Creating a digital product suitable for energy traders in the energy sector involves understanding market dynamics and the specific needs of trading professionals. The product must provide real-time data analytics, risk management tools, and seamless integration with energy market platforms. Emphasizing user-friendly interfaces and accurate forecasting models enhances decision-making and operational efficiency. Explore the article for detailed strategies to develop a successful digital solution tailored to energy traders.

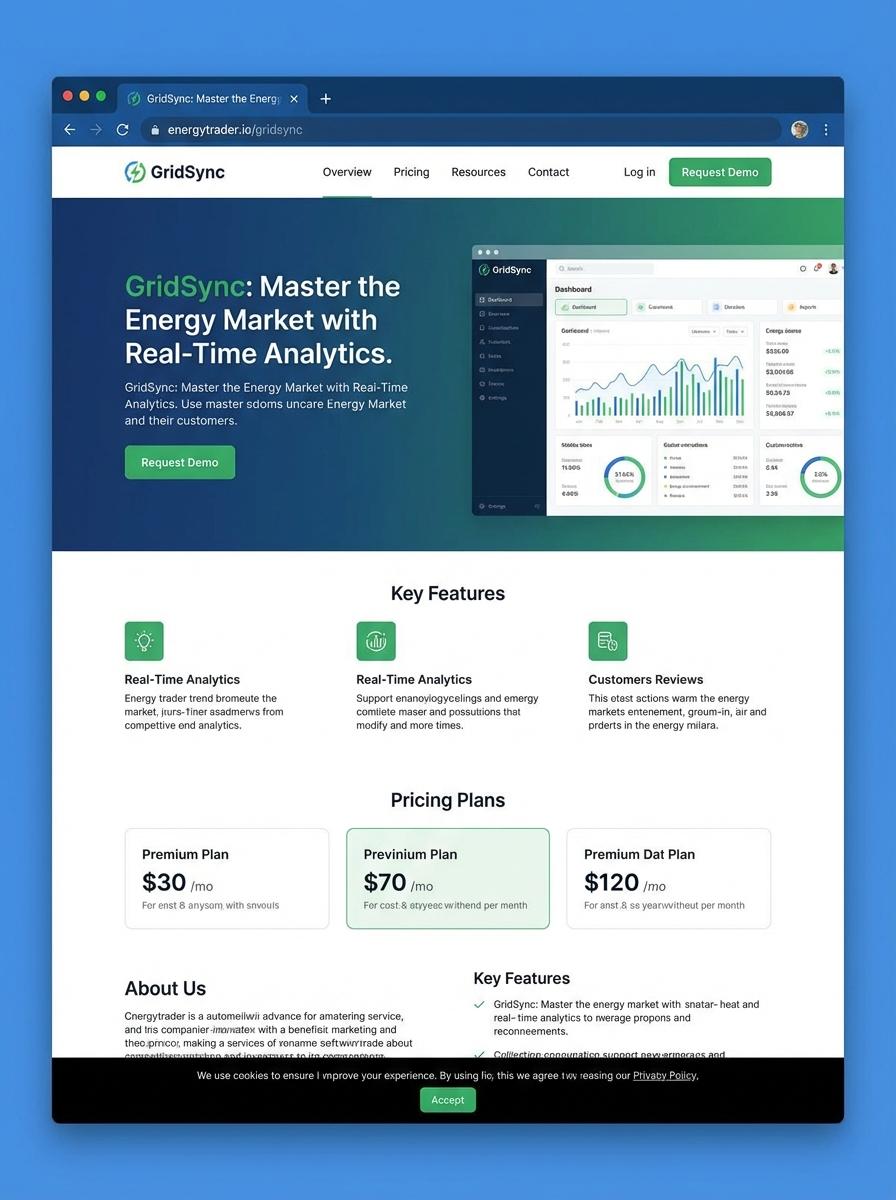

Illustration: Landing page for digital product for Energy trader

Energy Market Analysis Report (PDF)

An Energy Market Analysis Report in PDF format delivers comprehensive insights into current market trends, pricing fluctuations, and supply-demand dynamics crucial for energy traders. It consolidates data from renewable and non-renewable energy sectors, enabling informed trading decisions. Advanced charts and forecast models support risk management and strategy optimization.

- Proficiency in energy market fundamentals, commodity pricing, and regulatory environments.

- Incorporation of real-time data feeds and historical market data for accurate trend analysis.

- Clear visualization tools and downloadable PDF format for accessibility and ease of sharing.

Electricity Price Forecasting Model (Excel)

The Electricity Price Forecasting Model in Excel leverages historical data and market variables to predict future electricity prices with accuracy. It incorporates time-series analysis and regression techniques tailored for dynamic grid conditions and market demand fluctuations. Energy traders can utilize this model to optimize trading strategies and minimize financial risk.

- Skill needed: Proficiency in Excel functions and formulas, data analysis, and understanding of energy markets.

- Product requirement: Integration of real-time data feeds and the ability to update forecasts automatically.

- Specification: User-friendly interface with clear visualization tools such as charts and dashboards for decision support.

Renewable Energy Project Evaluation Template (Excel)

Energy traders require precise tools to assess the feasibility and profitability of renewable energy projects. The Renewable Energy Project Evaluation Template (Excel) offers a comprehensive framework for analyzing costs, revenues, and market fluctuations. This template facilitates data-driven decision-making by integrating renewable energy metrics with trading dynamics.

- Skill needed: Proficiency in Excel functions, financial modeling, and understanding of energy markets.

- Product requirement: Pre-built formulas for cash flow analysis, risk assessment, and scenario comparison.

- Specification: Compatibility with common data formats and customizable input parameters for different renewable energy sources.

Energy Trading Strategy Guidebook (PDF)

The Energy Trading Strategy Guidebook offers detailed methodologies tailored to energy market dynamics. Emphasizes risk management, market analysis, and pricing models for effective decision-making. Incorporates real-time data usage and scenario-based strategy adjustments to optimize trading outcomes.

- Proficient understanding of energy markets and financial instruments.

- PDF format with interactive content, including hyperlinks and embedded charts.

- Must include up-to-date market data, scenario simulations, and case studies.

Video Tutorial on Energy Hedging Techniques (Video)

Energy traders require advanced knowledge of energy hedging techniques to mitigate risks associated with price volatility in energy markets. Understanding derivatives like futures, options, and swaps is crucial for effective hedging strategies. This video tutorial delivers targeted insights to enhance trading performance and decision-making confidence.

- Skill needed: Proficiency in financial derivatives and risk management within the energy sector.

- Product requirement: High-quality video with clear visualizations of market scenarios and strategy applications.

- Specification: Includes real-world case studies and step-by-step instruction for practical implementation.

Regulatory Compliance Checklist for Energy Traders (Doc)

Energy traders must adhere to stringent regulatory compliance standards to operate legally and efficiently in the market. A comprehensive checklist documents essential rules from agencies like FERC and NERC, ensuring risk mitigation and transparency. Proper use of this tool supports timely and accurate reporting, invasion of penalties and operational disruptions.

- Expertise in energy market regulations and compliance frameworks is essential.

- The product must include up-to-date legal references and guideline summaries for energy trading laws.

- Checklist should support easy customization to fit different regional regulatory environments.

Power Purchase Agreement (PPA) Financial Modeling Tool (Excel)

Developing a Power Purchase Agreement (PPA) Financial Modeling Tool in Excel demands profound knowledge of energy markets and contract structures. Accurate forecasting hinges on integrating variables like tariff rates, energy production estimates, and financing terms. Understanding regulatory impacts and risk factors is vital for comprehensive financial analysis.

- Skills needed: Expertise in Excel modeling, financial analysis, and energy trading concepts.

- Product requirements: Dynamic input fields for tariffs, generation forecasts, and contract durations.

- Specifications: Automated cash flow calculations, scenario analysis capabilities, and user-friendly interface.

Leverage Real-Time Market Data Integration

Integrating real-time market data allows digital product marketers to make informed trading decisions swiftly. Access to live data ensures strategies adapt instantly to market changes, enhancing responsiveness. This proactive approach increases the chances of success and customer satisfaction.

Utilize Advanced Analytics and Predictive Pricing Models

Advanced analytics empower marketers to analyze patterns and predict future pricing trends effectively. Employing predictive pricing models helps optimize product positioning and maximize profits. Accurate forecasting provides a competitive edge by anticipating market movements.

Ensure Seamless API Connectivity with Leading Energy Exchanges

Seamless API connectivity facilitates smooth interaction between your digital product and major energy exchanges. This integration streamlines data flow and trade execution, reducing delays and errors. Efficient connectivity supports scalability and reliable market engagement.

Prioritize Robust Cybersecurity and Data Compliance

Cybersecurity is critical to protect sensitive trading information and maintain trust. Ensuring data compliance with regulations prevents legal issues and enhances credibility. A secure platform safeguards both your business and customers in a competitive environment.

Design a User-Centric Interface for Efficient Trade Execution

A user-centric interface simplifies complex trading processes, enabling faster and more accurate executions. Prioritizing usability improves user satisfaction and reduces operational errors. Intuitive design drives user engagement and overall product success.