeping for all asset activities.

- Skill needed: Proficiency in Excel functions such as formulas, conditional formatting, and data validation.

- Product requirement: Integration of dynamic scheduling and automated reminder features for preventive maintenance.

- Specification: Compatibility with various asset categories and the ability to generate comprehensive maintenance reports.

Investment Proposal Presentation (PowerPoint)

Investment Proposal Presentation in PowerPoint is tailored for asset managers to clearly communicate portfolio strategies, risk assessments, and expected returns. It includes detailed financial models and market analysis visuals to support decision-making. Customizable slides enhance the ability to address stakeholder queries efficiently.

- Strong proficiency in financial analysis and asset management concepts

- PowerPoint template with editable charts, graphs, and data placeholders

- Inclusion of clear risk metrics, portfolio diversification visuals, and performance forecasts

Digital Property Brochure (PDF)

Creating a Digital Property Brochure (PDF) tailored for asset managers involves highlighting key asset details, investment performance data, and market trends. Clear and concise presentation of property features, financial metrics, and legal information is essential for informed decision-making. High-quality visuals and interactive elements enhance user engagement and comprehension.

- Proficiency in graphic design and Adobe InDesign or similar layout software

- Incorporation of up-to-date financial and market data relevant to asset management

- Specification for optimized PDF file size ensuring quick download without compromising image quality

Property Walkthrough/Training Video (MP4)

Creating a Property Walkthrough/Training Video in MP4 format provides asset managers with a clear and structured approach to showcasing property features and operational procedures. These videos enhance comprehension and facilitate remote training, ensuring consistency across multiple properties. High-quality visuals and concise narration are essential to effectively communicate asset details and usage guidelines.

- Skill needed: Proficiency in video editing software and knowledge of real estate terminology.

- Product requirement: High-definition MP4 video format compatible with common playback devices.

- Specification: Include detailed walkthrough of property spaces, key asset features, safety protocols, and maintenance instructions.

Targeted Audience Segmentation for Institutional Investors

Effective audience segmentation is crucial when marketing digital products to institutional investors. By analyzing firmographics, investment behaviors, and portfolio priorities, marketers can tailor messaging to resonate specifically with this sophisticated group. Utilizing advanced segmentation ensures that campaigns reach decision-makers with relevant value propositions. This precision ultimately increases engagement and conversion rates significantly.

Data-Driven Performance Metrics and Reporting

Leveraging data-driven performance metrics enables marketers to measure the impact of their digital campaigns accurately. Key indicators such as click-through rates, conversion paths, and ROI provide a comprehensive view of effectiveness. Continuous reporting allows for timely adjustments and optimization of marketing strategies. This approach ensures sustained growth and maximizes resource efficiency.

Multi-Channel Digital Campaign Integration

Integrating campaigns across multiple digital channels creates a cohesive and amplified brand presence. Combining email marketing, social media, paid ads, and webinars allows for consistent messaging and broader reach. Synchronizing these channels enhances user experience and increases touchpoints with institutional investors. A unified multi-channel strategy drives higher engagement and strengthens brand recognition.

Thought Leadership Content Creation

Developing compelling thought leadership content establishes credibility and trust with institutional investors. Sharing insights through blogs, whitepapers, and webinars positions your brand as an industry expert. This content builds deeper relationships by addressing investor challenges and offering informed solutions. Consistent thought leadership nurtures loyalty and long-term engagement.

Compliance and Regulatory-Focused Messaging

Marketing to institutional investors demands strict adherence to compliance and regulatory standards. Messaging must be transparent, accurate, and aligned with financial regulations to maintain trust. Highlighting regulatory expertise reassures investors of your product's legitimacy and security. Prioritizing compliance protects your brand and fosters confidence among discerning investors.