Creating a digital product tailored for a Real Estate Investment Manager involves designing tools that streamline property analysis, portfolio management, and market trend tracking within the Real Estate sector. Such a product must integrate data visualization, financial modeling, and predictive analytics to enhance decision-making and investment strategies. It should also offer user-friendly interfaces to facilitate efficient management of assets and transactions. Explore the article for detailed ideas on developing an effective digital solution for real estate investment professionals.

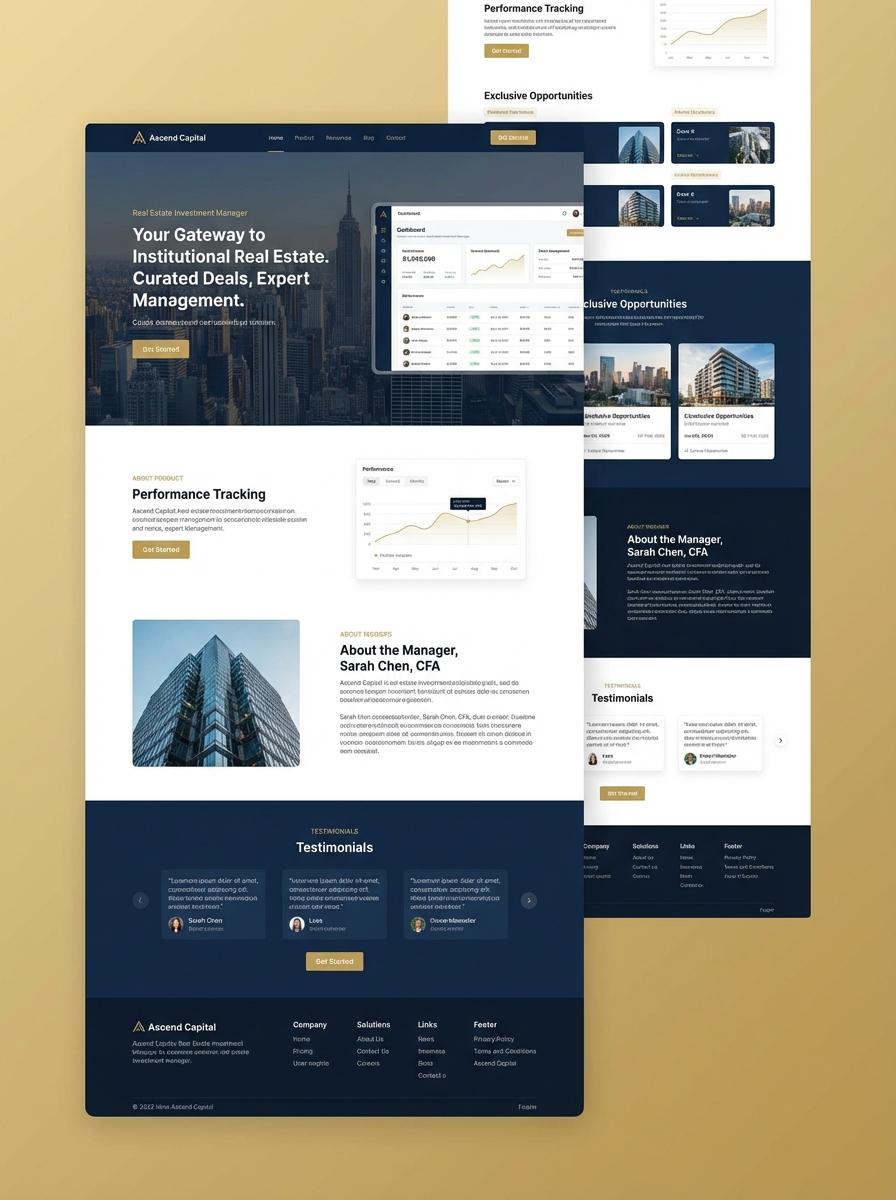

Illustration: Landing page for digital product for Real Estate Investment Manager

Real Estate Investment Analysis Spreadsheet (Excel)

Real Estate Investment Analysis Spreadsheet in Excel enables managers to evaluate property performance by calculating key metrics such as cash flow, ROI, and cap rate. It integrates data inputs for acquisition costs, rental income, and expenses to generate detailed financial projections. This tool supports decision-making with scenario analysis and sensitivity testing functionalities.

- Skills needed: Advanced Excel proficiency, financial modeling, understanding of real estate investment metrics.

- Product requirements: User-friendly interface, customizable input fields, automated calculation of investment performance indicators.

- Specifications: Compatibility with latest Excel versions, dynamic charts for visualization, ability to handle multiple property portfolios.

Property Market Research Report (PDF)

Real Estate Investment Managers require comprehensive insights on market trends, property valuations, and regional economic factors to make informed decisions. A Property Market Research Report provides detailed analyses of housing supply, demand metrics, and investment risk assessments essential for portfolio optimization. This report consolidates quantitative data and qualitative trends tailored to enhance strategic real estate investments.

- Ability to analyze real estate market dynamics and interpret economic indicators.

- Report must include up-to-date data on property prices, rental yields, and neighborhood demographic trends.

- Clear presentation format with executive summaries, charts, and region-specific investment recommendations.

Real Estate Deal Evaluation Template (Excel)

Real Estate Investment Managers require precise analysis tools to assess property deals effectively. The Real Estate Deal Evaluation Template in Excel simplifies cash flow projections, ROI calculations, and risk assessments. This template enhances decision-making by providing structured financial insights and scenario comparisons.

- Strong proficiency in Excel functions, including financial formulas and data visualization.

- Ability to interpret real estate market data and investment metrics accurately.

- Understanding of investment risk factors and their impact on deal outcomes.

- Comprehensive template with sections for purchase price, financing, income, expenses, and exit strategy.

- Built-in formulas for IRR, cash-on-cash return, and net operating income (NOI).

- Flexible input fields allowing customization for various deal scenarios and property types.

- Clear, user-friendly interface with labeled cells and color-coded inputs versus outputs.

- Compatibility with Excel 2016 and later versions, ensuring wide accessibility.

- Inclusion of charts and graphs to visualize investment performance trends over time.

Investor Pitch Deck Template (PowerPoint/PDF)

An Investor Pitch Deck Template tailored for Real Estate Investment Managers includes key slides such as market analysis, property portfolio, financial projections, and risk assessment. The design must showcase relevant real estate metrics like Cap Rate, ROI, and property value trends. Providing clear, concise data visualization enhances investor understanding and engagement.

- Skill needed: Expertise in real estate financial modeling and investor communication.

- Product requirement: Compatible with PowerPoint and exportable to PDF format.

- Specification: Includes customizable charts, maps, and investment highlights sections.

Portfolio Performance Dashboard (Excel)

The Portfolio Performance Dashboard in Excel allows Real Estate Investment Managers to consolidate asset data, monitor key metrics, and visualize portfolio returns efficiently. This tool tracks cash flow, occupancy rates, and internal rate of return (IRR) across multiple properties. It enables rapid identification of underperforming assets and supports data-driven decision-making.

- Skill needed: Proficiency in Excel functions, data analysis, and visualization techniques such as pivot tables and charts.

- Product requirement: Must integrate historical property data, rent rolls, expense reports, and market benchmarks.

- Specification: The dashboard should dynamically update with new data inputs and provide customizable views for total portfolio and individual asset performance.

Real Estate Due Diligence Checklist (PDF/Doc)

The Real Estate Due Diligence Checklist is an essential tool for Real Estate Investment Managers to systematically assess property value, legal status, and potential risks. This checklist ensures comprehensive evaluation of financial statements, title searches, and environmental reports. It enhances decision-making accuracy by consolidating critical investment criteria into a clear format.

- Skill needed: Expertise in property law, financial analysis, and risk assessment related to real estate investment.

- Product requirement: The checklist must be available in editable PDF and DOC formats for easy customization and sharing.

- Specification: Include sections covering title verification, zoning compliance, physical inspection, and financial performance metrics.

Property Investment Guide Video (MP4)

The Property Investment Guide Video offers comprehensive insights into real estate market analysis, risk assessment, and portfolio diversification specifically tailored for Real Estate Investment Managers. It covers essential strategies and data-backed techniques to optimize investment returns and manage assets efficiently. The video integrates practical examples and industry best practices to enhance decision-making processes.

- Skill needed: Proficiency in real estate market analysis, financial modeling, and risk management.

- Product requirement: High-resolution MP4 format compatible with multiple devices and platforms.

- Specification: Duration between 15 to 30 minutes with clear visual aids, subtitles, and a professional narration style.

Target High-Net-Worth Investors

Focus on high-net-worth investors seeking to diversify their real estate portfolios. Tailor your marketing strategy to highlight exclusive benefits and personalized investment options. Emphasize security and potential for high returns to capture their interest effectively.

Emphasize Data-Driven Decision Support

Promote the platform's data-driven decision support tools that enable smarter property investments. Showcase analytics, market trends, and predictive insights to build investor confidence. This approach aids investors in making well-informed and strategic decisions.

Showcase a User-Friendly Platform

Highlight the platform's user-friendly interface combined with robust risk management features. Simplicity in navigation along with advanced tools reassures investors about the safety and ease of managing their investments. This combination maximizes user satisfaction and engagement.

Highlight Exclusive Real Estate Opportunities

Draw attention to exclusive access to prime commercial real estate investments unavailable elsewhere. Stress the uniqueness and potential profitability of the opportunities offered. This exclusivity attracts investors seeking high-value and rare assets.

Demonstrate Proven Track Record

Build trust by showcasing a proven track record and transparent performance reporting. Use clear data and success stories to validate the platform's reliability and effectiveness. Transparency fosters investor confidence and long-term commitment.