Creating a digital product suitable for traders in the energy sector requires a deep understanding of market dynamics, real-time data integration, and user-friendly interfaces tailored to energy commodities. Such a product must handle complex analytics, provide accurate forecasting tools, and support swift decision-making under volatile conditions. Security and compliance with industry regulations are also critical components to ensure trust and reliability. Explore the detailed ideas in the article to learn how to build an effective digital solution for energy traders.

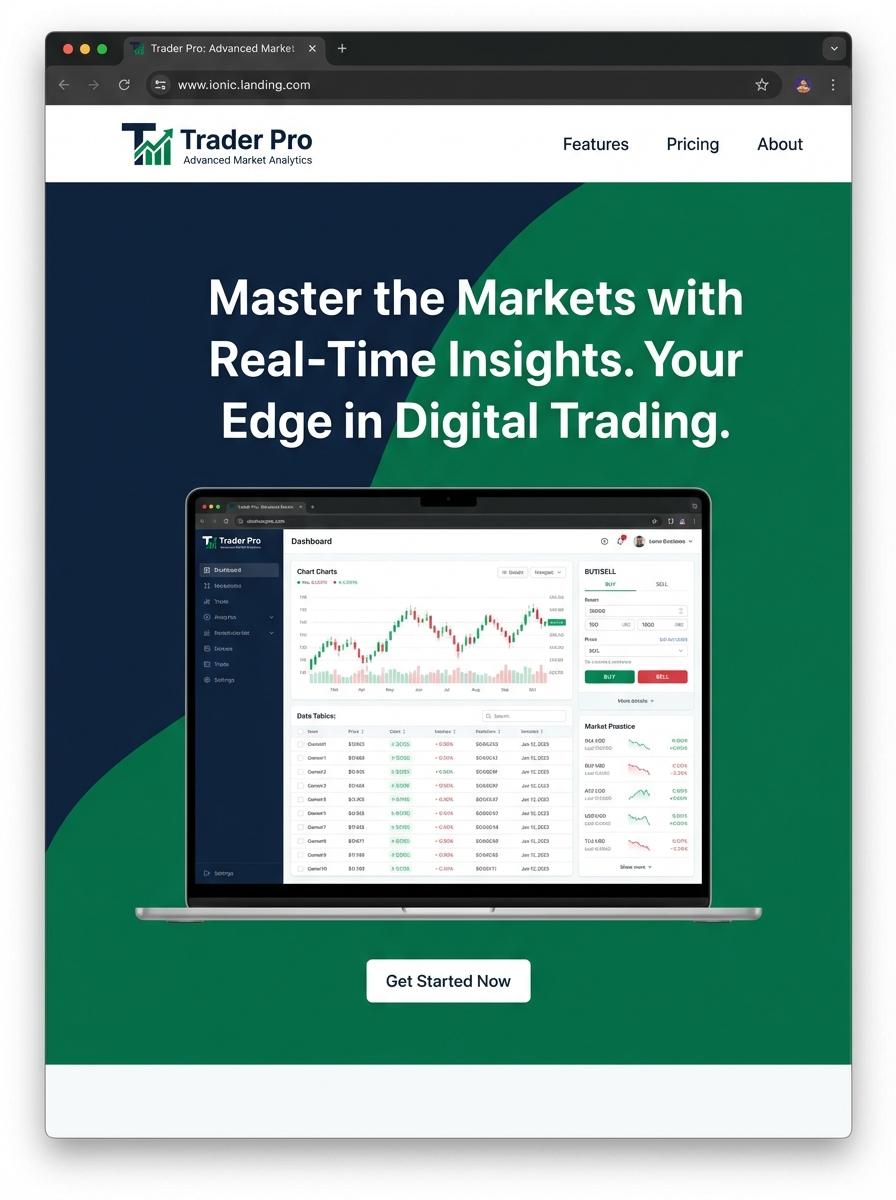

Illustration: Landing page for digital product for Trader

Energy Market Analysis Reports (PDF)

Energy Market Analysis Reports provide traders with comprehensive insights into market trends, price fluctuations, and supply-demand dynamics. These PDFs incorporate real-time data and historical analysis to support informed decision-making and risk management. Expert commentary and forecast models are essential for accurate market predictions tailored to energy trading strategies.

- Strong understanding of energy markets, including commodities and regulatory impacts.

- Ability to interpret and visualize complex data through charts and summarized reports.

- Integration of up-to-date market data feeds and secure PDF generation tools for consistent delivery.

Power Trading Strategy Guides (PDF/Doc)

Power Trading Strategy Guides deliver comprehensive insights and actionable techniques tailored for traders aiming to maximize market opportunities. These guides encompass detailed market analysis, risk management tactics, and entry-exit strategies optimized for diverse trading styles. The content is crafted to boost decision-making accuracy and trading confidence.

- Skill needed: Advanced understanding of technical analysis and market indicators.

- Product requirement: Clear, concise, and well-structured content formatted in PDF and DOC files for easy accessibility and printing.

- Specification: Inclusion of real-world examples, charts, and adaptable trading templates to support diverse trading approaches.

Excel Energy Price Forecasting Templates

Excel Energy Price Forecasting Templates provide traders with advanced tools to analyze market trends and predict future energy prices effectively. These templates integrate historical data and statistical models, enabling precise forecasting and risk assessment. Energy price volatility is minimized through automated calculations and customizable parameters tailored for trading strategies.

- Skill needed: Proficiency in Excel functions, data analysis, and energy market fundamentals.

- Product requirement: Accurate integration of historical energy price datasets and real-time market updates.

- Specification: Customizable forecasting models with dynamic charting and scenario analysis capabilities.

Regulatory Compliance Checklists (Excel/PDF)

Traders must adhere to various regulatory requirements, making a Regulatory Compliance Checklist essential for tracking adherence efficiently. These checklists, provided in Excel or PDF formats, help manage documentation and deadlines related to trade regulations. Maintaining up-to-date compliance records minimizes risks of penalties and operational disruptions.

- Skill needed: Knowledge of trade regulations and compliance standards relevant to the specific trading sector.

- Product requirement: Easy-to-update templates compatible with Excel and PDF formats, allowing quick adjustments to regulatory changes.

- Specification: Include categorized sections for documentation, deadlines, and action items with reminders or alerts integrated in the template.

Energy Trading Simulation Videos

Energy Trading Simulation Videos offer an immersive training platform tailored for traders to enhance decision-making skills within dynamic energy markets. These simulations replicate real-world market fluctuations and trading scenarios, enabling practical experience without financial risk. They focus on key market indicators, risk assessment, and strategic response techniques essential for effective energy trading.

- Skill needed: Proficiency in market analysis, risk management, and strategic decision-making specific to energy commodities.

- Product requirement: Realistic market data integration and scenario variability to mimic actual energy trading environments.

- Specification: High-quality video production with clear visualization of trading interfaces, charts, and market trends for user engagement.

Renewable Energy Investment Whitepapers (PDF)

Renewable Energy Investment Whitepapers provide traders with comprehensive analyses of market trends, regulatory impacts, and emerging opportunities in the sustainable energy sector. These PDF documents compile critical data, expert forecasts, and risk assessments to guide investment decisions. They enable informed trading strategies by highlighting key performance indicators and sector-specific developments.

- Skill needed: Strong understanding of renewable energy markets and financial analysis.

- Product requirement: High-quality, up-to-date market data and expert insights compiled into accessible PDF format.

- Specification: Clear visualization of data including charts, risk metrics, and sector forecasts tailored to trader needs.

Risk Management Dashboards (Excel)

Risk Management Dashboards in Excel empower traders to monitor and analyze financial risks in real time. These dashboards integrate diverse data metrics such as market volatility, exposure limits, and stop-loss triggers to enhance decision-making. Utilizing dynamic charts and automated alerts, they facilitate swift risk assessment and mitigation.

- Skill needed: Advanced Excel proficiency including pivot tables, formulas, and VBA scripting.

- Product requirement: Real-time data integration capability with key financial APIs.

- Specification: Customizable visualization tools for tracking risk exposure, profit/loss, and drawdown metrics.

Targeted Audience Segmentation for Traders' Specific Needs

Effective marketing begins with targeted audience segmentation to address the unique needs of traders. By categorizing traders based on their experience, goals, and trading style, you can tailor messages that resonate deeply. Understanding these segments allows for customized content and offers that boost engagement. This precision significantly increases the likelihood of conversion.

High-Converting Value Proposition for Trading Solutions

A compelling value proposition clearly communicates the benefits of your digital product to traders. Focus on how your solution addresses pain points such as speed, accuracy, and profitability. Highlight unique features and real-world results that differentiate your offering. A strong value proposition captures attention and drives action.

Data-Driven Campaign Optimization and Performance Tracking

Utilizing data-driven optimization ensures your marketing campaigns are continually refined for maximum impact. Tracking key metrics such as click-through rates, conversion rates, and user behavior enables informed decisions. Regular analysis helps identify what works and what needs adjustment. This approach maximizes your return on investment.

Trust-Building Content and Transparent Product Demonstration

Trust-building content is essential in convincing traders to adopt your product. Provide transparent demonstrations, tutorials, and case studies that showcase real benefits and ease of use. Authentic testimonials and clear communication reduce skepticism and build credibility. Establishing trust accelerates buyer confidence and loyalty.

Seamless User Onboarding with Clear ROI for Traders

A seamless onboarding process ensures traders quickly understand how to use your product and realize its value. Clear instructions combined with demonstrated ROI help maintain user engagement and satisfaction. Simplifying the transition from interest to active use reduces dropout rates. This leads to higher retention and success rates.