Creating a digital product suitable for real estate finance specialists involves developing tools that streamline financial analysis, improve investment decision-making, and enhance property valuation accuracy. Such products often integrate advanced data analytics, market trends, and customizable financial models tailored specifically for the real estate sector. Emphasizing user-friendly interfaces and real-time data access ensures specialists can efficiently manage transactions and portfolio performance. Explore detailed ideas in the article to understand the essential features and development strategies for these innovative solutions.

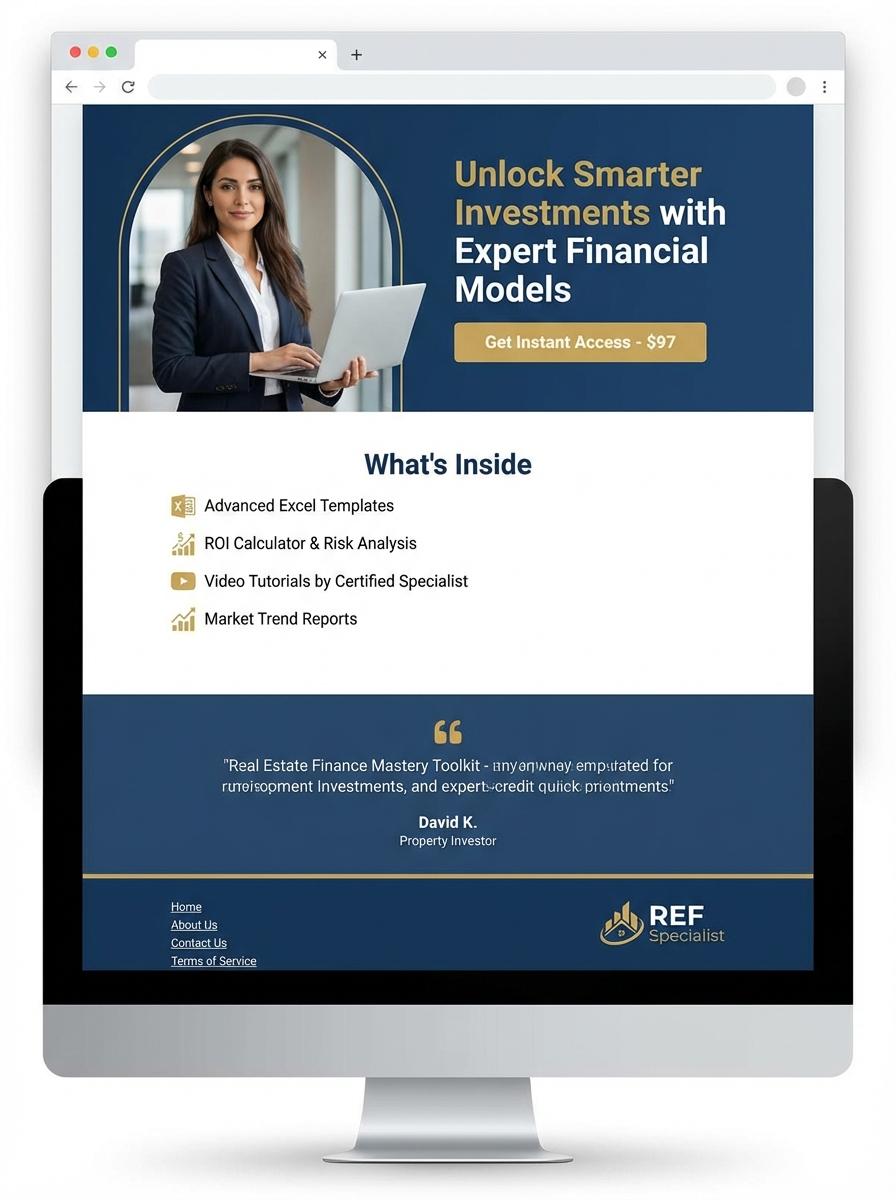

Illustration: Landing page for digital product for Real estate finance specialist

Real Estate Investment Analysis Excel Template

The Real Estate Investment Analysis Excel Template streamlines cash flow modeling and ROI calculations for properties. Designed for real estate finance specialists, it incorporates dynamic formulas for accurate risk assessment and market trend evaluation. Data-driven insights enhance investment decision quality and portfolio performance visibility.

- Proficiency in advanced Excel functions such as VLOOKUP, INDEX-MATCH, and pivot tables.

- Template requirements include pre-built financial models, customizable property input sheets, and scenario analysis tools.

- Specification to support multi-property comparison, sensitivity analysis, and automated report generation.

Property Valuation Report PDF

Property Valuation Report PDF offers an accurate and comprehensive analysis of real estate assets, tailored for real estate finance specialists. It integrates market data, property details, and financial metrics to support investment decisions and loan approvals. The report enhances transparency and facilitates trusted financial assessments.

- Advanced knowledge of real estate market trends and financial analysis.

- Integration with reliable data sources for up-to-date property and market information.

- Configurable templates for professional, clear, and compliant PDF report generation.

Real Estate Financial Modeling Course Video

The Real Estate Financial Modeling Course Video provides specialized training tailored for Real Estate Finance Specialists, focusing on advanced financial modeling techniques. It covers key concepts such as cash flow analysis, valuation methods, and investment risk assessment. Learners develop practical skills to analyze and forecast real estate investments accurately.

- Skill needed: Proficiency in Excel, financial analysis, and real estate market fundamentals.

- Product requirement: High-quality video tutorials with real-world case studies and downloadable practice files.

- Specification: Step-by-step modeling process including NOI calculations, IRR, and sensitivity analysis, optimized for beginner to intermediate levels.

Commercial Lease Cash Flow Calculator (Excel)

The Commercial Lease Cash Flow Calculator in Excel enables real estate finance specialists to accurately model lease income streams, operating expenses, and net cash flow. It supports detailed input of lease terms, rent escalations, and vacancy periods to forecast profitability over time. This tool is essential for investment analysis and financial planning in commercial real estate portfolios.

- Skill Needed: Advanced Excel proficiency, including formula creation, pivot tables, and financial functions.

- Product Requirement: Customizable input fields for lease terms, escalation schedules, and expense tracking.

- Specification: Output includes detailed period-by-period cash flow projections and summary financial metrics.

Due Diligence Checklist for Investors (Doc)

A comprehensive Due Diligence Checklist for Investors in real estate finance ensures thorough evaluation of financial statements, property valuations, and legal compliance. This document streamlines risk assessment and supports informed investment decisions. Key components include verifying title deeds, analyzing cash flow projections, and assessing market trends.

- Strong analytical skills to interpret financial data and legal documents.

- Clear, structured template compatible with common document formats like MS Word or PDF.

- Includes sections for financial reviews, legal checks, and property inspections to cover all investor concerns.

Real Estate Market Trend Report (PDF)

The Real Estate Market Trend Report in PDF format provides comprehensive data analysis on property values, investment flows, and market fluctuations. It includes detailed charts and projections tailored to current economic indicators and lending rates. This report is essential for finance specialists aiming to make informed investment decisions and risk assessments.

- Strong data analysis and financial modeling skills.

- High-resolution, editable charts and graphs compatible with PDF.

- Up-to-date integration of economic and lending rate data sources.

Real Estate Financing Options Guide (PDF)

A Real Estate Financing Options Guide in PDF format serves as a comprehensive resource for real estate finance specialists seeking to navigate various funding solutions. It includes detailed analysis of mortgage types, interest rates, and loan qualification criteria essential for advising clients. Such a guide enhances decision-making by presenting updated financing trends and regulatory insights.

- Skill Needed: Expertise in mortgage structures and credit risk assessment.

- Product Requirement: Clear, up-to-date data on lending policies and financial products.

- Specification: User-friendly layout with easy-to-navigate sections and indexed case studies.

Streamline Your Real Estate Finance Workflow with Cutting-Edge Digital Tools

Embrace innovative digital tools to simplify complex real estate finance operations, enabling smoother transaction management and faster approvals. Automating routine tasks reduces errors and frees up valuable time for strategic decision-making. Integrating these technologies ensures a cohesive workflow that enhances productivity and client satisfaction.

Maximize ROI on Property Investments Using Advanced Financial Analytics

Leverage advanced financial analytics to gain in-depth insights into property performance and market trends. Data-driven strategies help identify the most profitable investment opportunities and mitigate risks effectively. Employing these analytical tools enables investors to make smarter, evidence-based decisions for higher returns.

Secure, Compliant, and Automated Loan Processing Solutions for Real Estate Professionals

Implementing secure and compliant automated loan processing systems ensures regulatory adherence while speeding up loan approvals. These solutions minimize manual errors and enhance data security, boosting trust among clients and stakeholders. Streamlined compliance reduces administrative burdens and fosters a seamless financing experience.

Real-Time Market Insights for Smarter Real Estate Financing Decisions

Stay ahead with real-time market insights that empower professionals to react promptly to market fluctuations. Access to live data enables timely adjustments in financing strategies, optimizing outcomes. This immediate visibility into market trends supports more accurate forecasting and competitive advantage.

Boost Client Acquisition with Seamless Digital Mortgage Experiences

Deliver a seamless digital mortgage experience to attract and retain clients by simplifying the application and approval process. User-friendly platforms increase engagement and reduce dropout rates during mortgage applications. Enhancing digital interfaces fosters trust and improves overall client satisfaction, driving business growth.