Creating a digital product suitable for accountants in the energy sector requires understanding the unique financial regulations and operational complexities of the industry. Such a product should streamline financial reporting, support compliance with energy-specific tax laws, and integrate with existing energy management systems to enhance accuracy and efficiency. Incorporating real-time data analysis and automated auditing features can significantly reduce manual errors and improve decision-making. Explore the article for detailed strategies on developing a tailored digital solution that empowers accountants in the energy sector.

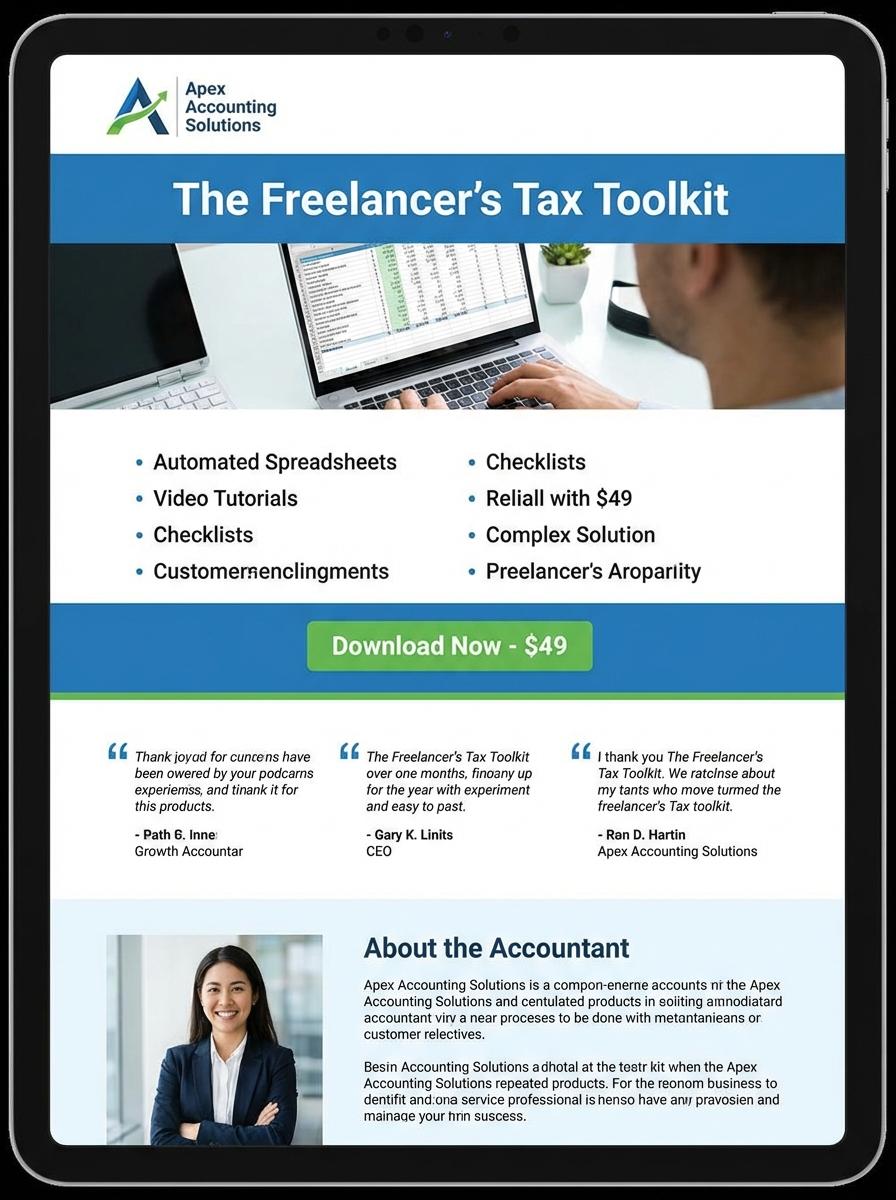

Illustration: Landing page for digital product for Accountant

Energy Sector Financial Statement Templates (Excel)

Accountants specializing in the energy sector require financial statement templates tailored for complex industry-specific transactions and regulatory compliance. These Excel templates must accommodate asset depreciation, revenue recognition, and cost allocations unique to oil, gas, and renewable energy companies. Accurate financial reporting is critical to decision-making and investor confidence in this sector.

- Proficiency in Excel functions, pivot tables, and financial modeling tailored to energy accounting standards.

- Templates must include customizable sheets for balance sheets, income statements, and cash flow statements specific to energy assets.

- Incorporation of industry-specific performance metrics, tax codes, and reporting compliance features essential for accountants.

Energy Industry Tax Compliance Checklist (PDF)

Accountants in the energy industry face complex tax regulations that require meticulous compliance tracking. A comprehensive checklist streamlines the process by highlighting key tax obligations, deadlines, and documentation requirements specific to energy sector entities. This tool enhances accuracy and reduces the risk of costly penalties.

- Skill needed: Proficiency in energy industry tax codes and accounting standards.

- Product requirement: Clear categorization of tax types, relevant deadlines, and necessary forms in a user-friendly PDF format.

- Specification: Include hyperlinks to updated IRS guidelines and state-specific regulations for quick reference.

Cash Flow Forecasting Model for Energy Projects (Excel)

The Cash Flow Forecasting Model for Energy Projects in Excel enables accountants to accurately predict project revenues and expenses over time. This model incorporates energy sector-specific variables such as fluctuating fuel costs, maintenance schedules, and regulatory fees to provide a detailed financial outlook. It supports scenario analysis to assess impacts of market volatility on cash flow projections.

- Skill Needed: Proficiency in Excel functions, financial modeling, and understanding of energy market dynamics.

- Product Requirement: Incorporation of customizable input fields for project timelines, cost categories, and revenue streams.

- Specification: Ability to generate detailed monthly and annual cash flow statements with sensitivity analysis options.

Budgeting Toolkit for Renewable Energy Firms (Excel)

The Budgeting Toolkit for Renewable Energy Firms in Excel enhances financial planning by integrating specific renewable energy cost factors and revenue streams. Accountants can efficiently manage capital expenditures, operational costs, and government incentives within customizable templates. This toolkit supports accurate forecasting and financial analysis to drive sustainable business decisions.

- Skill needed: Proficiency in Excel functions, financial modeling, and understanding of renewable energy market dynamics.

- Product requirement: Pre-built templates incorporating industry-specific budget categories, cost-driver assumptions, and incentive calculators.

- Specification: Compatibility with Microsoft Excel 2016 or later; includes charts, pivot tables, and scenario analysis tools tailored for renewable energy finance.

Regulatory Reporting Guide for Accountants in Energy (PDF)

Creating a Regulatory Reporting Guide for Accountants in Energy involves compiling comprehensive compliance requirements specific to energy sector accounting standards and regulations. This guide must detail financial reporting frameworks, tax obligations, and audit procedures unique to energy companies. Emphasizing clarity and accuracy ensures accountants can reliably navigate complex regulatory landscapes.

- Skill Needed: Expertise in energy sector accounting standards, regulatory compliance, and financial reporting.

- Product Requirement: Detailed and up-to-date information on energy industry regulations and accounting best practices.

- Specification: PDF format with clear sections, indexed content, and examples of regulatory reports.

Video Tutorial: Energy Project Cost Allocation Techniques

Accountants benefit from mastering energy project cost allocation techniques to ensure precise budgeting and financial reporting. Proper allocation methods improve project profitability analysis and regulatory compliance. This knowledge prevents cost overruns and supports strategic decision-making within energy projects.

- Skill needed: Proficiency in accounting principles related to energy sector financial management.

- Product requirement: Clear video explanations and case studies illustrating diverse cost allocation methods.

- Specification: High-quality visuals with step-by-step breakdowns of cost tracking and allocation processes.

Internal Audit Checklist for Energy Companies (Word/PDF)

The Internal Audit Checklist for Energy Companies in Word/PDF format is designed to cater specifically to accountants handling energy sector finances. The checklist ensures compliance with industry regulations, identifies financial discrepancies, and verifies the accuracy of energy-related transactions. It streamlines the audit process by focusing on key areas such as cost allocation, revenue recognition, and asset management.

- Skills needed: Proficiency in accounting principles, knowledge of energy industry regulations, and experience with internal auditing procedures.

- Product requirements: Editable Word and secure PDF formats, checklist customized for energy financial controls, and clear section divisions for easy navigation.

- Specifications: Includes detailed audit points for transaction accuracy, compliance checks, and risk assessment tailored to energy company accounting.

Streamline Workflows with Automated Accounting Solutions

Implementing automated accounting solutions saves time by reducing manual data entry and minimizing errors. This approach allows marketers to focus more on strategy rather than tedious bookkeeping tasks. Automating processes also ensures timely financial reporting, essential for making informed business decisions. Streamlined workflows accelerate overall marketing efficiency and success.

Enhance Data Accuracy and Compliance Effortlessly

Using reliable accounting tools improves data accuracy which is critical for tracking marketing expenses and revenues. These solutions help maintain financial records that comply with tax regulations automatically. Compliance reduces the risk of legal issues and fines that can disrupt marketing campaigns. Accurate data lays the foundation for better financial planning and resource allocation.

Seamless Integration with Popular Bookkeeping Software

Choose digital accounting software that offers seamless integration with popular bookkeeping platforms to simplify financial management. Integrations help consolidate all financial data in one place, making it easier to analyze performance metrics. This unified system provides clarity on budget expenditure and ROI on marketing efforts. Integration also reduces duplicate entry and potential mistakes across platforms.

Boost Productivity through Intuitive User Interfaces

An intuitive user interface ensures marketing teams can quickly learn and utilize accounting software with minimal training. Ease of use enhances productivity by allowing users to efficiently generate invoices, track payments, and monitor financial health. Streamlined access to financial data supports faster decision-making and agile marketing tactics. User-friendly design empowers teams to focus on growth instead of administrative burdens.

Secure Cloud-Based Access for Real-Time Financial Insights

Secure cloud-based access enables marketers to view real-time financial data anytime and anywhere, supporting agile responses to market changes. Cloud security features protect sensitive information from unauthorized access and cyber threats. Real-time insights improve forecasting accuracy and allow quick adjustments to marketing strategies. This accessibility fosters collaboration across teams and stakeholders for unified digital product marketing success.