Creating a digital product suitable for Real Estate Analysts involves designing tools that streamline data analysis, market trend evaluation, and property valuation. Such products must integrate advanced analytics, user-friendly interfaces, and real-time data to empower analysts in making informed decisions. Emphasizing accuracy, efficiency, and customization enhances the overall value for professionals in the Real Estate sector. Explore detailed ideas and strategies in the article to develop an effective digital solution for Real Estate Analysts.

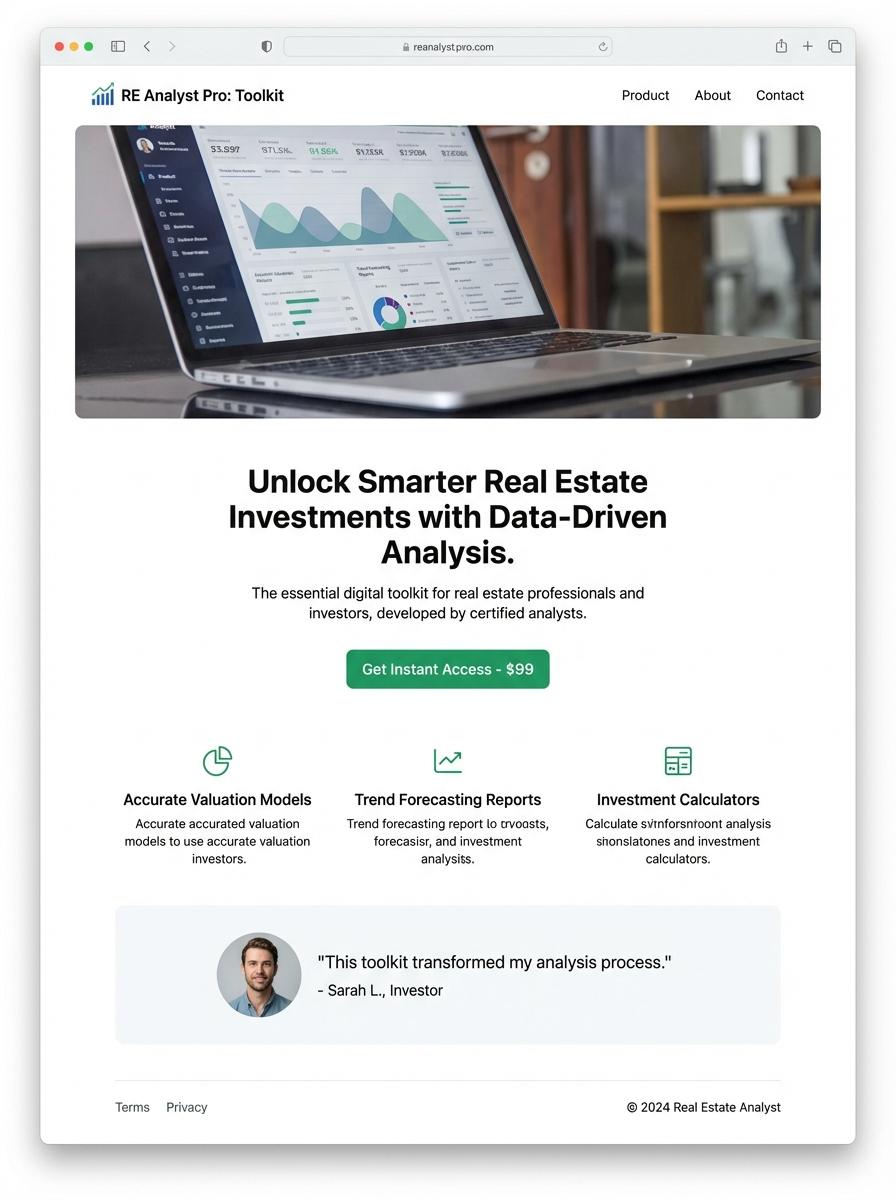

Illustration: Landing page for digital product for Real Estate Analyst

Real Estate Market Analysis Report (PDF)

A Real Estate Market Analysis Report provides in-depth insights into current property trends, pricing, and market dynamics essential for informed decision-making. It consolidates quantitative data, geographic information, and economic indicators to forecast market behavior. This report serves as a critical tool for real estate analysts seeking to evaluate investment opportunities and market risks accurately.

- Skills needed: Proficiency in data analysis, familiarity with real estate market trends, and ability to interpret economic and geographic data.

- Product requirements: High-resolution graphics, accurate data visualization, up-to-date market statistics, and clear monthly or quarterly summaries.

- Specifications: PDF format with interactive charts, customizable sections for different market types, and secure access features.

Rental Yield Calculator (Excel)

Real Estate Analysts rely heavily on accurate financial metrics to assess investment opportunities, with rental yield being a crucial indicator. A Rental Yield Calculator created in Excel enables precise calculation of gross and net yields by factoring in purchase prices, rental income, and expenses. This tool helps analysts make informed decisions by quantitatively comparing profitability across properties.

- Skills needed: advanced Excel functions, financial modeling, real estate market knowledge.

- Product requirement: customizable input fields for purchase price, rental income, expenses, and vacancy rates.

- Specification: automated yield calculations with options for gross and net rental yield metrics displayed in an easy-to-read format.

Comparative Market Analysis Template (Excel)

A Comparative Market Analysis Template in Excel empowers real estate analysts to accurately evaluate property values by comparing similar listings and sales data. Utilizing structured datasets and dynamic formulas enhances precision in price estimations and market trends analysis. Visual tools like charts and conditional formatting improve interpretation of competitive positioning within target markets.

- Skill needed: Proficiency in Excel functions including VLOOKUP, pivot tables, and data visualization techniques.

- Product requirement: Incorporate automated data input fields for property attributes such as location, size, and sale price.

- Specification: Template must support real-time updating capabilities and standardized report generation formats for client presentations.

Real Estate Investment Feasibility Study (PDF)

The Real Estate Investment Feasibility Study PDF provides a comprehensive analysis of market trends, financial projections, and risk assessment tailored for real estate analysts. It evaluates variables such as location demographics, property valuation, and cash flow forecasting to determine project viability. This study supports informed decision-making by presenting clear data visualization and actionable insights aligned with industry standards.

- Skill needed: Expertise in financial modeling and market analysis specific to real estate sectors.

- Product requirement: Interactive and easy-to-navigate PDF format with embedded charts and scenario simulations.

- Specification: Inclusion of up-to-date market data, regulatory compliance checks, and customizable investment criteria.

Due Diligence Checklist (DOC)

The Due Diligence Checklist (DOC) is an essential digital tool for Real Estate Analysts to systematically verify property details, legal documents, and financial assessments. This checklist ensures comprehensive evaluation of zoning laws, title deeds, and market comparables. It supports minimizing risks by organizing critical information for investment decisions.

- Proficiency in real estate laws, financial analysis, and property valuation.

- Integration capabilities with databases for title verification and market data.

- Customizable templates for different property types and due diligence stages.

Real Estate Investment Presentation Deck (PPT or PDF)

Real Estate Investment Presentation Deck is designed to provide comprehensive insights into property market trends, financial analysis, and potential investment returns. It incorporates detailed charts, risk assessments, and market comps tailored for real estate analysts. The deck streamlines complex data into a clear, compelling format for effective stakeholder communication.

- Strong analytical skills to interpret market data and financial metrics.

- High-resolution templates compatible with PowerPoint and PDF formats.

- Customizable slides featuring interactive charts, property comparables, and ROI projections.

Real Estate Valuation Model (Excel)

Real Estate Analysts utilize a Real Estate Valuation Model in Excel to accurately assess property values based on market trends, comparable sales, and income potential. This model incorporates key financial metrics such as Net Operating Income (NOI), Cap Rate, and Discounted Cash Flow (DCF) analysis to support investment decisions. Efficient use of Excel functions and financial modeling enhances the precision and reliability of valuation outcomes.

- Proficiency in Excel including advanced formulas, pivot tables, and VBA scripting.

- Integration of real estate market data and financial performance indicators.

- Capability to update valuation assumptions dynamically for scenario analysis.

Real-time Market Data Analytics for Smarter Investments

Utilize real-time market data analytics to make informed decisions and maximize the success of your digital product. Access to up-to-the-minute data enables you to anticipate market trends and customer needs accurately. Incorporating these insights will help tailor your marketing strategies effectively. This approach ensures your product remains competitive in a fast-changing digital environment.

AI-Driven Property Valuation Tools for Accurate Insights

Leverage AI-driven property valuation tools to provide precise and reliable market insights. These technologies enhance your product's credibility by offering data-backed predictions and valuations. Highlighting AI capabilities in marketing materials can attract tech-savvy customers. Accurate insights enable better investment decisions and improve user trust.

Seamless Integration with Leading Real Estate Platforms

Ensure your digital product offers seamless integration with popular real estate platforms. This compatibility elevates user experience by simplifying data access and workflow processes. Marketing this feature emphasizes convenience and flexibility, critical factors for customer adoption. Integration also expands your product's reach by connecting with an established user base.

Customizable Dashboards for Data-Driven Decision Making

Promote customizable dashboards to empower users with personalized data visualization options. Flexible dashboards help customers focus on the most relevant metrics, enhancing their decision-making process. Emphasizing this feature in your marketing appeals to users seeking tailored and actionable insights. A user-centric design increases satisfaction and product retention.

Automated Reporting Solutions to Increase Analyst Productivity

Highlight the benefits of automated reporting solutions that streamline data analysis and reduce manual effort. Automation boosts analyst productivity by generating timely, accurate reports with minimal intervention. Marketing this capability demonstrates efficiency improvements, a key selling point for business users. Efficient reporting leads to faster decisions and better overall performance.