Creating a digital product suitable for underwriters in the real estate sector requires understanding their specific needs for risk assessment, property valuation, and compliance checks. The product must streamline data analysis, integrate with existing databases, and provide accurate predictive analytics to aid decision-making. Prioritizing user-friendly interfaces ensures underwriters can efficiently evaluate property risks and make informed judgments. Explore the detailed ideas in the article to learn how to develop a tailored digital solution that enhances underwriting processes in real estate.

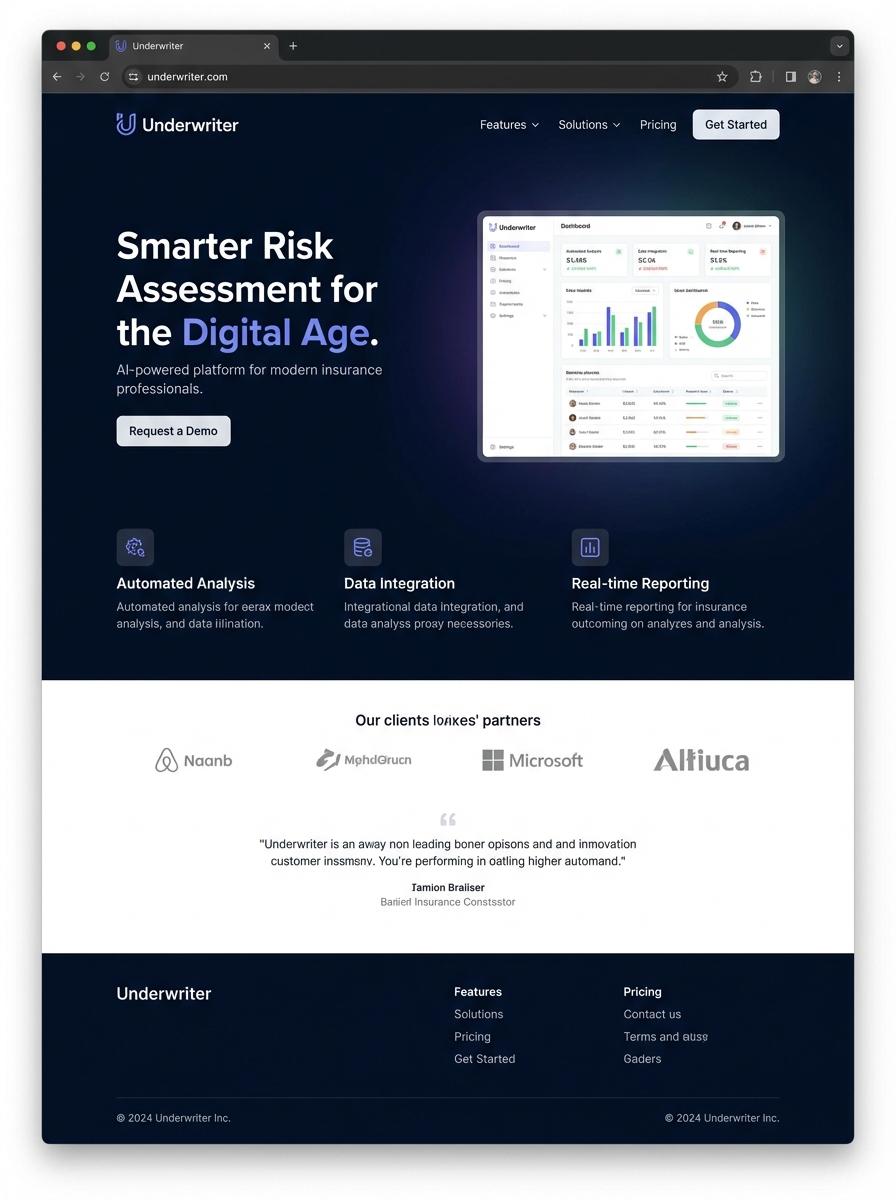

Illustration: Landing page for digital product for Underwriter

Real Estate Underwriting Checklist (Excel)

Effective real estate underwriting requires a comprehensive, organized approach to evaluate financial risks and property viability. The Real Estate Underwriting Checklist in Excel format allows underwriters to systematically assess critical factors such as property value, loan terms, and borrower creditworthiness. This tool enhances accuracy and consistency by providing a structured framework for data analysis and decision-making.

- Skill needed: Proficiency in Excel functions and financial analysis relevant to real estate underwriting.

- Product requirement: Includes customizable fields for loan-to-value ratios, debt service coverage, and cash flow projections.

- Specification: User-friendly interface with built-in formulas to automate risk metrics and generate summary reports.

Property Risk Assessment Report Template (Word/PDF)

The Property Risk Assessment Report Template is designed to streamline the evaluation process for underwriters by providing a structured format for documenting property-specific hazards. The template emphasizes critical factors such as structural integrity, fire protection measures, and environmental risks. Accurate and detailed reporting supports underwriters in making informed decisions regarding policy terms and coverage limits.

- Analytical skills to evaluate various property risks accurately and consistently.

- Template should be compatible with Microsoft Word and exportable to PDF formats.

- Include predefined fields for property description, risk categorization, inspection findings, and underwriting recommendations.

Loan Analysis Calculator (Excel)

The Loan Analysis Calculator in Excel enables underwriters to accurately assess loan applications by calculating key financial ratios such as debt-to-income and loan-to-value. It integrates borrower data and loan terms to deliver real-time analysis for informed decision-making. This tool enhances underwriting efficiency by automating complex computations and reducing errors.

- Skills needed: Proficiency in Excel formulas, financial modeling, and credit risk assessment.

- Product requirements: User-friendly interface, customizable input fields, and automated calculation functions.

- Specifications: Compatibility with Excel 2016 or later, macro-enabled for advanced features, and secure data protection measures.

Market Trend Analysis Presentation (PowerPoint)

Market Trend Analysis Presentation in PowerPoint format equips underwriters with critical insights into evolving risk factors, industry shifts, and financial models. This tool enables data-driven decision-making by visually representing trends, forecasts, and comparative statistics. It streamlines assessment processes and enhances risk evaluation through clear, concise information delivery.

- Skill needed: Expertise in financial modeling, risk assessment, and data visualization tailored for insurance underwriting.

- Product requirement: Interactive slides with customizable charts, real-time data integration, and industry-specific risk metrics.

- Specification: Compatibility with Microsoft PowerPoint 2019 or later, responsive design for various devices, and export options to PDF and print-ready formats.

Underwriting Training Video

Underwriting training videos deliver targeted educational content essential for underwriters to assess risk and make informed decisions efficiently. These videos incorporate case studies, industry regulations, and risk evaluation techniques relevant to the underwriting process. They enhance skill acquisition and ensure compliance with underwriting standards.

- Skill needed: Comprehensive understanding of risk assessment and insurance policy guidelines.

- Product requirement: Clear, high-quality audio-visual content with real-world underwriting scenarios.

- Specification: Interactive elements such as quizzes and annotations to reinforce learning and retention.

Due Diligence Document Checklist (PDF)

The Due Diligence Document Checklist for underwriters is a comprehensive PDF that consolidates critical files and data essential for risk assessment. It typically includes financial statements, legal agreements, and compliance certificates, ensuring all necessary documentation is systematically reviewed. This tool streamlines the underwriting process by providing a clear, organized framework for document verification.

- Strong knowledge of underwriting standards and regulatory compliance

- Clear, customizable PDF format with easy navigation and annotation features

- Inclusion of all relevant document categories such as financial, legal, and operational records

Borrower Credit Evaluation Form (Excel/PDF)

The Borrower Credit Evaluation Form is designed to assist underwriters in systematically assessing a borrower's creditworthiness. This form, available in Excel and PDF formats, enables efficient data entry, analysis, and documentation of crucial credit factors such as income, credit score, and debt-to-income ratio. It supports risk management by standardizing credit evaluation processes.

- Skill needed: Proficiency in financial analysis and understanding of credit risk assessment.

- Product requirement: Compatibility with both Excel and PDF to allow flexible data input and sharing.

- Specification: Includes fields for credit score, income verification, debt-to-income ratio, employment history, and loan purpose.

Targeted Messaging for Insurance Professionals

Crafting targeted messaging is essential to resonate with insurance professionals. Understand their unique pain points and industry jargon to tailor your communication effectively. This focused approach increases engagement and builds trust with your audience. Emphasizing relevant benefits will drive higher conversion rates.

Demonstrate Compliance and Security Features

Highlighting your digital product's compliance and security features reassures insurance professionals about data protection and regulatory adherence. Clearly communicate certifications, encryption standards, and privacy safeguards. This transparency helps build confidence and mitigates concerns about digital risks. Prioritize showcasing how your product supports legal obligations effortlessly.

Showcase Automation and Efficiency Gains

Insurance professionals value tools that improve productivity, making automation and efficiency critical selling points. Demonstrate how your product simplifies tasks, reduces manual workloads, and accelerates processes. Quantify time and cost savings to illustrate concrete benefits. Effective automation ultimately enhances customer service and operational agility.

Highlight Seamless Integration Capabilities

Promote your product's integration capabilities by showing compatibility with existing insurance systems and platforms. Seamless integration minimizes disruption and ensures smooth workflow adoption. Provide technical details and examples to validate the ease of connectivity. This reassures buyers about the product's adaptability in their tech environment.

Offer Personalized Demos and Case Studies

Delivering personalized demos and presenting relevant case studies build credibility and demonstrate real-world value. Tailor demos to the specific needs and challenges faced by insurance clients. Share success stories to highlight measurable outcomes and customer satisfaction. Personalized interactions significantly boost engagement and trust in your product.