Creating a digital product suitable for Customs brokers in the transportation sector requires a deep understanding of industry-specific challenges such as compliance, documentation, and real-time tracking. The solution must streamline complex customs clearance processes, reduce errors, and improve communication between stakeholders. Leveraging automation and integration with existing logistics platforms enhances efficiency and regulatory adherence. Explore the article for detailed strategies to develop an effective digital product tailored to Customs brokers in transportation.

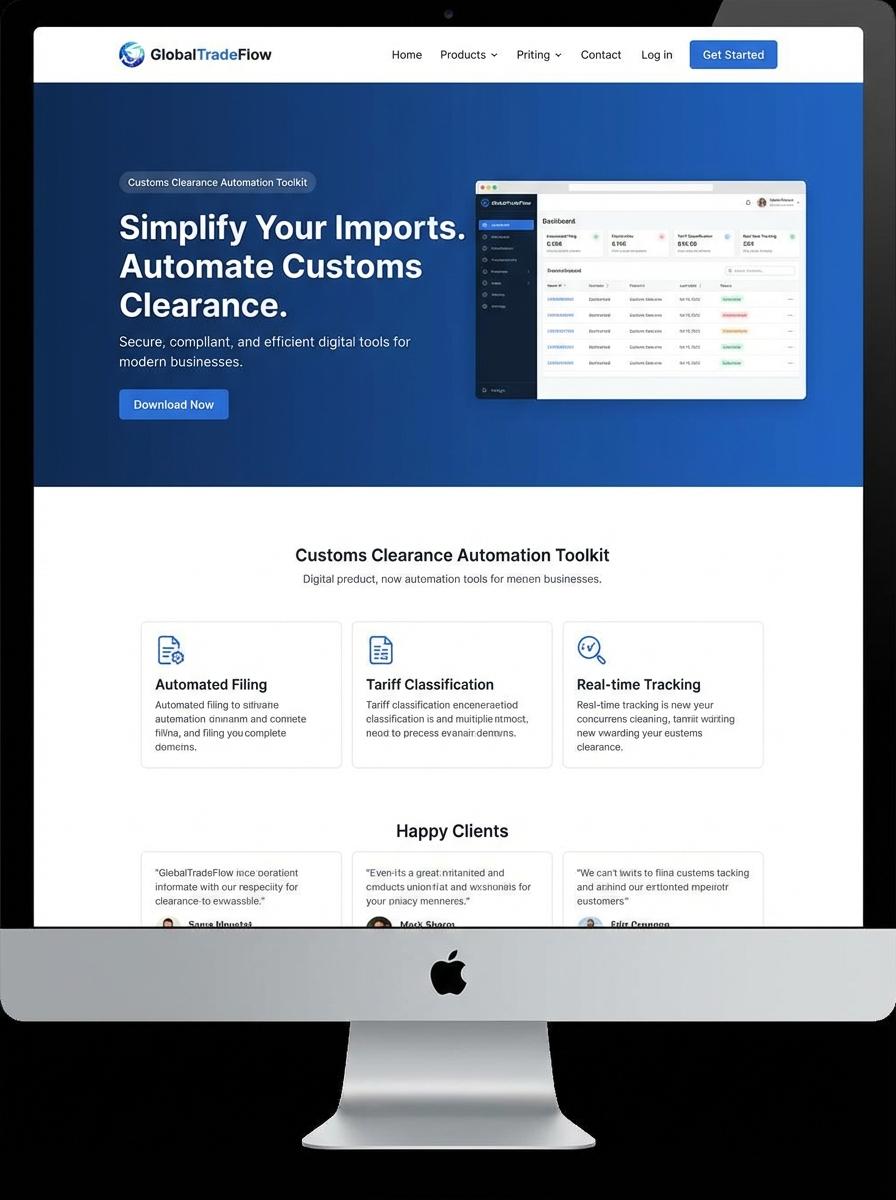

Illustration: Landing page for digital product for Customs broker

Customs Documentation Templates (PDF/DOC)

Customs brokers require customs documentation templates in PDF or DOC format to ensure compliance with international trade regulations. These templates must include fields for detailed shipment information, tariff codes, and regulatory declarations to streamline the clearance process. Properly formatted templates reduce errors and expedite customs approvals.

- Skill needed: In-depth knowledge of customs regulations and documentation standards.

- Product requirement: Editable PDF and DOC formats compatible with common office software.

- Specification: Templates must contain predefined fields for shipment details, HS codes, and signatures.

Import/Export Compliance Checklist (Excel)

Import/Export Compliance Checklist in Excel format streamlines customs brokerage by organizing essential regulatory requirements and deadlines. This tool enhances accuracy in tracking duties, tariffs, and documentation required by governments. It is designed to reduce risks associated with non-compliance and ensure timely processing of shipments.

- Understanding of international trade laws and customs regulations

- Excel template featuring customizable fields for product categories, HS codes, and country-specific rules

- Automated alert mechanisms for critical compliance deadlines and document submissions

Tariff Classification Guide (PDF)

The Tariff Classification Guide is an essential resource designed for customs brokers to accurately determine tariff codes, ensuring compliance with international trade regulations. This PDF guide includes comprehensive tables and examples aligned with the latest Harmonized System (HS) codes. It simplifies complex classification rules to reduce errors and expedite customs clearance.

- Skill needed: In-depth understanding of Harmonized Tariff Schedule and customs regulations.

- Product requirement: Clear, easy-to-navigate PDF format with searchable tariff codes and explanatory notes.

- Specification: Up-to-date classification rules with detailed examples for various product categories.

Customs Broker Training Video Series (Video)

The Customs Broker Training Video Series is designed to equip customs brokers with comprehensive knowledge of import and export regulations, tariff classifications, and compliance procedures. Each video focuses on practical scenarios and legal requirements that brokers encounter in their daily operations. Viewers gain insights into documentation processes and risk management techniques essential for efficient customs brokerage.

- Skill needed: In-depth understanding of international trade laws and customs regulations

- Product requirement: High-definition video content with clear visuals of customs documents and workflows

- Specification: Interactive quizzes and real-world case studies embedded within each training module

Trade Agreement Summary Sheets (PDF)

Trade Agreement Summary Sheets provide Customs brokers with concise, accurate details of tariffs, rules of origin, and compliance requirements for various international trade agreements. These PDFs streamline the assessment process, helping brokers ensure proper documentation and avoid clearance delays. Enhanced clarity in these summaries supports faster decision-making and reduces the risk of costly errors during shipments.

- Skill needed: Strong understanding of international trade regulations and customs compliance.

- Product requirement: Clear representation of tariff schedules, preferential treatment clauses, and origin criteria in a well-structured PDF layout.

- Specification: Compatibility with mobile and desktop devices for easy access during shipment processing.

Duty & Tax Calculation Spreadsheet (Excel)

The Duty & Tax Calculation Spreadsheet is designed specifically for customs brokers to streamline the computation of import duties and taxes. It integrates up-to-date tariff codes, country-specific tax rates, and currency conversion features to ensure accurate financial estimations. The spreadsheet automates complex calculations, reducing errors and enhancing efficiency in customs clearance processes.

- Skill needed: Proficiency in Excel formulas and data validation relevant to customs regulations

- Product requirement: Inclusion of a regularly updated tariff and tax rate database

- Specification: Customizable input fields for shipment details such as HS codes, country of origin, and declared value

Step-by-Step Customs Clearance Manual (PDF)

The Step-by-Step Customs Clearance Manual is a comprehensive PDF tailored for Customs brokers, detailing procedures for efficient import and export documentation. This manual highlights critical regulatory guidelines, tariff classifications, and declaration protocols to ensure compliance with international trade laws. Clear, actionable instructions facilitate accuracy and reduce clearance times.

- Skills needed: Expertise in customs regulations, tariff coding, and international trade compliance.

- Product requirements: Clear stepwise layout, accurate legal references, and up-to-date tariff schedules.

- Specifications: Interactive PDF format, searchable content, and printable sections for field use.

Streamline Customs Clearance with Automated Solutions

Implementing automated solutions streamlines customs clearance processes, reducing delays and minimizing errors. These systems can handle documentation, tariff classification, and duty calculations efficiently. By automating routine tasks, businesses save time and improve overall logistics flow. This ensures a faster, hassle-free delivery of digital products across borders.

Real-Time Tracking and Compliance Updates

Real-time tracking provides instant visibility into the status of shipments, enhancing transparency for both marketers and customers. Compliance updates ensure adherence to changing international trade laws, preventing costly fines or shipment holds. Together, these tools help maintain trust and reliability in the supply chain. Staying informed enables proactive responses to potential issues.

Secure Cloud-Based Documentation Management

Utilizing secure cloud-based platforms for documentation ensures that critical shipping and compliance documents are accessible anytime and anywhere. This enhances collaboration between teams and partners worldwide while safeguarding sensitive information. Cloud storage reduces the risk of document loss or misplacement. It also supports quick retrieval during audits or regulatory checks.

Seamless Integration with Trade and Logistics Platforms

Seamless integration with existing trade and logistics platforms enhances data flow and operational efficiency. This connectivity allows marketers to manage orders, shipments, and customs procedures from a unified interface. Streamlined workflows reduce manual input and errors, accelerating product delivery. Integration boosts overall supply chain agility and customer satisfaction.

Expert Support for International Trade Regulations

Access to expert support ensures compliance with complex international trade regulations, reducing risks related to customs and tariffs. Specialists provide guidance on legal requirements, documentation, and best practices for different markets. This expertise helps marketers avoid delays and penalties. Leveraging professional advice enhances confidence in cross-border digital product marketing.