Creating a digital product suitable for Mortgage Brokers in the real estate sector involves developing tools that streamline client management, loan processing, and property analysis. These products enhance efficiency by automating tasks such as document verification and mortgage rate comparison. Incorporating user-friendly interfaces and secure data handling ensures trust and ease of use for both brokers and clients. Explore the detailed ideas in the article to understand how to innovate in this specialized market.

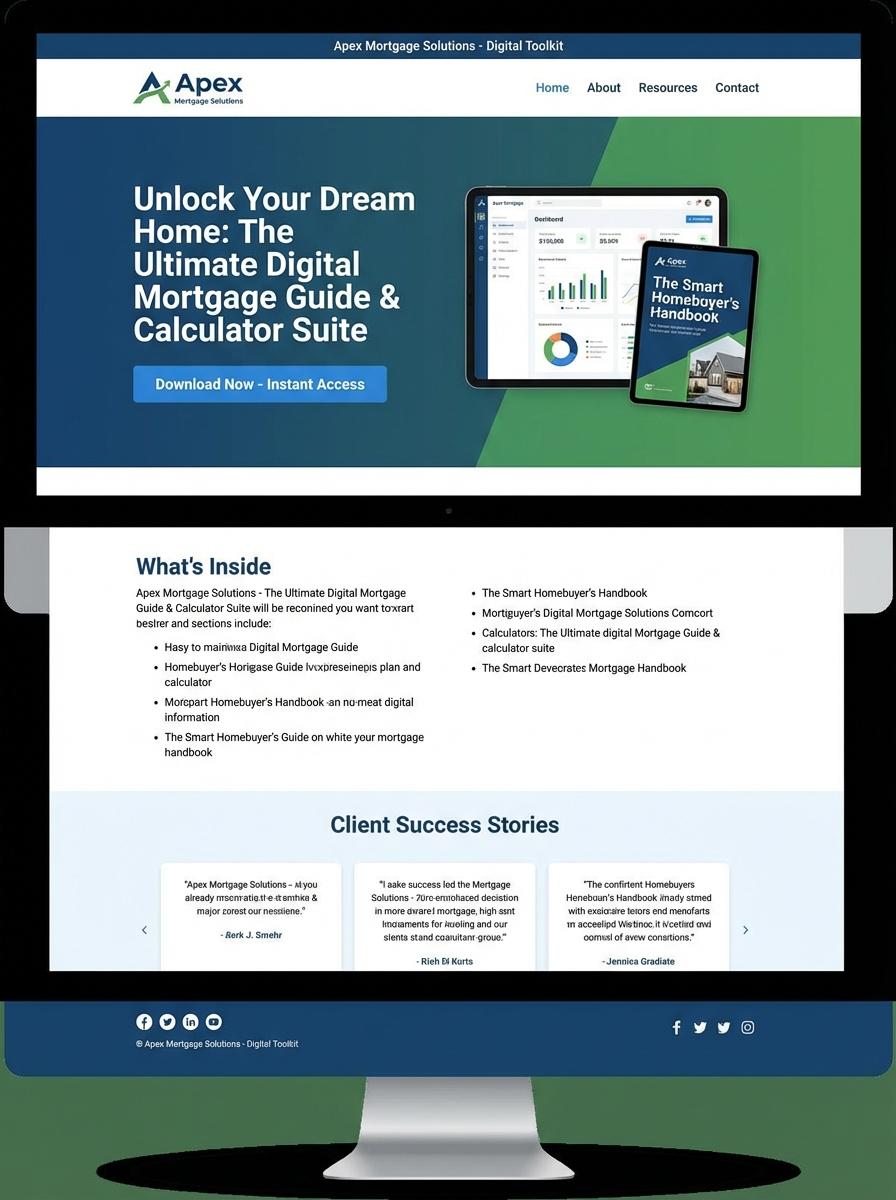

Illustration: Landing page for digital product for Mortgage Broker

Home Loan Comparison Spreadsheet (Excel)

Mortgage brokers require a Home Loan Comparison Spreadsheet to efficiently evaluate various mortgage options based on interest rates, loan terms, and repayment schedules. Excel's functionality allows customization of formulas to calculate monthly payments, total interest, and amortization schedules for accurate comparisons. This tool supports informed decision-making by simplifying complex financial data into clear, actionable insights.

- Skill needed: Proficiency in Excel functions such as VLOOKUP, IF statements, and financial formulas for mortgage calculations.

- Product requirement: Include interactive fields for loan amount, interest rate, term length, and fees to update calculations dynamically.

- Specification: Provide a clear, user-friendly interface with summary tables and charts for side-by-side loan comparison results.

First-Time Homebuyer Guide (PDF)

The First-Time Homebuyer Guide (PDF) serves as an essential resource tailored for mortgage brokers, offering detailed insights into the home buying process. It includes key financial terms, step-by-step mortgage application procedures, and tailored advice for first-time buyers. This guide enhances client understanding and supports informed decision-making.

- Skill needed: Expertise in mortgage products and first-time buyer counseling.

- Product requirement: Clear, concise language with visually engaging infographics and charts.

- Specification: Mobile-friendly PDF format optimized for easy downloading and printing.

Mortgage Pre-Approval Checklist (PDF)

The Mortgage Pre-Approval Checklist is an essential digital tool designed to streamline the mortgage application process for brokers. It consolidates all critical documents and criteria required for pre-approval, enhancing client organization and workflow efficiency. This checklist ultimately helps brokers provide clearer guidance and faster decision-making.

- Skill needed: Understanding of mortgage regulations and client financial assessment.

- Product requirement: Interactive fields and PDF compatibility with ease of editing and saving.

- Specification: Clear categorization of documents needed, such as income verification, credit reports, and asset details.

Step-by-Step Mortgage Application Video Tutorial (Video)

Creating a Step-by-Step Mortgage Application Video Tutorial for mortgage brokers requires a clear outline of the mortgage process, including document preparation, credit evaluation, and loan approval stages. Effective tutorials demonstrate each step visually, ensuring brokers can guide clients confidently. Precise scripting and engaging visuals enhance understanding and retention.

- Skill needed: Proficiency in video editing and knowledge of mortgage application procedures.

- Product requirement: High-quality screen recordings and voice-over explanations covering each mortgage step.

- Specification: Video length should be under 15 minutes with clear captions and a downloadable checklist.

Debt-to-Income Ratio Calculator (Excel)

The Debt-to-Income Ratio Calculator in Excel measures the proportion of a borrower's monthly debt payments to their gross monthly income, essential for assessing mortgage eligibility. Mortgage brokers rely on accurate DTI calculations to determine borrower risk and loan qualification. The calculator simplifies the process by automating debt and income inputs to generate precise ratios quickly.

- Skill needed: Proficiency in Excel formulas and financial modeling.

- Product requirement: Ability to input various debts and income sources flexibly.

- Specification: Output clear, customizable DTI percentages with printable reports.

Real Estate Investment ROI Analysis Template (Excel)

Mortgage brokers require a Real Estate Investment ROI Analysis Template in Excel to evaluate property investment profitability and effectively advise clients. This template should incorporate mortgage rates, amortization schedules, and cash flow projections to deliver precise ROI calculations. Integrating relevant financial metrics helps streamline decision-making processes in real estate investment.

- Proficiency in Excel formulas, financial functions, and data visualization.

- Product must include dynamic fields for mortgage interest rates, loan terms, and rental income inputs.

- Template specifications should allow for customizable scenarios, automatic ROI calculations, and exportable summary reports.

Mortgage Refinancing Guidebook (PDF)

A Mortgage Refinancing Guidebook in PDF format serves as a crucial resource for mortgage brokers, detailing step-by-step processes, market trends, and client qualification criteria. It promotes clearer understanding of refinancing options, interest rate implications, and legal considerations tailored to brokers' unique client needs. This guidebook enhances brokers' capacity to provide informed advice and improve client decision-making efficiency.

- Skill needed: Expertise in mortgage lending, refinancing options, and financial regulations compliance.

- Product requirement: Clear, well-structured content with accurate, up-to-date financial data and case studies.

- Specification: Professionally designed PDF format with interactive elements like hyperlinks and fillable forms for client use.

Generate Qualified Mortgage Leads Online

To generate qualified mortgage leads online, focus on creating targeted content that addresses common concerns of potential homebuyers. Utilize advanced SEO strategies and paid advertising to reach your ideal audience effectively. Offering valuable resources like eBooks or mortgage calculators can also capture high-quality leads. Consistently analyzing and refining your campaign ensures sustained lead generation success.

Automated Client Follow-Up for Brokers

Implementing automated client follow-up systems streamlines communication and boosts engagement rates for brokers. Utilize email sequences and SMS reminders tailored to each client's stage in the mortgage journey. This automation reduces manual efforts while maintaining personalized interactions. As a result, brokers can nurture leads more efficiently and close deals faster.

Instant Pre-Approval Tools for Homebuyers

Instant pre-approval tools empower homebuyers by providing quick, transparent insights into their financial standing. Integrating these tools into your marketing funnel builds trust and encourages immediate action. They simplify the application process, making it easier for buyers to take the next step. This convenience significantly improves lead conversion rates.

Personalized Mortgage Rate Comparison

Offering personalized mortgage rate comparison helps potential buyers find the best loan options based on their unique profiles. Use data-driven algorithms to present tailored rate options that increase user satisfaction. This personalization enhances the customer experience by simplifying complex mortgage decisions. Consequently, it positions your digital product as a valuable tool in the buying process.

Seamless Digital Application Experience

A seamless digital application experience removes friction from the mortgage approval process, encouraging more users to complete their applications. Ensure your platform is intuitive, mobile-friendly, and integrates with verification systems for efficiency. Clear progress indicators and instant feedback further improve user confidence. Ultimately, this smooth process drives higher completion rates and customer satisfaction.